🇨🇱 Chile

Chile maintains the strongest sovereign credit profile in Latin America, anchored by robust institutional frameworks, prudent macroeconomic management, and a relatively moderate debt burden that positions it favourably amongst regional peers. As of November 2025, the country holds investment-grade ratings from all three major international agencies, with Moody's assigning A2 with a Stable outlook, S&P Global maintaining A (foreign currency) and A+ (local currency) with Stable outlook, and Fitch affirming A- with Stable outlook. This creditworthiness reflects Chile's exceptional governance standards, credible policy frameworks including an independent central bank and fiscal rule, and strategic positioning as the world's largest copper producer controlling 24% of global output and second-largest lithium producer with 30% of global reserves. The country's extensive free trade network covering 65 economies representing 88% of global GDP provides crucial market access and diversification, whilst sovereign wealth funds accumulated during commodity booms offer countercyclical fiscal buffers.

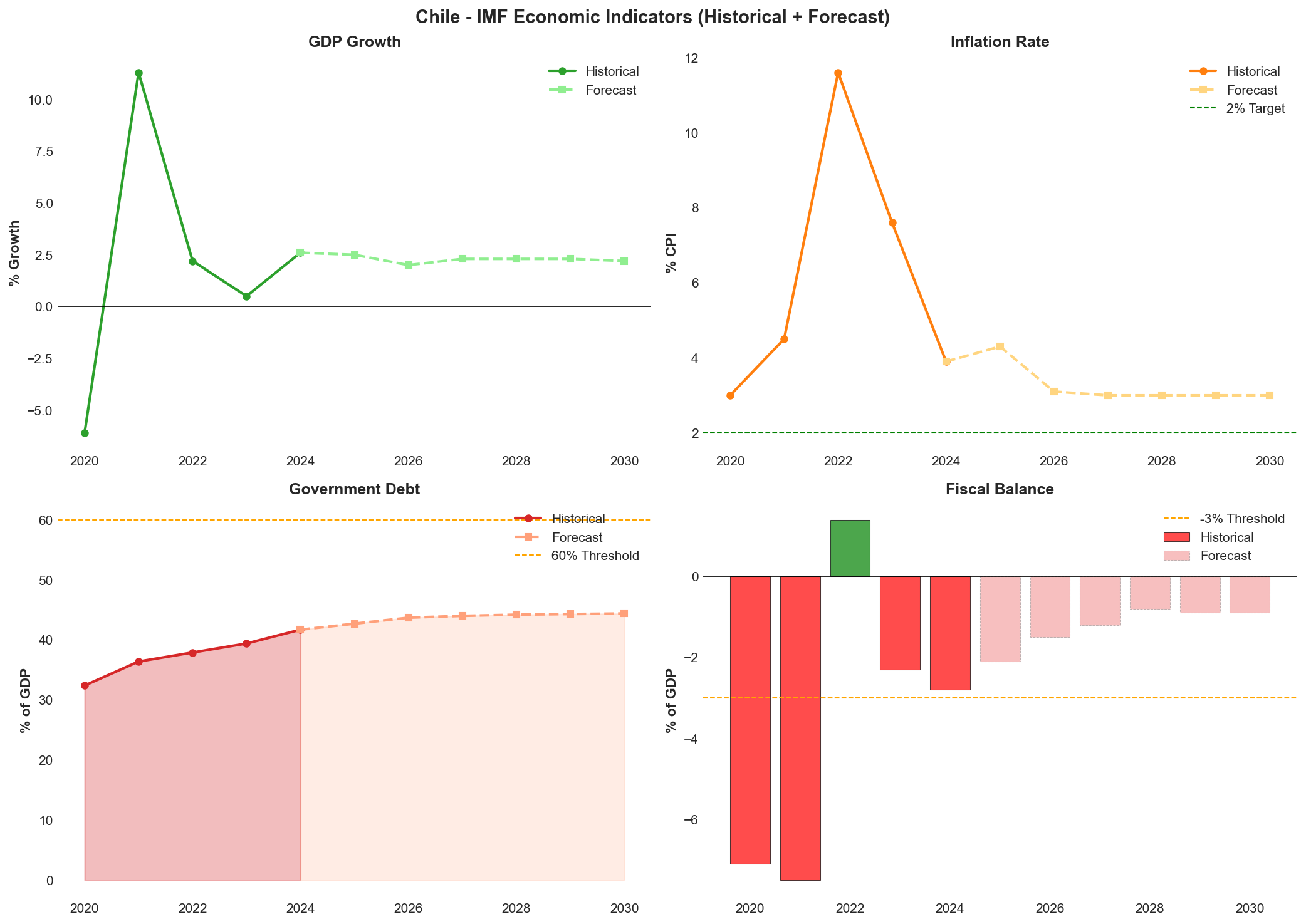

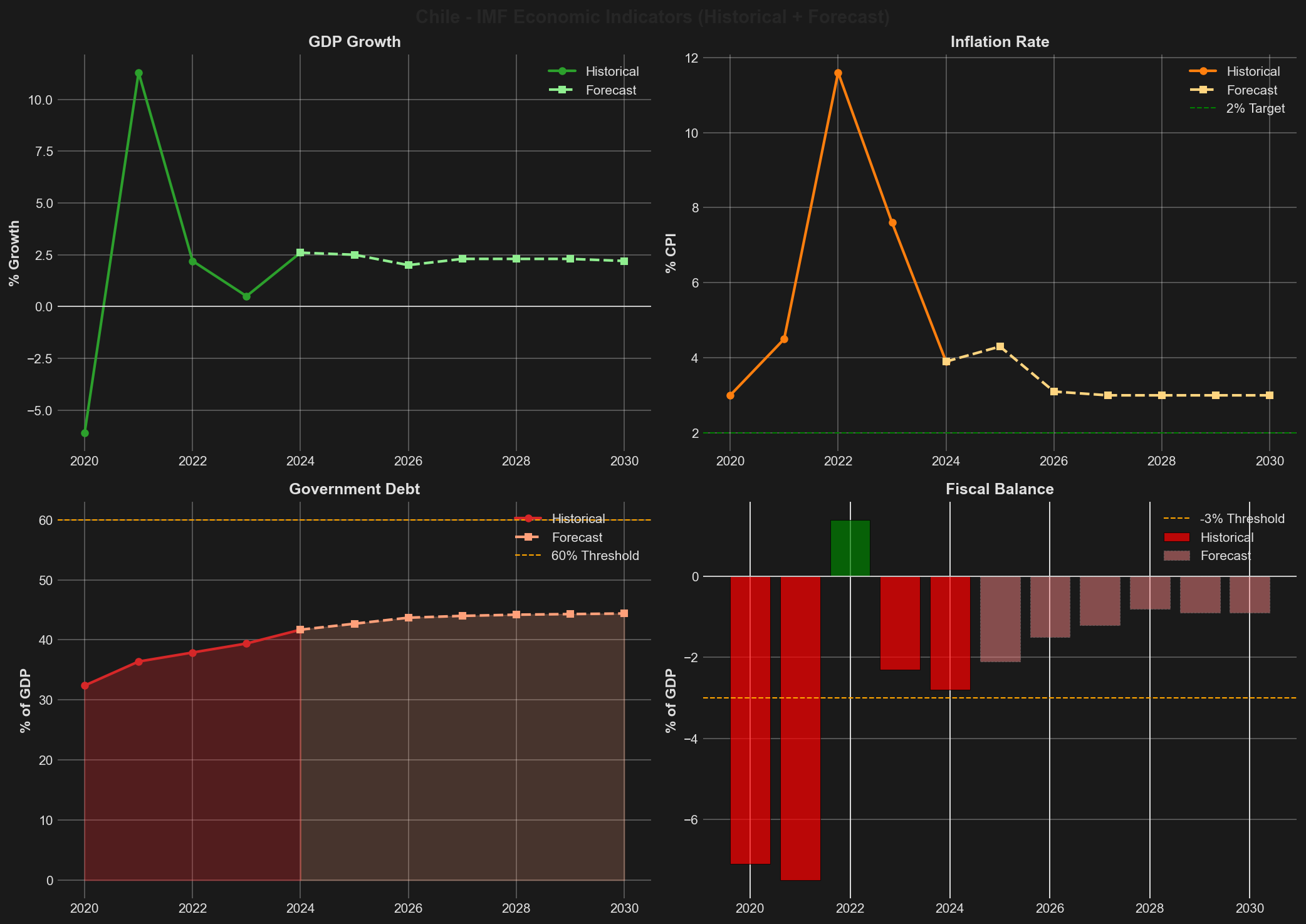

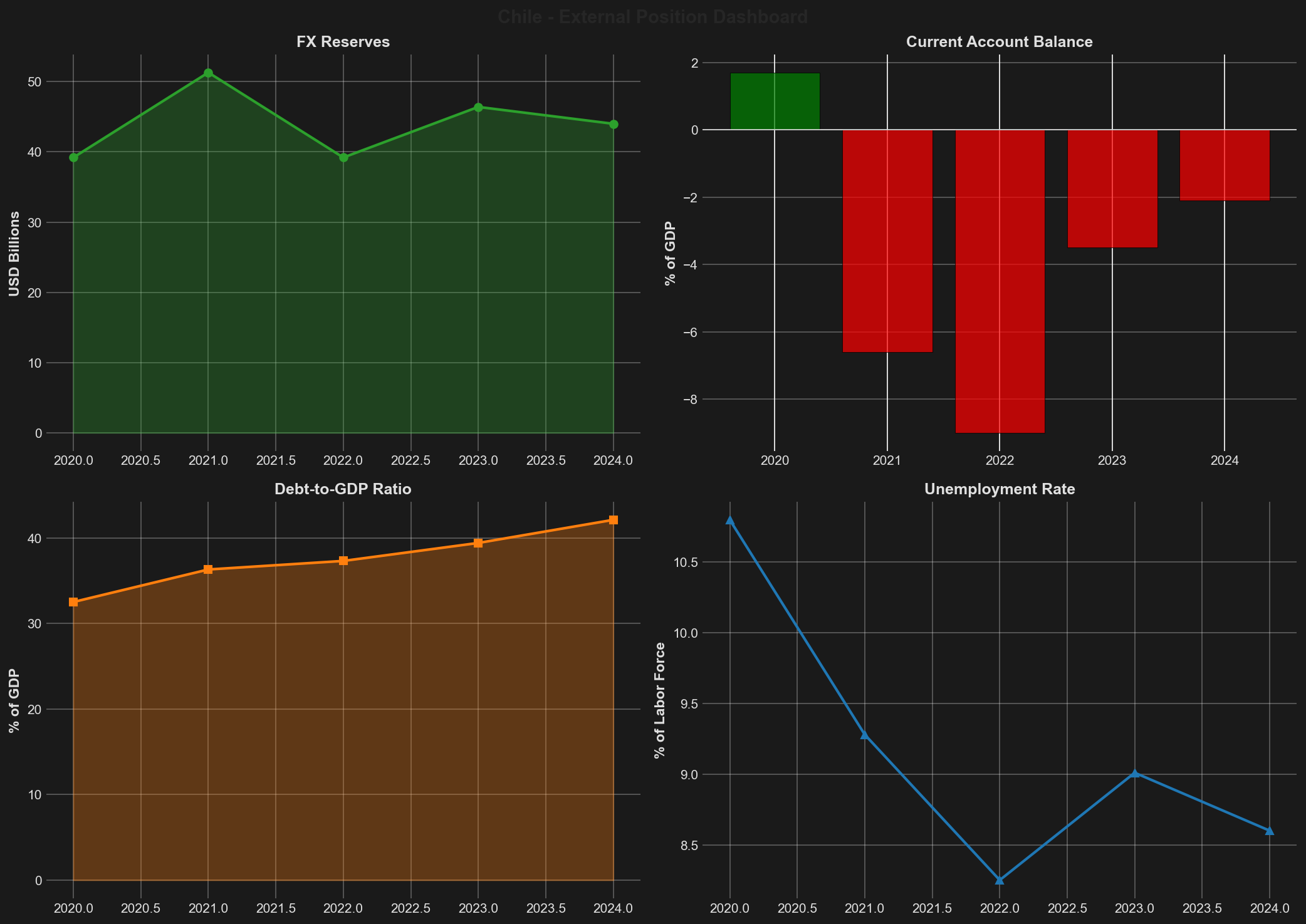

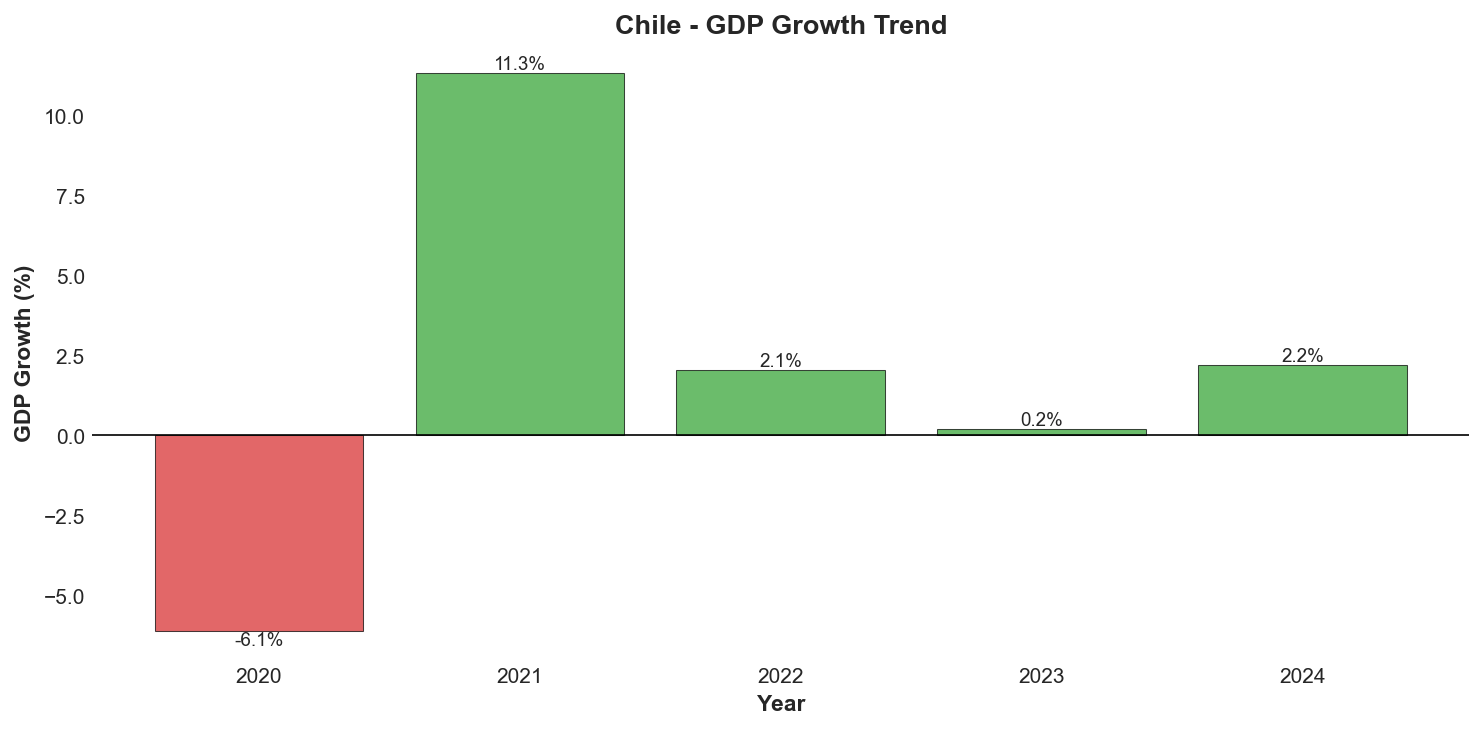

The Chilean economy has successfully navigated post-pandemic adjustments, achieving GDP growth of 2.2-2.6% in 2024 following near-stagnation of 0.2% in 2023, with momentum expected to stabilise around 2.0-2.3% in 2025 before settling at potential growth of approximately 2.2% through 2030 according to IMF projections. Inflation has declined substantially from its peak of approximately 14% in the third quarter of 2022 to 4.7% by early 2025, though it remains above the Central Bank's 3% target partly due to a 60% cumulative electricity tariff increase implemented between June 2024 and February 2025, with convergence to the 3.0% target expected by 2030. The fiscal position has improved