🇫🇷 France

France confronts its most severe fiscal and political crisis since the Fifth Republic's founding in 1958, yet retains fundamental economic strengths that distinguish it from peripheral eurozone economies. As of November 2025, all three major rating agencies have downgraded or warned on French sovereign debt, with the deficit reaching 5.8% of GDP—the highest in the European Union—while political fragmentation paralyzes governance and threatens implementation of the €120 billion consolidation plan required under EU oversight. The country's credit profile reflects this duality: on one hand, unprecedented political dysfunction following three government collapses in twelve months and the loss of double-A status from Fitch and S&P; on the other, a diversified economy anchored by global champions in aerospace, luxury goods, and pharmaceuticals, a banking sector with capital ratios exceeding 15%, and Europe's strongest labor market with employment rates at historic highs of 69.3%.

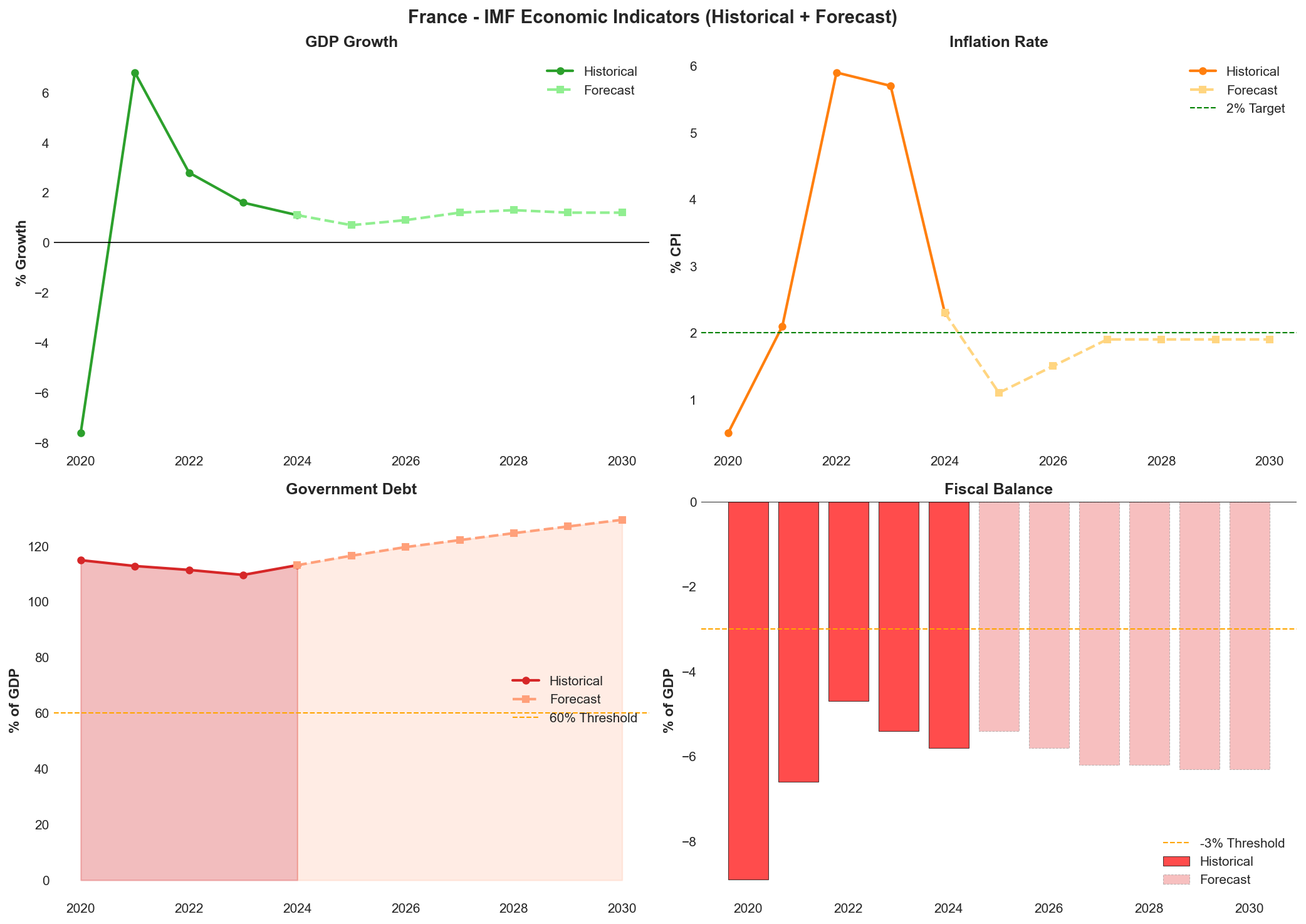

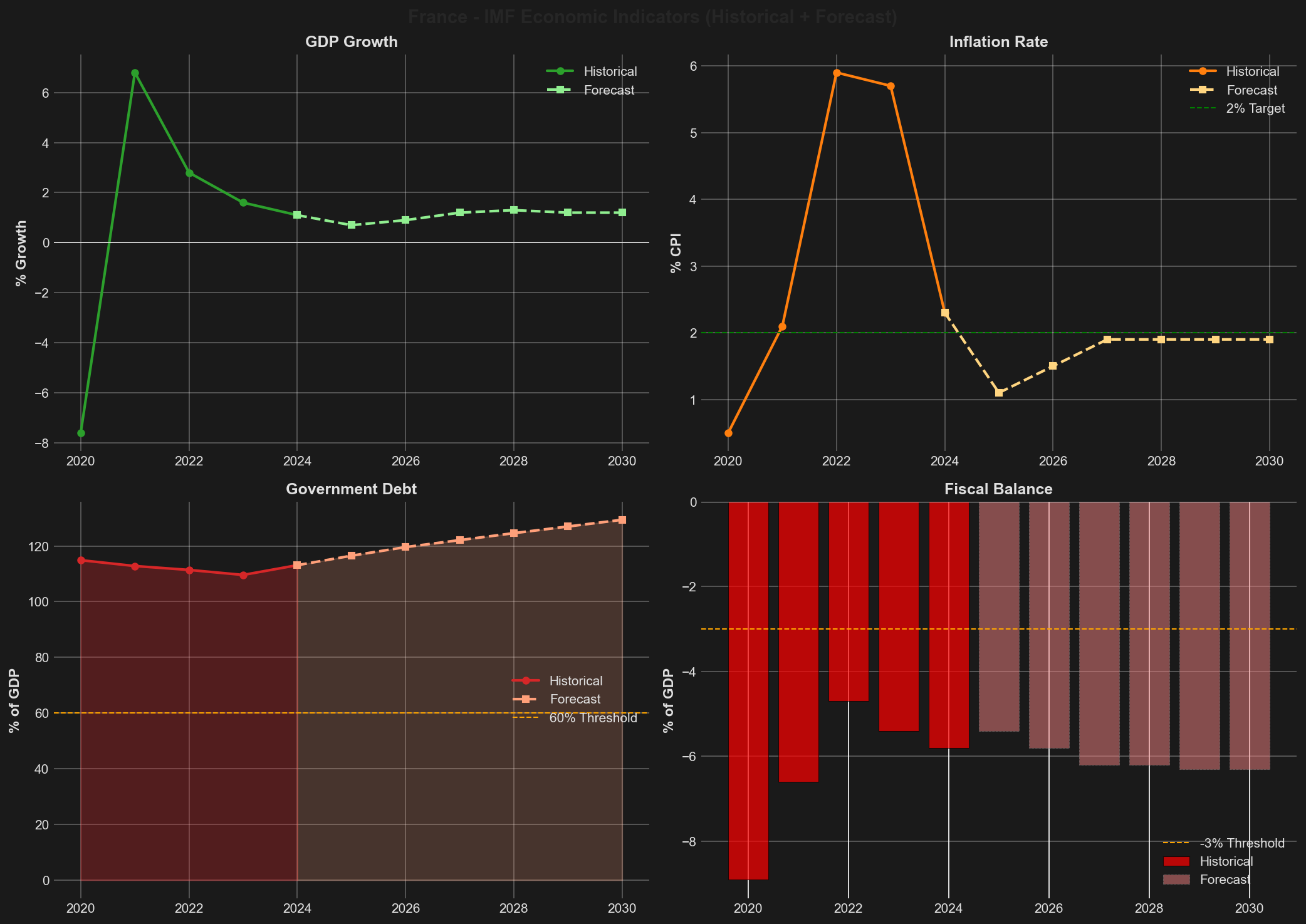

The current economic situation reveals both resilience and stagnation. Real GDP growth decelerated sharply from the post-pandemic rebound of 7.0% in 2021 to just 1.2% in 2024, with consensus projections for 2025 at a mere 0.6-0.8%—the weakest performance since the pandemic—as fiscal consolidation of 1% of GDP combines with political uncertainty to depress business investment and consumer confidence. The IMF's latest forecasts through 2030 project modest recovery to 1.2% growth but warn of fiscal balance deteriorating to -6.3% of GDP and government debt climbing to 129.4% by decade's end absent credible adjustment. Inflation dynamics proved favorable relative to European peers, with France weathering the 2022-2023 energy shock at peak inflation of just 4.9-5.2%—well below the eurozone average—thanks to limited Russian gas dependence and aggressive price controls. The labor market represents a genuine bright spot, with unemployment falling to 7.1-7.3% in early 2025 from over 10% in the mid-2010s, though projected to rise toward 7.8% as weak growth dampens hiring.