markedly from record deficits of 7.5% of GDP in 2021 to approximately 2.7% in 2024, with the government maintaining commitment to achieving broad fiscal balance by 2027 and IMF forecasts projecting a deficit of just 0.9% of GDP by 2030. Public debt remains moderate at 42-44% of GDP, well below the 55.1% median for A-category rating peers, with projections indicating stabilisation around 44.4% of GDP by 2030. External accounts have strengthened considerably, with the current account deficit narrowing from a record 9.0% of GDP in 2022 to an estimated 2.1-3.9% range in 2024, supported by record merchandise exports of $103.3 billion, though IMF projections suggest potential widening to 12.4% of GDP by 2030 as investment-related imports for green hydrogen and lithium processing projects accelerate.

Chile confronts significant structural challenges that constrain its credit profile and growth potential despite strong fundamentals. The economy exhibits pronounced commodity dependency, with copper representing over 50% of exports and mining contributing 14-16% of GDP, creating substantial vulnerability to price cycles and global demand fluctuations, particularly from China which absorbs 36% of exports. Export concentration extends beyond products to geographic markets, with potential US copper tariffs threatened by the Trump administration and China's economic trajectory presenting material downside risks to external accounts and fiscal revenues, which derive approximately 19% from mining activities. The labour market shows persistent weaknesses with unemployment at 8.5% as of 2024, above pre-pandemic levels and declining only gradually to a projected 7.9% by 2030, whilst informality rates exceeding 25% particularly affect women and younger workers. Political dynamics have proven challenging, with President Gabriel Boric's approval ratings languishing at 30-35% and ambitious reform agendas largely stalled beyond the significant breakthrough of comprehensive