France's main credit challenges center on the intersection of fiscal arithmetic and political capacity. The European Commission formally opened an Excessive Deficit Procedure on July 26, 2024, establishing a binding seven-year correction path requiring approximately €120 billion in cumulative savings to bring the deficit below 3% by 2029. Yet the political system has broken down following President Macron's disastrous decision to dissolve parliament in June 2024, producing a hung assembly with no path to majority: the left-wing New Popular Front holds 180-193 seats, Macron's centrist Ensemble 159-166 seats, and the far-right National Rally 142-143 seats in the 577-seat chamber where 289 are needed for comfortable governance. This arithmetic makes sustained policy implementation nearly impossible, with €40+ billion in required 2026-2029 consolidation measures remaining completely unspecified. The pension system illustrates the dilemma—at 14% of GDP, France's pension spending ranks third-highest in the OECD, and the 2023 reform raising retirement age from 62 to 64 was suspended until January 2028 as Prime Minister Lecornu's concession to survive no-confidence votes, costing €20 billion annually by 2035.

The forward-looking perspective on France's creditworthiness trajectory depends critically on whether institutional strengths can bridge the gap until political breakthrough becomes possible through the 2027 presidential election. The most probable path involves continued fiscal slippage and gradualism, with France missing consolidation targets by cumulative 2-3 percentage points but avoiding catastrophic scenarios through market tolerance for elevated deficits given core eurozone status, ECB backstops, and fundamental economic diversity. Public debt likely peaks at 118-122% of GDP in 2028-2030 before stabilizing, requiring EU deadline extension to 2030-2031. Moody's downgrade to A+ within 12-24 months will complete the loss of triple-A status, but ratings should then stabilize absent further deterioration. The critical inflection point arrives in 2027-2028: if the presidential winner secures parliamentary majority and demonstrates implementation commitment, France can restore credibility; alternatively, if paralysis persists and deficits remain above 6%, market confidence could crack with spreads blowing out toward 150-200 basis points and potential eurozone-wide contagion. The central question is whether France's Fifth Republic institutional design, suited to strong presidencies and stable majorities, can function effectively in today's fragmented political landscape.

Ratings Summary

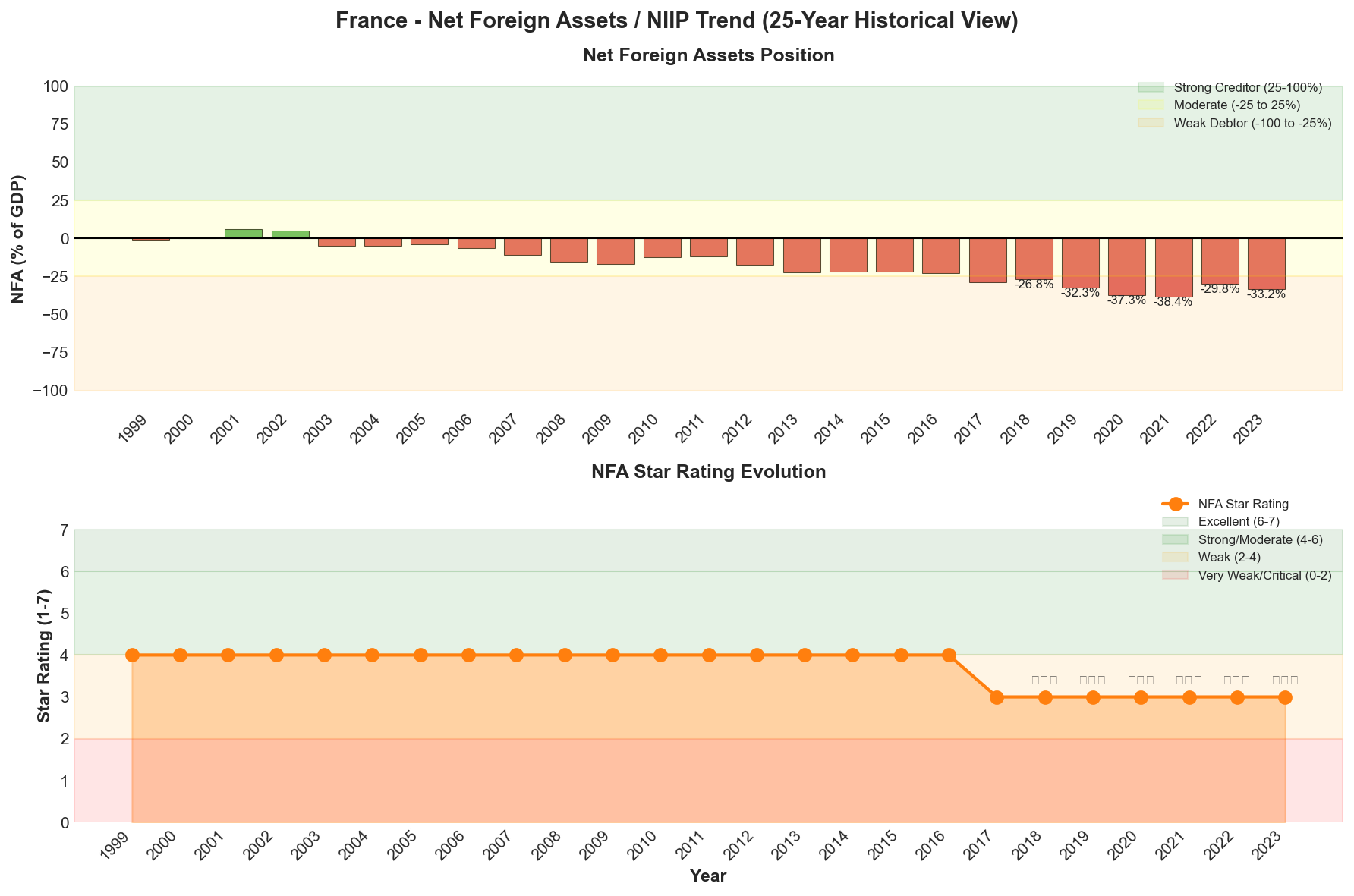

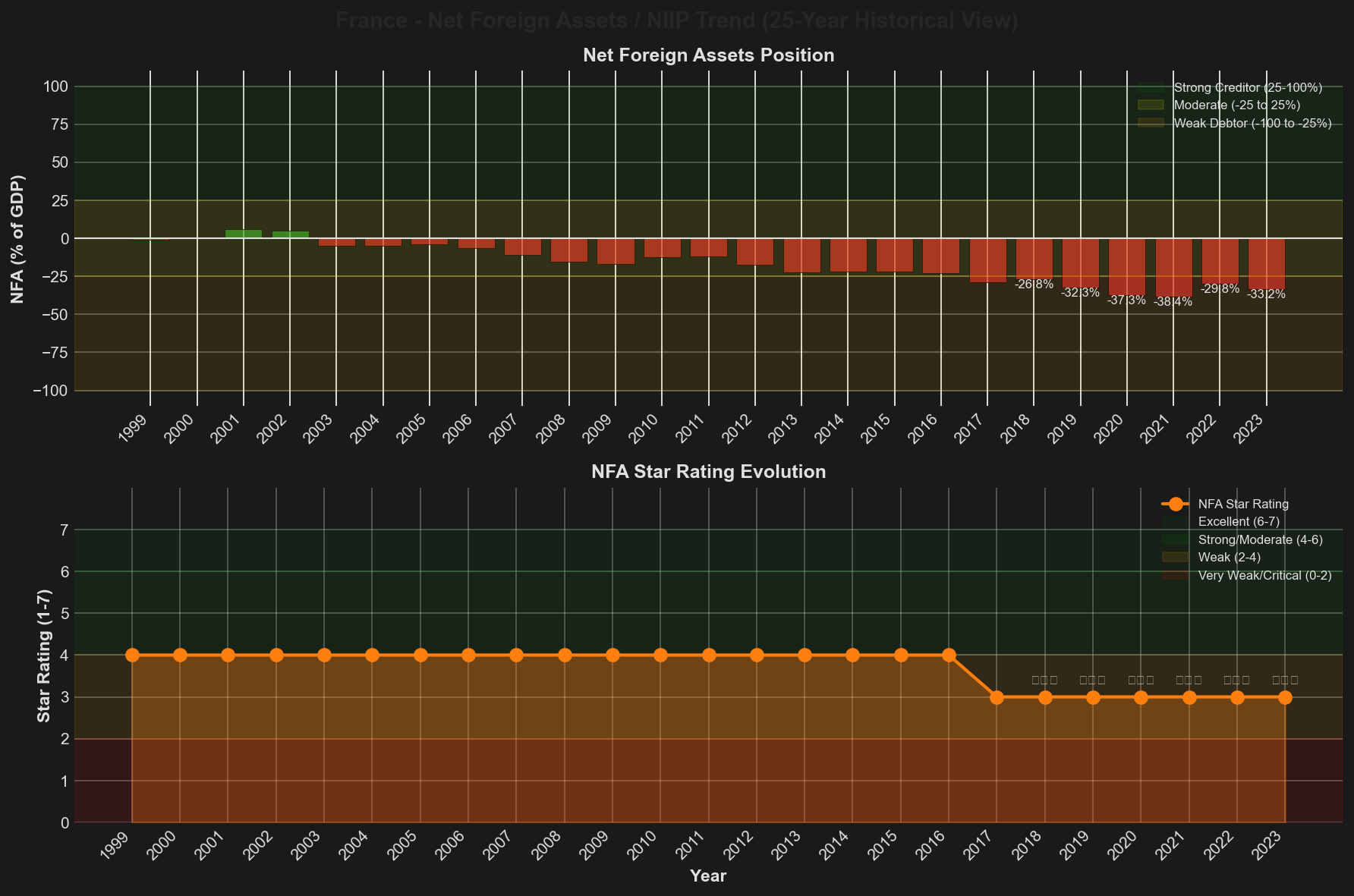

As of November 2025, France holds credit ratings of Moody's Aa3 with Negative outlook, S&P A+ with Stable outlook, and Fitch A+ with Stable outlook. The Net Foreign Assets assessment stands at ⭐⭐⭐ (3/7 stars), reflecting a weak debtor position with Net Foreign Assets at -33.2% of GDP as of 2023. France experienced unprecedented credit deterioration in the third and fourth quarters of 2025 as political crisis compounded fiscal challenges, with Fitch stripping the country of double-A status on September 12 following Prime Minister François Bayrou's ouster via no-confidence vote, and S&P following with an unscheduled downgrade on October 18 brought forward by six weeks after PM Sébastien Lecornu survived two no-confidence votes only by suspending the 2023 pension reform until 2028. Moody's affirmed its Aa3 rating on October 25 but revised the outlook to negative, signaling potential downgrade within 12-24 months and representing France's last remaining double-A equivalent rating.

Credit Ratings

| Agency | Rating | Outlook | Last Action | Effective Rating Level |

|---|---|---|---|---|

| Moody's | Aa3 | Negative | October 25, 2025 (Outlook revision) | Single-A equivalent |

| S&P | A+ | Stable | October 18, 2025 (Downgrade from AA-) | Single-A |

| Fitch | A+ | Stable | September 12, 2025 (Downgrade from AA-) | Single-A |

The rating actions share common analytical themes that illuminate the depth of France's challenges. Fitch projects French debt rising from 113.2% of GDP to 121% by 2027 with "no clear horizon for debt stabilization," noting the deficit will remain above 5% through 2026-2027 despite government targets. S&P emphasized that "political uncertainty will affect the French economy by dragging on investment activity," projecting debt reaching 121% by 2028 absent significant additional measures. Moody's highlighted "increased risk that fragmentation of the country's political landscape will continue to impair the functioning of France's legislative institutions," specifically warning against sustained rollback of structural reforms like the pension increase to age 64. All agencies identified similar downgrade triggers: further evidence of durably weakened legislative institutions, continued difficulties implementing fiscal consolidation measures, pension reform reversal, and debt-to-GDP approaching 125%.

Market reactions to the downgrades underscore the severity of France's credit deterioration. French 10-year bond yields widened to 80 basis points above German Bunds—approaching Italian levels—while the country now offers higher yields than Spain despite historically stronger fundamentals. This spread widening reflects investor concern about implementation capacity rather than fundamental solvency, given France's euro membership, ECB backstop access, and diversified economic base. France retains one critical advantage in the rating landscape: Moody's negative outlook provides a 12-24 month window for stabilization efforts before France loses its last double-A equivalent rating, creating urgency for the political system to demonstrate consolidation credibility through 2025-2026 performance.

Economic Indicators

France's economic trajectory reflects the tension between underlying resilience and near-term stagnation driven by fiscal consolidation and political uncertainty. Real GDP contracted 8.0% in 2020 during the pandemic before rebounding strongly at 7.0% in 2021, but growth decelerated sharply to 2.6% in 2022, 1.1% in 2023, and 1.2% in 2024. The 2025 consensus projects just 0.6-0.8% growth—the weakest performance since the pandemic—as fiscal consolidation of approximately 1% of GDP combines with political uncertainty to depress business investment and consumer confidence. The IMF's latest projections through 2030 show modest recovery to 1.2% growth but remain well below the eurozone average, constrained by fiscal headwinds and weak external demand particularly from Germany. The OECD and European Commission similarly project subdued recovery to 0.9-1.3% in 2026, with France's potential GDP growth estimated at just 1.0-1.2%—insufficient to support debt sustainability without substantial fiscal adjustment.

| Indicator | 2020 | 2021 | 2022 | 2023 | 2024 | 2025 (f) | 2030 (IMF) |

|---|---|---|---|---|---|---|---|

| GDP Growth (%) | -8.0 | +7.0 | +2.6 | +1.1 | +1.2 | +0.6 to +0.8 | +1.2 |

| Inflation (%) | +0.5 | +1.6 | +5.2 | +4.9 | +2.3 | +0.9 to +1.2 | +1.9 |

| Debt-to-GDP (%) | 114.9 | 113.0 | 111.9 | 110.6 | 113.0 | 116.0 | 129.4 |

| Fiscal Balance (%) | -9.0 | -6.6 | -4.8 | -5.5 | -5.8 | -5.6 | -6.3 |

| Current Account (%) | -1.7 | -1.0 | -2.0 | -0.7 | +0.1 to +0.4 | -0.6 | +1.6 |

| Unemployment (%) | 8.0 | 7.9 | 7.3 | 7.4 | 7.4 | 7.8 | 7.0 |

*Comprehensive view of key macroeconomic indicators from IMF data, showing historical trends (2020-2024) and medium-term forecasts through 2030 for GDP growth, inflation, government debt, and fiscal balance.*

Inflation dynamics proved remarkably favorable relative to European peers during the 2022-2023 energy crisis. France weathered the energy shock with peak inflation of 4.9-5.2%—substantially below the eurozone average exceeding 8% and UK peaks above 11%—thanks to limited Russian gas dependence (just 17% of supply versus 40%+ in Germany and Italy) and aggressive price controls on electricity and gas that cushioned household purchasing power. Inflation moderated to 2.3% in 2024 and is projected at just 0.9-1.2% in 2025, undershooting the ECB's 2% target and providing monetary policy space as the ECB continues rate cuts. The IMF projects inflation normalizing to 1.9% by 2030, consistent with price stability. This inflation performance preserved social stability and consumer confidence during a critical period, contrasting with severe living standards crises in peer economies, though France's predominance of fixed-rate lending limits monetary transmission compared to variable-rate markets.

The labor market represents a genuine bright spot in France's economic performance and demonstrates the success of structural reforms implemented from 2019-2023. The employment rate reached 69.3% in Q1 2025—a historic high—while unemployment fell to 7.1-7.3%, the lowest level in over a decade and well below the 10%+ rates that prevailed in the mid-2010s. Successive reforms boosted labor force participation to 74.4%, up 1.6 percentage points from 2019, through unemployment insurance reforms, apprenticeship expansions, and hiring incentives that reduced barriers to workforce entry particularly for younger workers. The IMF projects unemployment declining further to 7.0% by 2030 as structural improvements continue to bear fruit. However, near-term pressures are evident as unemployment is projected to rise to 7.8-7.9% in 2025 and employment growth turned negative (-0.2%) for the first time since the pandemic as fiscal consolidation and weak growth dampen hiring.

Productivity growth remains the Achilles heel constraining France's medium-term potential. Labor productivity has failed to return to pre-COVID trends despite strong employment gains, contributing to France's potential GDP growth estimate of just 1.0-1.2%—insufficient to support debt sustainability without fiscal adjustment. Total factor productivity growth remains subdued, constrained by regulatory barriers in services sectors, limited digital technology adoption among small and medium enterprises despite strong large-company performance, and skills mismatches where the education system doesn't fully align with evolving labor market needs in rapidly changing sectors. This productivity constraint represents the fundamental challenge France must address to restore sustainable growth trajectories and explains why employment gains have not translated into stronger GDP performance.

Net Foreign Assets & External Position

France's external position reveals a persistent structural weakness that distinguishes it from traditional core eurozone economies and contributes to credit vulnerability. As of 2023, France's Net Foreign Assets stood at -33.2% of GDP, earning a ⭐⭐⭐ (3/7 stars) rating that classifies the country as a "Weak" debtor with notable external liabilities. This positions France among the EU's largest net borrowers alongside Spain, Ireland, and Greece, contrasting sharply with Germany's positive Net International Investment Position of approximately +€3.5 trillion. The negative NIIP reflects decades of current account deficits that required external financing, creating dependence on continued foreign investor confidence in French sovereign and corporate debt.

*Twenty-five year historical evolution of net foreign assets as percentage of GDP (upper panel) and corresponding NFA star rating progression (lower panel), illustrating long-term external balance sheet dynamics and structural shifts in sovereign external position.*

The five-year trend in Net Foreign Assets demonstrates volatility but persistent weakness, with the position deteriorating from -32.3% of GDP in 2019 to a trough of -38.4% in 2021 during the pandemic before improving modestly to -29.8% in 2022 and then widening again to -33.2% in 2023. Throughout this period, France has consistently maintained the ⭐⭐⭐ (3/7 stars) rating, indicating stable classification within the "Weak" category defined as -50% to -25% NFA/GDP. The deterioration in 2020-2021 reflected pandemic-related fiscal expansion and current account pressures, while the 2022 improvement came from valuation effects and temporary trade balance improvement before structural deficits reasserted themselves in 2023. This pattern suggests France's external position remains vulnerable to cyclical shocks while lacking clear trajectory toward strengthening.