pension reform approved in January 2025. Social tensions remain elevated despite the definitive end of constitutional reform efforts following two failed referendums, with security concerns, persistent inequality, and inadequate social services dominating public discourse ahead of the November 2025 presidential election where polling indicates a rightward shift in voter sentiment.

Looking forward, Chile's creditworthiness trajectory appears stable with modest upside potential contingent on successful economic diversification and structural reform implementation. The country's strategic positioning in critical minerals essential for global decarbonisation provides a structural tailwind, with the ambitious green hydrogen initiative targeting $330 billion in investment and production costs below $1.5/kg by 2030 representing a potentially transformative opportunity to reduce commodity dependency. However, realising this potential requires sustained political consensus for difficult reforms to boost productivity growth, address infrastructure gaps in transportation and water management, and enhance economic complexity beyond traditional mining exports. The incoming administration taking office in March 2026 will inherit solid macroeconomic foundations but face pressure to balance fiscal consolidation requirements with social spending demands in a context of moderate growth potential and persistent unemployment. Chile's strong institutional frameworks, independent judiciary, and demonstrated capacity for policy adjustment provide confidence in navigating these challenges, though external vulnerabilities to commodity cycles and global financial conditions warrant continued monitoring as key rating considerations.

Key Economic Trends

*Comprehensive view of key macroeconomic indicators from IMF data, showing historical trends (2020-2024) and medium-term forecasts through 2030 for GDP growth, inflation, government debt, and fiscal balance.*

Ratings Summary

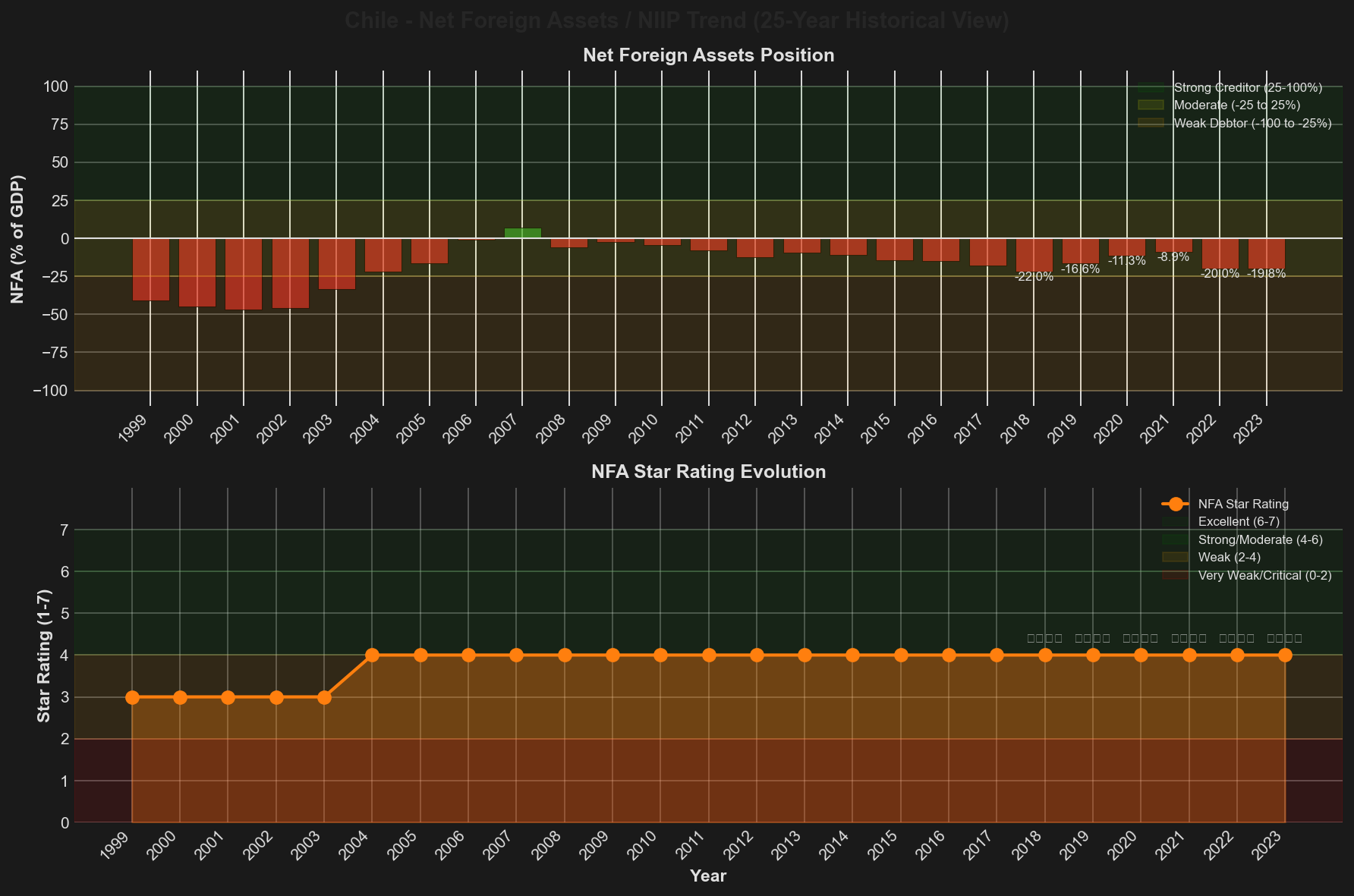

As of November 2025, Chile maintains investment-grade sovereign credit ratings from all three major international agencies, reflecting the strongest credit profile in Latin America. Moody's Investors Service assigns A2 with a Stable outlook, S&P Global Ratings maintains A for foreign currency obligations and A+ for local currency with Stable outlook, whilst Fitch Ratings affirms A- with Stable outlook. The Net Foreign Assets assessment stands at ⭐⭐⭐⭐ (4 out of 7 stars), indicating a moderate external debtor position with net foreign liabilities of 19.8% of GDP as of 2023, within the acceptable range for investment-grade sovereigns.

S&P Global raised Chile's outlook from negative to stable in October 2024, citing improved fiscal management and the government's commitment to halting the multi-year rise in the debt burden, maintaining Chile's position as Latin America's highest-rated sovereign, two notches above Uruguay. Fitch's most recent affirmation in January 2025 highlighted Chile's relatively strong sovereign balance sheet with public debt projected at 42.6% of GDP versus the 55.1% median for A-category peers, whilst also noting the successful pension reform agreement as evidence of institutional strength and capacity for political compromise despite challenging approval ratings. Moody's June 2024 affirmation emphasised the country's strong governance frameworks, credible macroeconomic policies anchored by an independent central bank and fiscal rule, and sound public finances as key rating supports.

All three agencies consistently identify Chile's robust institutional quality, prudent policy frameworks, and moderate debt levels as primary credit strengths. Rating constraints centre on commodity dependency, with copper representing over 50% of exports and mining contributing 14-16% of GDP, creating vulnerability to price cycles and external demand shocks. Geographic export concentration, particularly the 36% share destined for China, represents an additional monitoring factor given potential spillovers from Chinese economic slowdown or trade tensions. The agencies acknowledge recent political challenges including low presidential approval ratings and social tensions, though the definitive end of constitutional reform uncertainty following two failed referendums has paradoxically provided greater regulatory clarity for investors. Looking ahead, rating stability depends on continued fiscal consolidation progress toward the 2027 balanced budget target, successful economic diversification efforts including green hydrogen development, and maintenance of strong institutional frameworks despite political pressures.

Credit Ratings

| Rating Agency | Current Rating | Outlook | Last Action Date |

|---|---|---|---|

| S&P Global | A (Foreign Currency) / A+ (Local Currency) | Stable | October 15, 2024 |

| Moody's | A2 | Stable | June 20, 2024 |

| Fitch | A- | Stable | January 23, 2025 |

Chile's investment-grade ratings reflect a multi-decade track record of sound macroeconomic management and institutional strength that distinguishes it within the Latin American region. The country has maintained investment-grade status continuously since the 1990s, weathering multiple external shocks including the 2008-2009 global financial crisis, the 2014-2016 commodity price collapse, and the COVID-19 pandemic without rating downgrades to speculative grade. This resilience stems from countercyclical policy frameworks including sovereign wealth funds accumulated during commodity booms, a flexible exchange rate regime that serves as an automatic stabiliser, and credible fiscal rules that anchor medium-term consolidation commitments.

S&P Global's October 2024 outlook revision from negative to stable represented a significant positive development, acknowledging the government's progress in stabilising the debt trajectory after pandemic-related fiscal expansion. The agency projects Chile's general government debt will peak around 42-44% of GDP before stabilising, well below the approximately 55% median for A-category sovereigns. S&P particularly values Chile's strong external position with adequate foreign exchange reserves, diversified export base despite copper concentration, and extensive free trade network providing market access resilience. The rating agency maintains Chile two notches above Uruguay at BBB with Stable outlook, reflecting superior institutional quality and fiscal metrics despite Uruguay's lower commodity dependency.