The composition of France's international investment position reveals important nuances beneath the headline negative figure. Direct investment contributes positively at approximately +€437 billion to France's net position, reflecting the country's stock of valuable foreign assets through multinational corporations like LVMH, Total, and Airbus that exceed foreign direct investment in France. However, "other investment" including loans and deposits represents a substantial negative position of approximately -€1,035 billion, indicating France's role as a net borrower in international credit markets. Portfolio investment positions fluctuate with market valuations but generally show modest net liabilities. Foreign investors own approximately 50-55% of French government debt—a double-edged sword that provides diversification and market depth but creates dependence on external confidence and exposes France to potential sudden stops in capital flows during risk-off episodes.

France's current account dynamics show cyclical improvement masking structural challenges. The current account moved from a deficit of -0.7% of GDP in 2023 to a small surplus of +0.1 to +0.4% in 2024—the first positive balance after two years of deficits—driven by normalization of energy prices and recovery in electricity production. The IMF projects the current account strengthening to +1.6% of GDP by 2030, suggesting gradual external rebalancing. However, this improvement reflects primarily cyclical factors rather than fundamental competitiveness gains. France's manufactured goods deficit widened from €36 billion in 2019 to €54 billion in 2023, reflecting chronic competitiveness challenges in industrial production, while the capital goods deficit doubled from €20-25 billion pre-2016 to €39 billion in 2023. The automotive trade balance deteriorated by €8.5 billion between 2019-2023 as electric vehicle imports surged, with Germany's Tesla plant in Berlin contributing to a bilateral automotive deficit that grew from €2.4 billion to €5.9 billion.

External debt metrics reveal the scale of France's international obligations and associated vulnerabilities. Gross external debt reached €7.77 trillion ($8.19 trillion) in Q2 2025—a record high—though approximately 75% is denominated in euros, substantially limiting currency risk given France's eurozone membership and ECB backstop access. Net external debt stood at €1,227.5 billion in 2021 (latest detailed breakdown available), representing the difference between gross external liabilities and external assets. The Net International Investment Position of -€593.9 billion in 2024 (improving from -€771.4 billion in 2023) reflects both flow effects from current account dynamics and valuation changes from exchange rate and asset price movements. The 50-55% foreign ownership of French government debt creates particular vulnerability, as rating downgrades and spread widening could trigger portfolio rebalancing by international investors seeking to reduce exposure to deteriorating credits.

The foreign exchange reserves position is limited but appropriate given eurozone membership. France holds approximately $40-45 billion in foreign currency reserves as of November 2025, primarily in US dollars, representing just 1-2% of GDP—small by emerging market standards but typical for a eurozone core member where the European Central Bank manages most reserve holdings and provides lender-of-last-resort functions. France's total official reserve assets reached €303-330 billion in mid-2025, but this includes €226 billion in gold (representing the majority), €31-32 billion in foreign currency, €38-39 billion in IMF claims and Special Drawing Rights, and €6-7 billion in other reserve instruments. The limited foreign exchange reserves reflect reduced precautionary needs given euro membership and ECB backstop capabilities, though they provide minimal buffer against external shocks compared to countries maintaining substantial war chests.

Credit Strengths & Vulnerabilities

Credit Strengths

France's diversified economy spanning advanced services, competitive industry, and world-class agriculture provides fundamental resilience across business cycles that distinguishes it from more concentrated economies. Services comprise 78.8% of GDP, encompassing finance, tourism, business services, and consulting sectors where France maintains competitive advantages. Industry represents 19.5% of GDP with global champions in aerospace through Airbus and Safran, luxury goods via LVMH, Hermès, Kering, and L'Oréal, pharmaceuticals led by Sanofi, energy through EDF's nuclear leadership, and defense via Thales and Dassault Aviation. Agriculture accounts for just 1.7% of GDP yet France ranks as the world's second-largest agricultural exporter after the United States, demonstrating exceptional productivity. This sectoral breadth insulates France from sector-specific shocks and provides multiple engines for growth recovery once political uncertainty recedes.

The banking sector demonstrates exceptional health that partially offsets sovereign risk concerns and represents a source of stability rather than vulnerability. The 2025 IMF Financial Sector Assessment Program confirmed the sector has "weathered recent shocks effectively" with capital and liquidity buffers maintained at "healthy levels." Common Equity Tier 1 ratios across major French banks consistently exceed requirements by substantial margins, with BNP Paribas, Crédit Agricole, and Société Générale maintaining CET1 ratios of 14-16%—well above regulatory minimums and providing significant shock-absorption capacity. The August 2025 ECB/EBA stress test showed French banks maintaining 10.52% CET1 even under severe adverse scenarios involving cumulative -5.9% real GDP over three years. Asset quality metrics remain favorable with NPL ratios near historic lows of 2.3-2.6%, while liquidity coverage ratios averaging 144-147% substantially exceed the 100% regulatory minimum. Crucially, French banks hold domestic government debt equal to just 3.3% of total assets—below the eurozone average of 6%—limiting sovereign-financial sector nexus risks.

France's labor market transformation represents a genuine policy success that provides both economic and fiscal benefits. The employment rate reached 69.3% in Q1 2025—a historic high—while unemployment fell to 7.1-7.3% from over 10% in the mid-2010s, demonstrating that structural reforms can deliver results even in continental European social market economies. Labor force participation rose to 74.4%, up 1.6 percentage points from 2019, as successive reforms from 2019-2023 reduced barriers to workforce entry particularly for younger workers through unemployment insurance reforms, apprenticeship expansions, and hiring incentives. This employment strength directly supports fiscal sustainability by expanding the tax base and reducing social spending on unemployment benefits, while also enhancing social cohesion and political stability. Even as unemployment ticks up to 7.8% in 2025 due to weak growth, France has fundamentally improved labor market functioning compared to the structural unemployment that plagued the country for decades.

Euro membership eliminates currency risk and provides critical institutional backstops that enhance France's creditworthiness despite fiscal challenges. Government debt is 100% euro-denominated, eliminating foreign exchange risk that plagues many emerging markets and some peripheral European economies with legacy foreign currency obligations. The European Central Bank provides lender-of-last-resort functions and market stabilization through instruments like the Transmission Protection Instrument, ensuring France maintains market access even during periods of fiscal stress. Debt management is exemplary with average maturity exceeding 8 years reducing rollover frequency, diversified investor base with 50-55% non-residents broadly distributed geographically, and consistently strong bid-to-cover ratios around 2.7 at auctions demonstrating robust demand. France pioneered green bond issuance and maintains instrument diversity including nominal, inflation-linked, and ESG-linked securities that appeal to different investor segments. This financial architecture ensures France can continue financing deficits at manageable costs barring major credit rating deterioration or eurozone-wide crisis.

Credit Vulnerabilities

Political fragmentation following the June 2024 snap elections created a hung parliament that makes sustained policy implementation nearly impossible and represents the binding constraint on France's creditworthiness. The National Assembly contains no path to the 289-seat majority needed for comfortable governance, with the left-wing New Popular Front holding 180-193 seats, Macron's centrist Ensemble 159-166 seats, and the far-right National Rally 142-143 seats. France lacks any tradition of coalition-building, while mutual incompatibility among the three blocs prevents alternative arrangements—the left and far-right can combine their 322-336 seats to block any government, yet ideological differences preclude cooperation on positive agendas. This arithmetic produced three government collapses in twelve months: Michel Barnier's center-right administration lasting just 91 days (the shortest tenure in Fifth Republic history), François Bayrou's government surviving nine months before falling 364-194, and Sébastien Lecornu resigning after 27 days before immediate reappointment. The Constitution prohibits dissolving parliament again until July 2025, while the 2027 presidential race further reduces reform incentives as politicians avoid unpopular measures.

Public finances reached crisis levels with the deficit at 5.8% of GDP in 2024—the highest among all 27 EU member states—representing a 1.8 percentage point overshoot of the 4.4% target and marking two consecutive years of significant slippage after 2023's 0.6 percentage point miss. Public debt rose from 110.6% in 2023 to 113.0% in 2024, reversing three years of modest decline, with the European Commission projecting debt climbing to 116.0% in 2025 and 118.4% in 2026 before potentially peaking around 121% by 2027-2028 absent credible consolidation. The IMF's latest projections show an even more alarming trajectory with debt reaching 129.4% of GDP by 2030 and the fiscal balance deteriorating to -6.3% of GDP, suggesting current policies are unsustainable. The EU formally opened an Excessive Deficit Procedure on July 26, 2024, establishing a binding seven-year correction path requiring approximately €120 billion in cumulative savings to bring the deficit below 3% by 2029, yet €40+ billion in required 2026-2029 measures remain completely unspecified due to political paralysis.

Excessive public spending at 58-61% of GDP—the highest in the OECD versus a 40-45% average—creates immense rigidity that makes fiscal consolidation extraordinarily difficult regardless of political will. Approximately 25% of the workforce is employed in the public sector, while social benefits rank among Europe's most generous, meaning every proposed cut faces fierce resistance from affected constituencies. The tax burden already reaches 45% of GDP (second-highest in OECD after Denmark), limiting revenue options and raising competitiveness concerns as businesses and high earners consider relocation to lower-tax jurisdictions. Rising interest costs consume an increasing share of fiscal resources, climbing from 2.0% of GDP in 2023 to 2.5% in 2025 and potentially 3.0% by 2030 as low-cost debt issued during the negative-rate era matures and refinances at current market rates of 3-4%. Spending pressures are intensifying rather than abating, with defense commitments requiring increases toward NATO's 2% of GDP target, climate transition investments demanding substantial resources, and aging-related costs rising as the baby boom generation retires.