Fitch Ratings' January 2025 affirmation emphasised the successful pension reform agreement as evidence of institutional capacity to address structural challenges through political compromise. The reform, which increases mandatory contributions from 10% to 16% over nine years whilst maintaining the private AFP system with added state components, demonstrates pragmatic policymaking despite President Boric's low approval ratings of 30-35%. Fitch projects Chile's public debt at 42.6% of GDP, noting the relatively favourable maturity profile of 11.4 years and the government's continued market access at competitive spreads, exemplified by the July 2024 social bond issuance of €1.6 billion priced at just 105 basis points over mid-swaps.

Moody's A2 rating, affirmed in June 2024, reflects the agency's assessment of Chile's "high" economic strength and "very high" institutional strength within its sovereign rating methodology. Moody's particularly values the independence and credibility of the Central Bank of Chile, which successfully navigated the post-pandemic inflation surge through timely monetary tightening and has begun a gradual easing cycle with the policy rate at 4.75% as of January 2025. The agency notes Chile's fiscal rule framework, which targets structural balance adjusted for copper price cycles, provides a credible anchor for medium-term consolidation despite near-term slippage. Key rating sensitivities identified by Moody's include sustained fiscal consolidation progress, maintenance of moderate debt levels, and management of external vulnerabilities related to commodity dependency and current account dynamics.

Economic Indicators

| Indicator | 2020 | 2021 | 2022 | 2023 | 2024 | 2030 (Forecast) |

|---|---|---|---|---|---|---|

| GDP Growth (%) | -6.14 | 11.33 | 2.06 | 0.20 | 2.20-2.64 | 2.2 |

| Inflation Rate (%) | 3.0 | 4.5 | 11.6 | 7.6 (avg) / 3.9 (eoy) | 4.4-4.7 | 3.0 |

| Debt-to-GDP Ratio (%) | 32.5 | 36.3 | 37.3 | 39.4 | 42.1-44.0 | 44.4 |

| Fiscal Balance (% GDP) | -7.2 | -7.5 | -1.1 | -2.3 | -2.5 to -2.7 | -0.9 |

| Current Account (% GDP) | 1.7 | -6.6 | -9.0 | -3.5 | -2.1 to -3.9 | -12.4 |

| FX Reserves (USD bn) | 39.2 | 51.3 | 39.2 | 46.4 | 44.0-44.4 | - |

| Unemployment Rate (%) | 10.8 | 9.28 | 8.25 | 9.01 | 8.6 | 7.9 |

| Copper Price (USD/lb) | 2.80 | 4.23 | 4.00 | 4.04 | 4.18-4.20 | - |

*Comprehensive external position dashboard showing foreign exchange reserves, current account balance, and unemployment trends.*

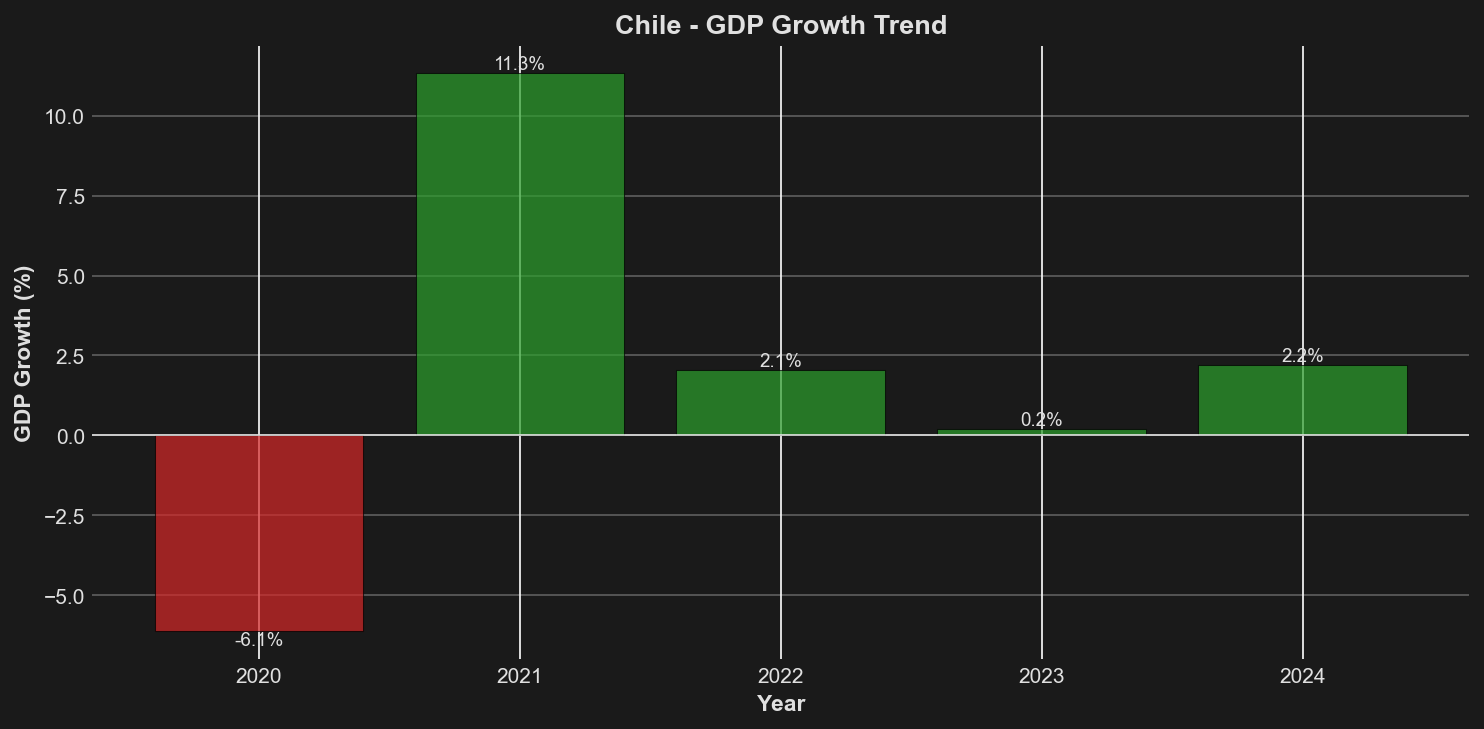

*Historical GDP growth trends showing annual percentage changes, with color coding for positive (green) and negative (red) growth periods.*

The Chilean economy has completed a full cycle of pandemic-related disruption and recovery, transitioning from the dramatic 11.33% rebound in 2021 back toward trend growth rates around 2.2-2.6% in 2024. The 2021 surge reflected the combination of base effects from the 6.14% contraction in 2020, unprecedented fiscal stimulus including pension withdrawal programmes totalling approximately 20% of GDP, and pent-up demand release as mobility restrictions eased. This stimulus-driven boom proved unsustainable, generating significant macroeconomic imbalances including a record current account deficit of 9.0% of GDP in 2022, inflation surging to approximately 14% by the third quarter of 2022, and rapid peso depreciation that necessitated aggressive monetary tightening.