The pension system crisis illustrates the intersection of fiscal arithmetic and political dysfunction that threatens France's long-term sustainability. At 14% of GDP, France's pension spending is the third-highest in the OECD after Greece and Italy versus a 9% average, reflecting generous benefits and early retirement ages that are fiscally unsustainable given demographic trends. The 2023 reform raising retirement age from 62 to 64 triggered massive protests but was projected to reduce long-term liabilities significantly, saving approximately €20 billion annually by 2035. However, the suspension of this reform until January 2028—Prime Minister Lecornu's concession to survive October 2025 no-confidence votes—fundamentally undermines fiscal credibility and will cost €20 billion annually by 2035 (approximately 0.5% of GDP). Without implementation, the pension deficit widens from €5 billion today to €15 billion by 2035 and €30 billion by 2037, while spending rises to 15.5% of GDP by 2050. This represents the type of structural reform reversal that rating agencies explicitly warned would trigger downgrades.

Credit Opportunities

Fiscal consolidation success could stabilize debt by the early 2030s and restore market confidence, creating potential for rating outlook upgrades if France demonstrates sustained commitment through 2025-2026 target achievement. The European Commission's November 2024 assessment acknowledged France's consolidation path is "consistent with debt sustainability over the long term" if fully implemented, suggesting the technical framework exists even if political execution remains uncertain. If France can close 2025 near the 5.4% deficit target and achieve 4.4-4.6% in 2026, this would signal credible implementation capacity and potentially stabilize Moody's outlook at Aa3 before eventual downgrade, or even enable S&P and Fitch to revise outlooks to positive from stable. Sovereign spreads would narrow from current 80 basis points above Germany toward 40-50bp historical norms, reducing borrowing costs and creating virtuous cycle dynamics where lower interest payments ease future consolidation requirements.

Monetary policy easing by the European Central Bank supports investment recovery and growth acceleration as rate cuts transmit through the economy, though France's predominance of fixed-rate lending limits transmission compared to variable-rate markets. The ECB has embarked on a rate-cutting cycle from the 4% peak reached in 2023, with policy rates declining toward 2-2.5% by late 2025 and potentially reaching neutral levels around 1.5-2% by 2026-2027. This easing reduces financing costs for businesses and households, supporting investment in productive capacity and consumption of durable goods. For the French government, lower ECB rates translate into reduced borrowing costs on new debt issuance, with 10-year yields potentially declining from current 3.5-4% toward 2.5-3% if fiscal credibility improves alongside monetary easing. The combination of easier monetary conditions and reduced political uncertainty could deliver growth acceleration toward 1.5-1.8% by 2027-2029, substantially improving fiscal dynamics through higher tax revenues and lower cyclical spending.

Structural reforms in services sector deregulation, digital adoption support, and innovation incentives could boost potential growth toward 1.5%+ and address the productivity stagnation that constrains France's long-term prospects. Regulatory barriers in protected professions like notaries, pharmacies, and taxis limit competitive dynamism and keep prices elevated while restricting employment growth. Deregulation could unleash entrepreneurship and productivity gains similar to those achieved in telecommunications and energy sectors following earlier liberalization. The France 2030 investment plan commits €54 billion to emerging technologies including quantum computing, artificial intelligence, biotechnology, and clean energy, positioning France for next-generation competitive advantages if successfully implemented. Digital transformation support for small and medium enterprises could close the adoption gap with large companies, enabling productivity gains across the broader economy. These reforms require parliamentary approval and sustained implementation—currently blocked by political paralysis—but represent significant upside potential if governance improves post-2027.

Climate transition leadership in nuclear technology, where France generates 70% of electricity from zero-carbon sources, enables both export opportunities and domestic decarbonization advantages that could enhance competitiveness. France's nuclear expertise through EDF, Framatome, and Orano positions the country to benefit from global nuclear renaissance as countries seek reliable low-carbon baseload power. Small modular reactor technology development could create new export markets, while nuclear-powered hydrogen production supports industrial decarbonization. The existing nuclear fleet provides France with among Europe's lowest electricity costs and carbon intensities, offering competitive advantages for energy-intensive industries like chemicals, steel, and data centers. As carbon border adjustment mechanisms and climate regulations intensify, France's clean energy infrastructure becomes increasingly valuable, potentially attracting investment and improving trade balances in energy-intensive goods.

Credit Threats

Implementation failure on fiscal consolidation due to political paralysis represents the most immediate and probable threat to France's creditworthiness. With €40+ billion in required 2026-2029 consolidation measures lacking concrete identification and three governments having collapsed in twelve months, the risk of continued target misses leading to debt trajectory toward 125% of GDP is substantial. If France closes 2025 at 5.7-6.0% deficit (versus 5.4% target) and 2026 at 6.0-6.5% (versus 4.6% target), market confidence could erode rapidly as investors conclude France lacks capacity to implement necessary adjustments. The European Commission would face pressure to escalate enforcement through enhanced surveillance, potential fines of 0.1% GDP annually, or structural fund suspensions, though such actions risk being counterproductive by worsening fiscal dynamics. Rating agencies would likely accelerate downgrades, with Moody's moving to A+ within months rather than 12-24 months, and S&P/Fitch potentially following to A/A- as implementation failures mount.

Further credit rating downgrades completing the loss of double-A status and potentially forcing institutional investor sales represent a critical threshold risk. Moody's negative outlook signals potential downgrade to A+ within 12-24 months, which would complete France's fall from triple-A status held as recently as 2012. Some institutional investors maintain mandates requiring minimum AA- ratings for sovereign exposure, meaning downgrades to A+ across all three agencies could trigger forced selling of French government bonds estimated at €50-100 billion. This would widen spreads substantially beyond current 80 basis points above Germany, potentially toward 120-150bp or higher, increasing borrowing costs and creating self-reinforcing dynamics where higher interest payments worsen fiscal trajectories requiring further adjustment. Insurance companies and pension funds with long-duration liabilities might reduce French sovereign exposure in favor of higher-rated alternatives, while emerging market investors who traditionally compare France to peripheral eurozone credits might demand additional risk premiums.

US tariff escalation with 20% reciprocal tariffs on EU goods, 25% on automobiles, and potential 200% on wine and spirits threatens €15-20 billion in exports concentrated in aerospace, wine/spirits, and luxury goods sectors. President Trump's "Liberation Day" announcement on April 2, 2025 imposed a 20% baseline tariff on all EU goods claiming the EU imposes 39% in tariffs and trade barriers on US products, alongside 25% tariffs on automobiles and auto parts. Most threateningly for France, Trump announced potential 200% tariffs on wine, champagne, and all alcoholic products on March 13 after the EU imposed 50% retaliatory tariffs on US bourbon whiskey. Aerospace represents France's largest sectoral exposure at approximately €9 billion in annual exports to the US, while wine and spirit exports total €3.9 billion annually with the US representing the largest single market for French wine globally. Historical precedent from 2019-2021 is sobering: 25% tariffs on French wine triggered a 40% export plunge and €500 million net loss. Luxury goods exports of €4.5 billion annually face pricing power limits despite brand strength. Natixis research estimates 10% tariff increases could reduce French GDP by 0.3%—material given France's already-weak 0.6-0.8% growth outlook for 2025.

German economic weakness persisting as France's top trading partner remains in recession or stagnation, dragging French growth below 0.5% and undermining fiscal consolidation assumptions that depend on revenue growth. Germany absorbs 13.7% of French exports, making it the single largest destination, while broader European exposure reaches 65.6% of total exports. Germany's economy contracted in 2024 and faces structural challenges including energy transition costs, automotive sector disruption from electric vehicle competition, and demographic headwinds. If German growth remains below 0.5% through 2025-2027 rather than recovering to 1.5-2% as baseline forecasts assume, French export performance would disappoint significantly. This would reduce GDP growth by 0.2-0.4 percentage points annually, worsening fiscal balances by approximately 0.3-0.5% of GDP through lower tax revenues and higher cyclical spending. The combination of weak domestic demand from fiscal consolidation and weak external demand from German stagnation could push France toward outright recession, making deficit reduction impossible and triggering the downside scenario.

Economic Analysis

Growth Dynamics and Structural Constraints

France's economic performance reflects deep structural constraints that limit growth potential despite cyclical recovery efforts and monetary policy support. The deceleration from 2021's post-pandemic rebound of 7.0% growth to just 1.2% in 2024 and projected 0.6-0.8% in 2025 reveals an economy struggling to generate momentum beyond temporary catch-up effects. The IMF's projection of 1.2% growth by 2030 suggests France will remain trapped in low-growth equilibrium absent significant structural reforms, with potential GDP growth estimated at just 1.0-1.2%—insufficient to support debt sustainability without sustained fiscal consolidation. This growth constraint reflects the intersection of demographic headwinds as the working-age population declines, productivity stagnation with labor productivity failing to return to pre-COVID trends, and regulatory barriers particularly in services sectors that limit competitive dynamism.