The subsequent adjustment through 2023-2024 has been managed relatively smoothly, with growth slowing to just 0.2% in 2023 as monetary policy tightening and fiscal consolidation dampened domestic demand, before recovering to a more sustainable 2.2-2.6% pace in 2024. The IMF projects growth stabilising around 2.2% through 2030, reflecting Chile's structural growth potential constrained by low productivity gains, limited economic complexity, and demographic headwinds from an ageing population. This potential growth rate, whilst modest, compares favourably to regional peers and reflects Chile's relatively advanced development stage with GDP per capita exceeding $16,000 on a purchasing power parity basis.

Inflation dynamics have followed the expected disinflation path, declining from the 11.6% average in 2022 to 7.6% average in 2023 and further to 4.4-4.7% by 2024, though remaining above the Central Bank's 3% target. The persistence of above-target inflation partly reflects the 60% cumulative electricity tariff increase implemented between June 2024 and February 2025 to address utility company financial distress and accumulated deficits from frozen tariffs during the pandemic. Core inflation measures have declined more rapidly, suggesting underlying price pressures have moderated substantially. The Central Bank projects convergence to the 3% target by early 2026, with IMF forecasts indicating sustained price stability at 3.0% through 2030, supporting the credibility of Chile's inflation targeting regime.

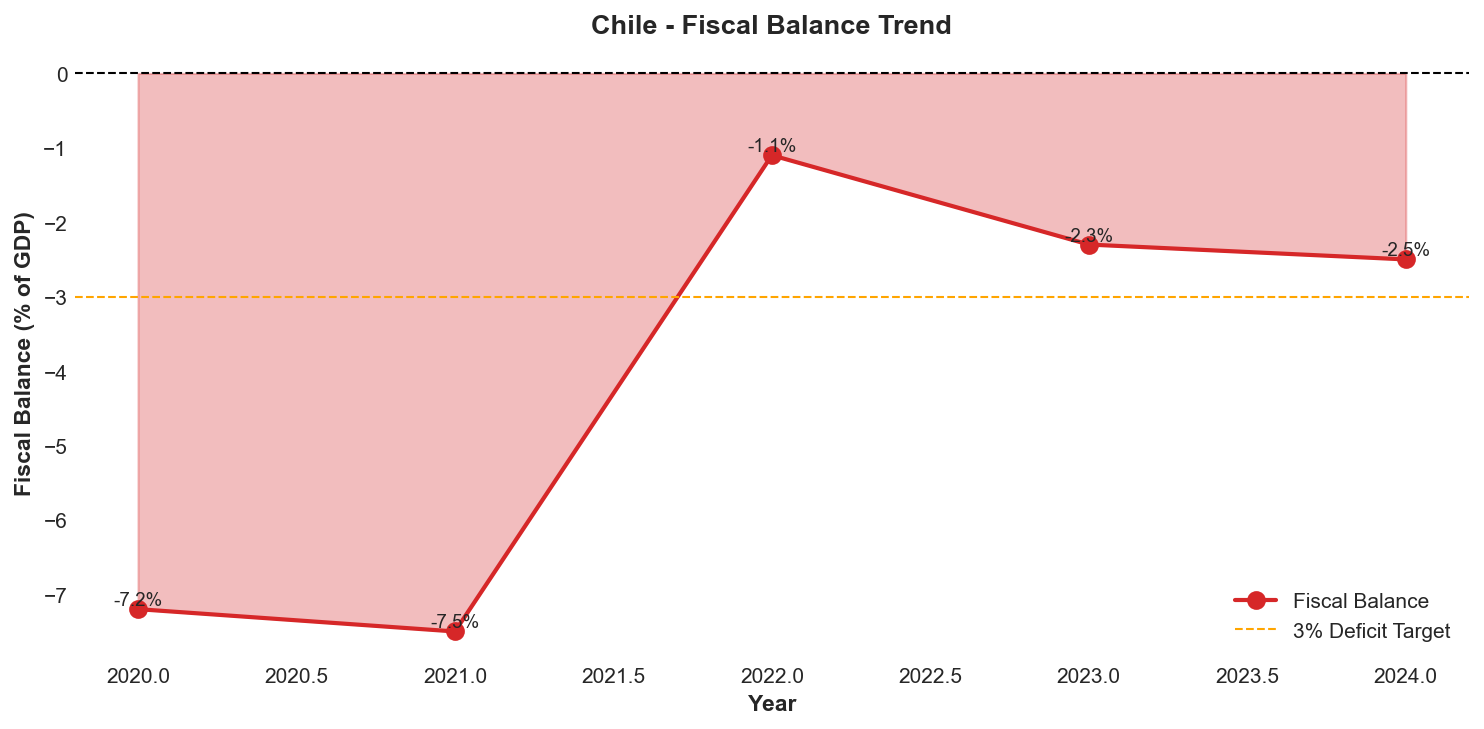

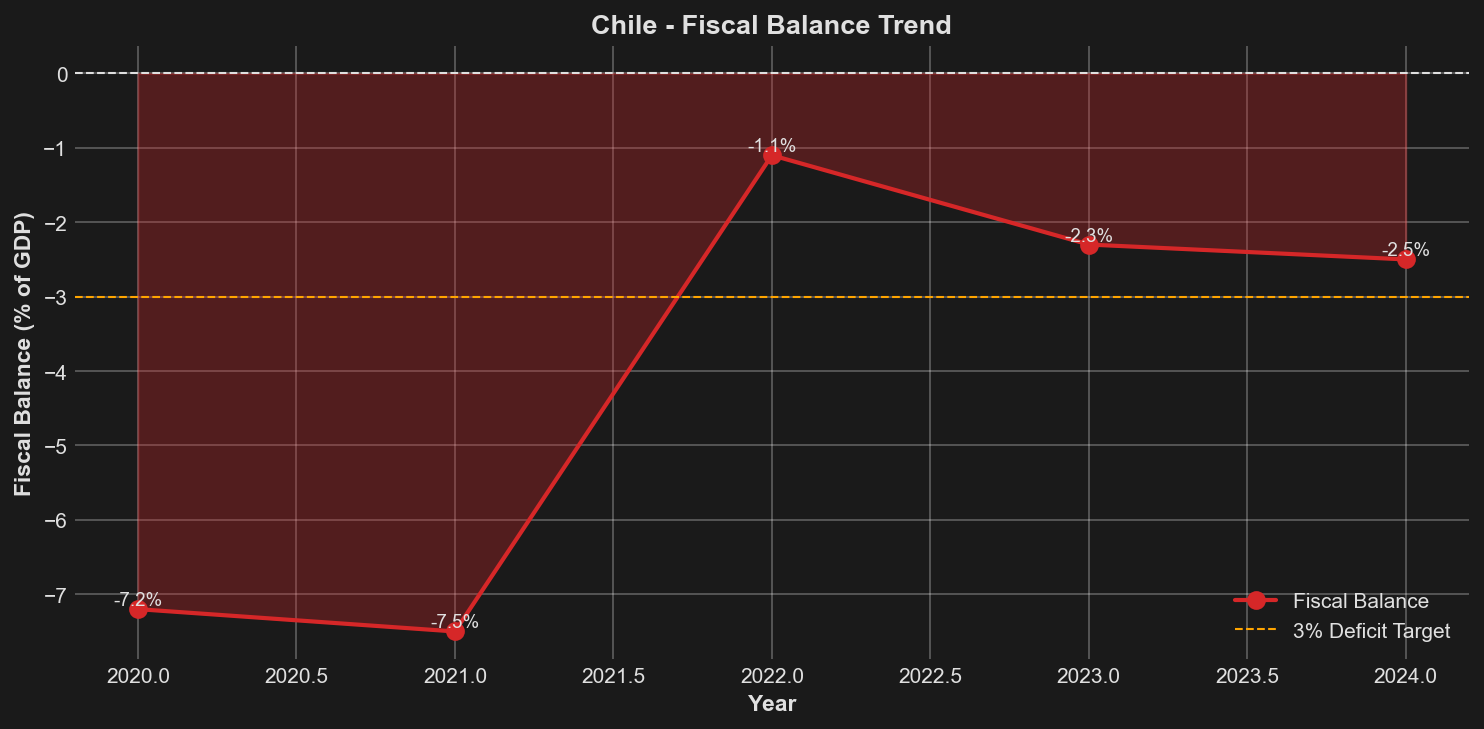

*Fiscal balance as percentage of GDP, showing government surplus (positive) or deficit (negative) positions over time.*

Fiscal metrics show substantial improvement from pandemic-era deficits, with the general government balance recovering from a record 7.5% of GDP shortfall in 2021 to approximately 2.7% in 2024. The 2024 outcome exceeded the government's target of 2.3% due to revenue underperformance linked to weaker-than-expected copper prices and economic activity, highlighting the persistent challenge of commodity-dependent fiscal revenues. The government maintains its commitment to achieving broad fiscal balance by 2027, requiring additional consolidation measures worth approximately 1% of GDP over the next three years. IMF projections suggest the deficit will narrow to 0.9% of GDP by 2030, indicating successful medium-term consolidation whilst maintaining space for essential social spending and infrastructure investment.

Public debt has risen steadily from 32.5% of GDP in 2020 to an estimated 42-44% range in 2024, reflecting pandemic-related fiscal expansion and subsequent deficits. However, this trajectory remains manageable and well below rating peer medians, with IMF forecasts projecting stabilisation around 44.4% of GDP by 2030. The debt stock benefits from a favourable maturity profile averaging 11.4 years and diversified currency composition, with the government maintaining regular market access at competitive spreads. The fiscal framework includes sovereign wealth funds, though these buffers were drawn down during the pandemic and require rebuilding through a medium-term strategy as copper revenues recover.