The composition of growth reveals concerning patterns with domestic demand constrained by fiscal consolidation while external demand faces headwinds from weak trading partner performance. Private consumption—typically representing 55-60% of GDP—grew just 0.5-0.7% in 2024 as real wage growth remained modest and household confidence deteriorated amid political uncertainty. Business investment declined in 2024-2025 as policy uncertainty consistently ranks as the top concern in surveys, with firms delaying capital expenditures and some relocating to more stable jurisdictions. Government consumption and investment face sharp constraints from consolidation requirements, with the 2025 budget imposing spending freezes and cuts totaling €40 billion. Net exports provided modest positive contribution in 2024 as the current account moved to small surplus, but this reflects primarily cyclical energy price normalization rather than fundamental competitiveness improvements, and faces reversal risks from potential US tariffs and German weakness.

Sectoral Performance and Competitiveness

France's sectoral performance demonstrates the economy's dual nature with world-class champions coexisting alongside struggling traditional industries. The aerospace sector delivered strong results in 2024 with Airbus achieving 766 aircraft deliveries despite supply chain challenges, while defense orders surged amid European rearmament following Russia's Ukraine invasion. However, the sector faces gathering headwinds from potential US tariffs on the approximately €9 billion in annual exports to America, with Dassault Aviation particularly vulnerable given up to half its private jet sales derive from the US market. The luxury goods industry maintained pricing power with LVMH, Hermès, and Kering generating approximately €45 billion in annual exports, though LVMH shares fell 13% in late February/early March 2025 on tariff concerns and Chinese demand weakness. Pharmaceuticals led by Sanofi benefited from partial exemptions from some April 2025 US tariffs, though details remain unclear.

The automotive sector continues structural decline with the trade balance deteriorating €8.5 billion between 2019-2023 as electric vehicle imports surged, particularly from Tesla's Berlin plant contributing to a bilateral deficit with Germany that grew from €2.4 billion to €5.9 billion. French automakers Renault and Stellantis face intense competition in the EV transition from Chinese manufacturers and Tesla, while lacking the scale advantages of German premium brands. The 25% US tariff on automobiles and auto parts compounds existing challenges. Traditional manufacturing shows persistent competitiveness problems with the manufactured goods deficit widening from €36 billion in 2019 to €54 billion in 2023, while the capital goods deficit doubled to €39 billion reflecting France's difficulty competing in machinery and equipment production. Services provide consistent strength with tourism generating €31 billion surplus as France maintains its position as the world's number one destination, while financial services, business consulting, and cultural industries contribute positive trade balances.

Investment Climate and Business Confidence

The investment climate deteriorated sharply in 2024-2025 as political uncertainty and fiscal consolidation combined to depress business confidence and capital formation. Policy uncertainty consistently ranks as the top concern in business surveys, with firms citing inability to plan investments when government composition changes every 3-9 months and major policy directions remain unclear. Foreign Direct Investment inflows totaled $42 billion in 2023, down 44.6% from 2022's elevated $75.9 billion, though France remained Europe's most attractive FDI destination for the fifth consecutive year with 1,259 foreign investment projects representing a record. However, the 2024-2025 political crisis and rating downgrades raise questions about whether FDI inflows can be sustained at historical levels, particularly as competing jurisdictions like Germany and Spain offer greater political stability.

Corporate bankruptcies reached 64,000 in 2024, up 30% versus pre-pandemic levels, as COVID-era support measures fully expired and firms faced the combined pressures of higher interest rates, weak demand, and elevated input costs. While this represents normalization toward long-term averages rather than crisis, the trend bears monitoring as further increases could stress banking sector asset quality. Business investment declined in 2024-2025 for the first time since the pandemic, with gross fixed capital formation falling 0.5-1.0% as firms delayed or cancelled projects. The France 2030 investment plan's €54 billion commitment to emerging technologies provides some offset, but implementation depends on political stability and sustained funding that current fiscal pressures threaten. The combination of weak investment, modest consumption growth, and fiscal consolidation creates a low-growth trap where pessimistic expectations become self-fulfilling.

Political & Institutional Assessment

Constitutional Crisis and Governance Breakdown

France's political system has entered uncharted territory with the Fifth Republic's institutional design proving inadequate for governing in a fragmented multi-party landscape. President Emmanuel Macron's decision to dissolve parliament on June 9, 2024—after his coalition suffered a crushing defeat to Marine Le Pen's National Rally in European elections—ranks among the greatest strategic blunders in modern French political history. The snap legislative elections of July 2024 produced a hung parliament with no path to majority: the left-wing New Popular Front won 180-193 seats, Macron's centrist Ensemble 159-166 seats, and the far-right National Rally 142-143 seats in the 577-seat National Assembly where 289 seats are needed for comfortable governance and France lacks any tradition of coalition-building. The result was immediate paralysis with three governments collapsing between September 2024 and November 2025.

Michel Barnier's center-right administration became the first government toppled by no-confidence vote since 1962, lasting just 91 days—the shortest tenure in Fifth Republic history—after using Article 49.3 to force through the 2025 budget without a parliamentary vote. François Bayrou survived nine months before his government fell 364-194 after proposing €44 billion in cuts including scrapping public holidays. Sébastien Lecornu resigned after an unprecedented 27 days and was immediately reappointed, surviving two no-confidence votes in October only by suspending pension reform until 2028—a concession that fundamentally undermines fiscal credibility and demonstrates how political survival now requires abandoning the very reforms necessary for sustainability. The parliamentary arithmetic makes governance nearly impossible as the left and far-right can combine their 322-336 seats to block any government, yet mutual incompatibility prevents alternative coalitions.

Constitutional Constraints and Political Calendar

The Constitution creates additional constraints that extend the crisis timeline and limit resolution options. Article 92 prohibits dissolving parliament within one year of the previous dissolution, meaning the earliest possible new legislative elections is July 2025—though polls suggest an even more fragmented result given National Rally's strength at 32% versus the left's 25%. Presidential elections aren't due until April-May 2027, and Macron is barred by term limits from seeking a third term, creating a lame-duck dynamic where political opponents see little incentive to compromise, preferring to wait for the next election cycle. The run-up to 2027 further constrains reform appetite as politicians avoid unpopular measures that could damage electoral prospects. This creates a structural impediment to the sustained multi-year implementation required for fiscal consolidation, as governments focused on short-term survival cannot commit to medium-term adjustment paths.

Four governance mechanisms remain available, all problematic. First, Article 49.3 allows forcing legislation through without votes, but automatically triggers no-confidence motions that have now toppled one government and nearly felled two others, making it an increasingly risky tool. Second, temporary budgets under special law roll over previous year appropriations, avoiding government shutdown but precluding meaningful policy change and leaving France operating on autopilot. Third, the Senate—where Macron's allies retain influence—can delay or modify legislation, but cannot block National Assembly decisions and provides only limited leverage. Fourth, emergency executive powers exist under Article 16 for national crises, but deploying them for budget disputes would provoke constitutional crisis and likely trigger mass protests, making this option politically unthinkable absent genuine emergency.

Marine Le Pen's Conviction and Far-Right Dynamics

Marine Le Pen's March 31, 2025 criminal conviction adds significant volatility to an already unstable political landscape. A Paris court sentenced her to four years prison (two suspended, two under house arrest with electronic monitoring), a €100,000 fine, and five-year ban from holding public office effective immediately for embezzling EU funds through fake parliamentary assistant jobs. The ban applies during appeals, potentially barring Le Pen from the 2027 presidential race where she was polling at 35% before conviction—her strongest position ever after three previous unsuccessful campaigns. If the conviction is upheld through appeals, 29-year-old Jordan Bardella becomes the National Rally's standard-bearer, though he lacks Le Pen's experience, gravitas, and personal connection with the party's working-class base.

Le Pen's supporters decry "lawfare" and political persecution, while international far-right figures from Viktor Orbán to Donald Trump voiced support, framing the conviction as establishment attempt to prevent democratic choice. The conviction's ultimate political impact remains uncertain—it could weaken the National Rally by removing its most effective leader, or alternatively strengthen it by creating a martyrdom narrative and energizing the base. For France's credit profile, the conviction removes the leading opposition figure at a critical juncture when the country needs political stability and consensus-building. If Le Pen is barred and Bardella proves ineffective, the National Rally's 143 seats might become more willing to compromise with centrist forces, potentially enabling governance. Conversely, if the conviction energizes the far-right and they gain additional seats in potential July 2025 elections, the paralysis could deepen.

Institutional Quality and Rule of Law

Despite the political dysfunction, France's underlying institutional quality and rule of law provide important stabilizing factors that distinguish it from countries with weaker governance frameworks. France maintains strong property rights, independent judiciary, and reliable contract enforcement, ranking 21st globally on Transparency International's Corruption Perceptions Index—well ahead of Southern European peers and most emerging markets. The judiciary's willingness to convict a leading presidential candidate demonstrates institutional independence, though it also reveals the political system's fragmentation extends beyond parliament. Membership in the EU single market ensures regulatory alignment and access to 450 million consumers, while France's permanent seat on the UN Security Council and nuclear deterrent ensure geopolitical relevance and influence.