The current account has undergone dramatic swings, moving from a modest 1.7% of GDP surplus in 2020 to a record 9.0% deficit in 2022 before adjusting to a more sustainable 2.1-3.9% deficit range in 2024. The 2022 deterioration reflected the combination of surging imports driven by stimulus-fuelled domestic demand and elevated commodity prices that boosted import values. The subsequent improvement stems from both stronger export performance, with merchandise exports reaching a record $103.3 billion in 2024, and import moderation as domestic demand cooled. However, IMF projections suggest potential widening to 12.4% of GDP by 2030, likely reflecting substantial capital goods imports associated with green hydrogen projects, lithium processing facilities, and infrastructure modernisation that will temporarily elevate the deficit before generating future export revenues.

Foreign exchange reserves declined from a peak of $51.3 billion in 2021 to approximately $44 billion by 2024, reflecting Central Bank interventions to smooth exchange rate volatility during the adjustment period. Reserve coverage remains adequate at approximately 6.5 months of imports, with the Central Bank pursuing a gradual accumulation strategy targeting a 40% increase over three years through daily purchases of up to $25 million. This rebuilding programme aims to enhance buffers against external shocks whilst avoiding excessive exchange rate appreciation that could undermine export competitiveness.

Labour market conditions show persistent weakness despite economic recovery, with unemployment at 8.6% in 2024 compared to pre-pandemic levels around 7%. The IMF projects gradual improvement to 7.9% by 2030, though this remains elevated by historical standards and reflects structural challenges including high informality rates exceeding 25%, skills mismatches, and labour market rigidities. Youth unemployment and female labour force participation remain particular concerns, with the latter at just 53% compared to 72% for males, indicating substantial untapped productive potential.

Copper prices, the critical external variable for Chile's economy, have shown relative stability around $4.00-4.20 per pound through 2023-2024 after the surge to $4.23 in 2021. Cochilco, the Chilean Copper Commission, projects prices around $4.25 per pound for 2025, supporting fiscal revenues and export earnings. However, downside risks from potential Chinese economic slowdown, global recession concerns, or technological disruption to copper demand through substitution or enhanced recycling warrant continued monitoring given the metal's outsized importance to Chile's economic and fiscal performance.