The Fifth Republic's institutional design—while currently strained—has delivered stability for 66 years through various crises including Algerian independence, May 1968 protests, multiple cohabitation periods, and the 2008 financial crisis. The strong presidency provides executive continuity even when governments change, while the two-round electoral system typically produces clear majorities. The current crisis reflects unprecedented fragmentation rather than institutional failure per se, and the system retains mechanisms for resolution through the 2027 electoral cycle. These institutional strengths explain why market reactions to political chaos remain measured compared to reactions in countries with weaker governance frameworks—investors distinguish between political noise and fundamental institutional breakdown, betting that France's institutions will ultimately prove resilient.

Banking Sector & Financial Stability

Capital Adequacy and Stress Test Results

France's banking sector demonstrates exceptional resilience that provides a critical stabilizing factor offsetting sovereign credit concerns. The August 2025 ECB/EBA stress test confirmed French banks maintain robust capital positions with the ability to absorb severe economic shocks while remaining well above regulatory minimums. French banks entered the stress test with a Common Equity Tier 1 ratio of 15.91%—substantially above the eurozone aggregate of 15.81-15.86%—and maintained 10.52% even under the severe adverse scenario involving cumulative -5.9% real GDP over three years, 12.5% unemployment, and -28.2% commercial real estate prices. This 5.39 percentage point decline under stress remains comfortably above the regulatory minimum of approximately 8-9% including buffers, demonstrating significant shock-absorption capacity.

Individual bank capital positions reflect consistent strength across the sector. BNP Paribas reported 2024 net income of €11.7 billion with Return on Tangible Equity of 10.9%, maintaining what management describes as a "solid financial structure" with Stage 3 coverage ratio of 69.7% indicating strong provisioning against non-performing loans. Crédit Agricole achieved record 2024 performance with net income of €8.6 billion (+4.6% year-over-year) and RoTE of 14.0%—exceeding its 12% target for 2025 by a full year—supported by CET1 ratios of 11.7% for Crédit Agricole SA and 17.2% for the broader group including regional banks. Société Générale delivered 2024 net income of €4.2 billion with CET1 ratio of 13.3%, representing 310 basis points above regulatory requirements, and RoTE of 6.9% meeting strategic targets. These capital levels provide substantial buffers against potential deterioration in asset quality or market conditions.

Asset Quality and Credit Risk Management

Asset quality metrics remain favorable despite slight deterioration reflecting the challenging economic environment. The eurozone NPL ratio held steady at 2.28-2.31% in Q3-Q4 2024, with French banks specifically at 2.61% in Q3 2024—near historic lows and demonstrating effective credit risk management through the pandemic and subsequent inflation shock. By comparison, France's 2022 NPL ratio reached just 2.08%, the lowest in recent history per World Bank data, indicating the current modest increase reflects normalization rather than crisis. Sectoral breakdowns show commercial real estate NPLs at 4.61% (stable despite sector challenges), SME loans at 4.88% (slightly elevated but controlled), and residential mortgages at just 1.58% (declining), with the residential strength reflecting France's conservative mortgage underwriting standards and predominance of fixed-rate lending.

The cost of risk remains well-contained across major banks, indicating provisions are adequate relative to expected losses. BNP Paribas maintained cost of risk at 38 basis points in 2024, below its 40bp target and reflecting benign credit conditions. Crédit Agricole reported 27bp cost of risk at the lower end of its 25-30bp guidance range, while Société Générale achieved 26bp demonstrating effective risk management. Stage 2 loans—showing significant credit risk increase but not yet non-performing—represent 9.67% of total loans, indicating banks are proactively managing deteriorating credits before they become NPLs through restructuring, additional monitoring, and selective provisioning. The coverage ratio for Stage 3 NPLs averages 65-70% across major banks, providing substantial loss absorption capacity if economic conditions deteriorate further.

Liquidity and Funding Stability

Liquidity positions provide additional stability with French banks maintaining substantial buffers above regulatory requirements. Liquidity Coverage Ratios average 144-147%—substantially above the 100% regulatory minimum—with individual banks ranging from Société Générale's 152% to consistent above-requirement positions across the sector. The LCR measures banks' ability to meet liquidity needs over a 30-day stress scenario, and French banks' positions indicate they could withstand significant deposit outflows or market disruptions without accessing emergency central bank facilities. Net Stable Funding Ratios average 114.6% (Société Générale: 116%), well exceeding the 100% requirement and indicating stable long-term funding structures with appropriate maturity matching between assets and liabilities.

The loan-to-deposit ratio reached 100.43% in Q4 2024—the lowest since 2015—reflecting strong deposit franchises that reduce dependence on wholesale funding markets. French banks successfully issued medium and long-term debt securities throughout 2024 despite market volatility, demonstrating continued investor confidence in the sector. Total issuance exceeded €100 billion across the major banks, with spreads remaining moderate relative to historical ranges. The deposit base proved stable through political turbulence, with no evidence of flight to safety or cross-border deposit movements that characterized earlier eurozone crises. This funding stability reflects depositor confidence in the banking sector's health and the implicit backstop provided by eurozone membership and ECB liquidity facilities.

Sovereign-Financial Sector Nexus

Sovereign debt exposure represents a key concern given France's fiscal challenges, but analysis reveals the risks are limited and manageable. French banks hold domestic government debt equal to 3.3% of total assets—below the eurozone average of 6%—though this represents approximately 71% of CET1 capital, creating potential vulnerability if sovereign spreads widen substantially or ratings deteriorate significantly. Specific holdings include BPCE Group with €182 billion in French government bonds, Banque Postale with approximately €90 billion, and SFIL with €45 billion. However, crucially, banks with larger exposures primarily hold bonds to maturity in their banking books rather than trading books, reducing mark-to-market volatility risks and limiting the impact of spread widening on reported capital ratios.

The Banque de France's December 2024 Financial Stability Report concluded that "limited exposure to French government debt contributes to resilience," while the sovereign-financial sector nexus appears "manageable" compared to peripheral eurozone countries where banks hold 10-15% of assets in domestic sovereign debt. The 50-55% foreign investor base for French sovereign debt further reduces concentration risk by diversifying the holder base beyond domestic banks. The December 2024 Moody's downgrade of France from Aa2 to Aa3 triggered downgrades for seven major French banks, but crucially the outlook was upgraded from negative to stable despite lower ratings, signaling confidence in the sector's ability to navigate sovereign stress. Rating agencies recognize that French banks maintain higher capital quality, lower NPL ratios than southern European peers, strong liquidity positions, and diversified universal banking models combining retail, corporate, investment banking, asset management, and insurance.

Profitability and Business Model Resilience

Profitability trends show divergence between banks and across business lines, with 2024 marking strong recovery in fee-based revenues offsetting net interest margin compression. The eurozone aggregate ROE reached 10.22% in Q3 2024—the highest since Q2 2015—though French banks underperformed this benchmark due to structural factors. France's predominance of fixed-rate lending, particularly in mortgages where 90%+ of loans carry fixed rates, shielded asset quality during the 2022-2024 rate-hiking cycle by preventing payment shock for borrowers, but limited net interest income growth as banks couldn't immediately reprice assets. French banks posted Net Interest Margins of just 0.89% in Q4 2024 versus the eurozone average of 1.60%, reflecting this structural disadvantage.

However, 2024 marked strong recovery in other revenue sources demonstrating business model diversification. BNP Paribas revenues grew 4.1% to €48.8 billion, driven by 8.4% growth in Corporate & Investment Banking as capital markets activity rebounded and M&A advisory strengthened. Crédit Agricole revenues increased 4.3% to €38.1 billion with record investment banking performance, while asset management and insurance divisions contributed steady fee income. Société Générale revenues jumped 6.7% to €26.8 billion with particularly strong retail banking rebound in Q4 2024 as the bank's restructuring efforts gained traction. Investment banking, asset management, and insurance provided particular strength across all three major banks, demonstrating the value of universal banking models that combine multiple revenue streams and reduce dependence on any single business line.

Outlook & Scenarios

Short-Term Outlook (12 months)

The short-term outlook through November 2026 envisions continued political paralysis, modest fiscal slippage, and subdued growth as France navigates the most challenging period before potential resolution through the 2027 electoral cycle. GDP growth will likely remain weak at 0.6-0.8% in 2025 as fiscal consolidation of approximately 1% of GDP combines with political uncertainty to depress business investment and consumer confidence. The 2025 fiscal deficit will close at 5.5-5.7% of GDP versus the 5.4% target, representing the third consecutive year of target misses and further eroding credibility with rating agencies and market participants. If parliament can be dissolved again in July 2025, new elections would likely produce an even more fragmented result given National Rally polling at 32%, potentially deepening rather than resolving the impasse.

Moody's will likely downgrade France from Aa3 to A+ within the 12-24 month window signaled by the negative outlook, completing the loss of double-A status across all three major rating agencies. This downgrade will occur if France demonstrates continued implementation difficulties through mid-2026, with the specific trigger likely being the 2026 budget process if it reveals similar political dysfunction to 2025. Sovereign spreads will oscillate between 70-100 basis points above German Bunds—elevated but manageable—with periodic widening to 100-120bp during political crises or negative news flow. The banking sector will maintain stability with CET1 ratios above 14% and NPL ratios contained below 3%, though profitability may moderate as economic weakness dampens loan growth and fee income.

The US-EU trade situation represents a critical variable with the July 14, 2025 deadline for the 90-day negotiation window approaching. Sources indicated in late July 2025 that von der Leyen and Trump agreed on a tariffs and trade deal, suggesting near-term resolution that avoids the most damaging scenarios of 200% wine tariffs and broad 20-25% tariffs on all goods. However, even with negotiated compromise, some tariff increases will likely remain, reducing French GDP by 0.1-0.2 percentage points and creating headwinds for aerospace, luxury goods, and wine sectors. The labor market will show continued resilience with unemployment rising modestly to 7.8-7.9% but employment rates remaining historically elevated, providing some offset to weak growth through sustained consumer spending.

Medium-Term Outlook (1-3 years)

The medium-term outlook through 2027-2028 hinges critically on the 2027 presidential election and subsequent June 2027 legislative elections, which represent the most likely inflection point for either political breakthrough or continued deterioration. The base case assigns 50-60% probability to a muddle-through scenario where fiscal consolidation proceeds more slowly than planned but avoids crisis. Under this path, the 2026 deficit reaches 5.5-6.0% versus the 4.6% target, and 2027-2028 deficits remain in the 4.5-5.5% range rather than declining toward 3% as required. Public debt peaks at 118-122% of GDP in 2028-2030 before gradually stabilizing in the early 2030s, requiring EU deadline extension to 2030-2031 but maintaining market access given France's core eurozone status and institutional quality.

GDP growth recovers modestly to 0.9-1.3% in 2026-2027 as monetary easing by the ECB provides support, with policy rates declining toward neutral levels of 1.5-2% by late 2026. However, fiscal drag and political uncertainty constrain the upside, preventing the stronger 1.5-2% growth that would significantly improve fiscal dynamics. The 2027 presidential election produces a clear winner who secures sufficient parliamentary majority in June 2027 legislative elections to enable governance, though whether through National Rally victory, left-wing coalition, or reconstituted center-right alliance remains uncertain. The new government implements gradual reforms over 2027-2029 that demonstrate commitment to consolidation without triggering social unrest, allowing France to approach the 3% deficit threshold by 2029-2030 rather than the mandated 2029.

Credit ratings stabilize at A+ across all three agencies following Moody's eventual downgrade, with outlooks returning to stable as implementation improves post-2027. Sovereign spreads narrow modestly to 60-80bp above Germany as political risk premium declines, though France remains differentiated from core credits given elevated debt levels. The banking sector maintains strong capital positions with CET1 ratios of 14-15% and returns to more normal profitability with ROEs of 10-12% as economic conditions improve and net interest margins stabilize. Foreign direct investment recovers toward $60-70 billion annually as political stability returns, while corporate bankruptcies decline from the elevated 64,000 level toward 50-55,000 representing long-term average.

Rating Scenarios

The upside scenario (15-20% probability) envisions political breakthrough enabling comprehensive reform and accelerated consolidation. The 2027 presidential election produces a decisive winner who secures clear parliamentary majority through electoral coattails, ending the fragmentation that has paralyzed governance. This new government implements a comprehensive reform package including immediate restoration of pension reform (retirement age to 64, with pathway to 65 by 2035), services sector deregulation removing barriers in protected professions, digital transformation incentives for SMEs, and targeted spending reductions totaling €100+ billion cumulatively through 2031. Tax reform focuses on broadening bases and eliminating inefficient expenditures rather than raising rates, while public sector efficiency gains through digitalization reduce spending by 2-3% of GDP over 5-7 years.

Under this scenario, France meets the 2025 deficit target of 5.4%, achieves 4.4-4.6% in 2026 (near target), and delivers 3.5-3.8% by 2028, reaching the 3% threshold by 2029 or 2030. Public debt stabilizes at 115-117% of GDP before declining gradually to 110-112% by 2033, supported by primary surpluses of 1.5-2.0% of GDP. Credit rating agencies respond positively with Moody's returning outlook to stable at Aa3, followed by upgrades to Aa2 once consolidation demonstrates sustainability, while S&P and Fitch upgrade to AA- within 2-3 years as credibility is restored. Sovereign spreads narrow to 40-50bp above Germany, returning to historical norms. GDP growth accelerates to 1.2-1.4% in 2025-2026 and 1.5-1.8% in 2027-2029 as structural reforms boost productivity, with labor productivity growth reaching 1.5% annually and raising potential GDP toward 1.8-2.0%.

The downside scenario (25-30% probability) envisions fiscal consolidation failure triggering market confidence crisis. Political paralysis deepens with governments lasting 6-9 months, preventing sustained implementation of consolidation measures. The 2025 deficit reaches 6.0%+, 2026 exceeds 6.5%, and trajectory toward 7%+ becomes evident by 2027 as spending pressures (defense, climate, aging, interest costs) overwhelm revenue capacity. Public debt accelerates toward 125-130% of GDP by 2030 with interest burden approaching 3.5-4.0% of GDP, creating self-reinforcing dynamics where borrowing costs increase debt accumulation. Moody's downgrades to A+ within 12 months, followed by S&P and Fitch downgrades to A/A- as implementation failures mount.

Sovereign spreads widen to 150-200bp above Germany as investors demand premium for deteriorating fundamentals, approaching or exceeding Italian levels despite stronger economic structure. French 10-year yields reach 4.5-5.0%, substantially increasing refinancing costs on the €300 billion annual rollover. The banking sector faces pressure from sovereign exposure as mark-to-market losses and higher risk weights affect capital ratios, potentially triggering defensive deleveraging that contracts credit availability. GDP growth falls to 0.2-0.4% in 2025, with potential contraction of -0.1 to +0.3% in 2026, and weak recovery to 0.5-0.8% in 2027. Unemployment rises toward 8.5-9.0% as hiring freezes spread, while corporate bankruptcies accelerate toward 75,000-80,000 annually. Social unrest escalates through mass protests and strikes reminiscent of gilets jaunes, while the far-right or far-left gains power in 2027 on anti-establishment platforms potentially advocating eurozone exit or ECB confrontation.

Conclusion

France stands at a critical crossroads between gradual adjustment and potential crisis, with the next 24-36 months determining which path the country follows. The convergence of political paralysis following three government collapses in twelve months, fiscal deterioration reaching 5.8% deficit (highest in the EU), and credit rating downgrades to A+/Aa3 (lowest in modern history) creates the most challenging sovereign credit environment since the euro crisis. Yet beneath this turbulence lies substantial resilience through a diversified economy with global champions across aerospace, luxury goods, and pharmaceuticals; a robust banking sector with 15-16% CET1 ratios and 2.3-2.6% NPL ratios near historic lows; a historic employment rate of 69.3% demonstrating successful labor market reforms; and exemplary debt management with 8+ year average maturity and stable 50-55% foreign investor base providing continued market access.

The fiscal consolidation challenge is immense but theoretically manageable, requiring €120 billion in cumulative savings to reduce the deficit from 5.8% to below 3% by 2029 while public spending at 58-61% of GDP (highest in OECD) creates rigidity and tax burden at 45% of GDP (second-highest) limits revenue options. The pension system's suspension until 2028 costs €20 billion annually by 2035, while rising interest burden from 2.0% to potentially 3.0% of GDP consumes growing fiscal space. However, other countries accomplished comparable consolidations over 5-7 years when political will materialized, suggesting France's challenge is less economic than political—can a functioning parliamentary majority be assembled to implement sustained reforms?

Political fragmentation represents the binding constraint, with the hung parliament (NFP 180-193, Ensemble 159-166, RN 142-143) lacking any path to the 289-seat majority needed for stable governance and France's absence of coalition-building tradition preventing alternative arrangements. The Constitution prohibits new elections until July 2025, while the 2027 presidential race further reduces reform incentives, creating structural impediments to the sustained multi-year implementation required for fiscal consolidation. €40+ billion in required 2026-2029 consolidation measures remain completely unspecified, guaranteeing continued market skepticism and raising questions whether the Fifth Republic's institutional design suited to strong presidencies can function in fragmented political landscapes.

The most probable near-term path involves continued slippage and gradualism, with France missing fiscal targets by cumulative 2-3 percentage points, closing 2025 at 5.5-5.7% deficit, 2026 at 5.5-6.0%, and approaching 3.5-4.0% by 2029 rather than the mandated 3%. Public debt peaks at 118-122% of GDP in 2028-2030 before stabilizing, requiring EU deadline extension to 2030-2031 and market tolerance for elevated deficits given France's core eurozone status. Moody's downgrades to A+ within 12-24 months completing triple-A loss, but ratings then stabilize absent further deterioration. GDP growth remains subdued at 0.6-0.8% in 2025, recovering to 0.9-1.3% in 2026-2027 as monetary easing provides modest support. This muddle-through scenario (50-60% probability) represents neither crisis nor triumph but grinding adjustment over 7-10 years.

The 2027-2028 period represents the critical inflection point when either political breakthrough enables acceleration toward the upside scenario (15-20% probability) or continued dysfunction triggers the downside scenario (25-30% probability) of spread blowouts, growth near zero, and potential eurozone-wide contagion. If the 2027 presidential winner secures parliamentary majority and demonstrates commitment through 2027-2028 implementation, France can restore credibility and stabilize on an upward trajectory. Alternatively, if political paralysis persists and deficits remain above 6% through 2027, market confidence could crack with spreads widening toward 150-200bp and self-reinforcing dynamics taking hold. France will not default and is unlikely to require bailouts given eurozone membership and ECB backstops, but the country faces years of difficult adjustment, compressed investment, and foregone growth opportunities that represent the cost of political paralysis measured in percentage points of GDP growth and hundreds of thousands of jobs.