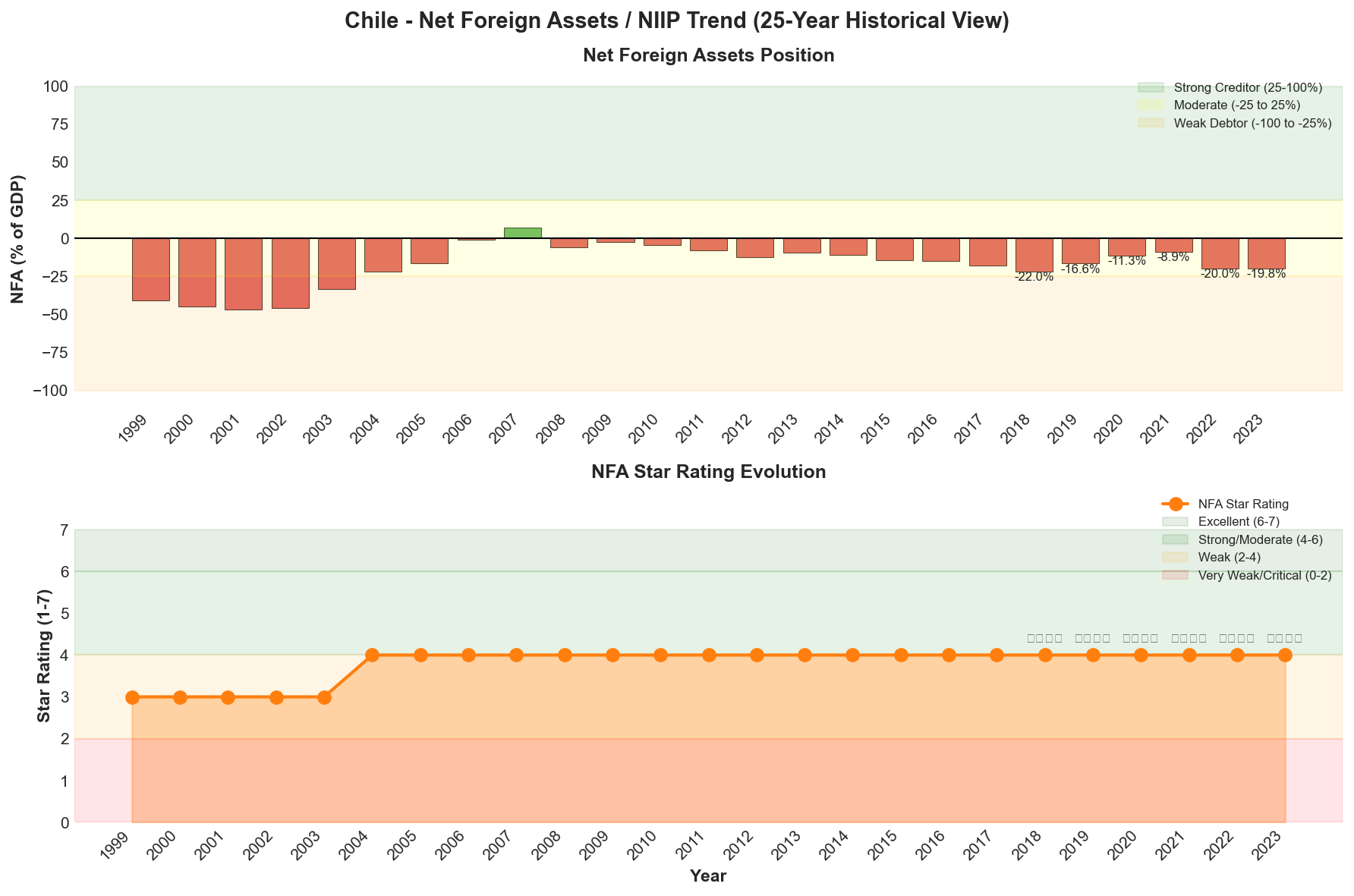

Net Foreign Assets & External Position

Twenty-five year historical evolution of net foreign assets as percentage of GDP (upper panel) and corresponding NFA star rating progression (lower panel), illustrating long-term external balance sheet dynamics and structural shifts in sovereign external position.

Chile's external balance sheet reflects a moderate net debtor position, with net foreign assets standing at negative 19.8% of GDP as of 2023 according to the External Wealth of Nations database. This represents a deterioration from negative 8.9% in 2021, primarily reflecting valuation effects from peso depreciation and the accumulation of current account deficits during the post-pandemic adjustment period. The Net Foreign Assets assessment assigns Chile a rating of ⭐⭐⭐⭐ (4 out of 7 stars), categorising the country as a "Moderate" external debtor within the acceptable range of negative 25% to positive 25% of GDP. This position, whilst indicating external liabilities moderately exceed assets, remains manageable for an investment-grade sovereign and compares favourably to many emerging market peers with more pronounced external vulnerabilities.

The composition of Chile's external liabilities demonstrates a relatively favourable structure, with foreign direct investment representing a substantial portion of gross external liabilities rather than debt instruments that require scheduled repayments. FDI inflows remained healthy at $15.3 billion in 2024, the third-highest level in nine years, with reinvested earnings comprising 67% of flows indicating investor confidence in long-term prospects. Investment has increasingly targeted green sectors, with InvestChile supporting projects worth a record $56.2 billion in 2024 focused on green hydrogen, lithium processing, and renewable energy infrastructure. This composition provides greater resilience to external shocks compared to debt-heavy liability structures, as equity investments adjust through valuation changes rather than creating immediate payment pressures.

External debt reached an all-time high of $255.3 billion in September 2024, though public sector debt metrics remain manageable at 41.6% of GDP with an average maturity of 11.4 years. The government maintains regular access to international capital markets at competitive spreads, exemplified by the July 2024 issuance of €1.6 billion in social bonds priced at just 105 basis points over mid-swaps. Private sector external debt, whilst substantial, primarily reflects borrowing by large mining companies and banks with strong balance sheets and natural hedges through export revenues or foreign currency assets. The Central Bank monitors external debt sustainability through regular stress testing, with assessments confirming adequate resilience to moderate exchange rate depreciation or interest rate increases.

Foreign exchange reserves of approximately $44 billion as of 2024 provide adequate liquidity buffers, representing 6.5 months of import coverage and exceeding standard adequacy metrics. The Central Bank has initiated a gradual reserve rebuilding programme targeting a 40% increase over three years through daily purchases of up to $25 million, aiming to enhance resilience against external shocks whilst avoiding excessive exchange rate appreciation. The flexible exchange rate regime continues to serve as an effective automatic stabiliser, with the peso depreciating 12.4% against the dollar in 2024 amid global uncertainty, facilitating external adjustment without requiring dramatic policy interventions or reserve depletion.

Chile's trade performance demonstrates both strengths and vulnerabilities in the external position. Merchandise exports reached a record $103.3 billion in 2024, generating a trade surplus of $23.6 billion that expanded 19.3% year-over-year. Copper exports totalled $20.1 billion, benefiting from stable prices around $4.18-4.20 per pound and volume growth from new mining projects. However, export concentration creates vulnerability, with mining products comprising 58% of total exports and copper alone representing approximately 50%. Geographic concentration compounds this risk, with China absorbing 36.1% of exports primarily in copper, whilst the United States accounts for 16.8%. This dual concentration in both product and destination markets exposes Chile to significant external shocks from Chinese economic slowdown, global commodity price cycles, or trade policy changes.

Diversification efforts show modest progress, with agricultural exports exceeding $7 billion in 2024 with 20% growth, particularly in premium products including cherries ($3.5 billion) and table grapes ($1 billion). The comprehensive free trade network covering 65 economies provides crucial market access, with the EU interim trade agreement entering force in February 2025 eliminating tariffs on 99.9% of EU exports whilst securing lithium supply access for European battery manufacturers. The modernised EFTA agreement signed in 2024 provides 99% duty-free agricultural access, whilst ongoing negotiations to upgrade the China FTA seek to capture additional value from the relationship. These agreements enhance export resilience and provide strategic positioning in global supply chains for critical minerals essential to the energy transition.

The current account deficit has improved substantially from a record 9.0% of GDP in 2022 to an estimated 2.1-3.9% range in 2024, reflecting both stronger export performance and import moderation as domestic demand cooled. However, IMF projections suggest potential widening to 12.4% of GDP by 2030, likely reflecting substantial capital goods imports associated with green hydrogen projects, lithium processing facilities, and infrastructure modernisation. This projected deterioration warrants careful monitoring, though it should be interpreted in context as investment-related imports that will generate future export capacity rather than consumption-driven deficits. The financing structure will be crucial, with FDI and long-term project finance preferred over portfolio flows or short-term debt that could create rollover risks.

Chile's strategic positioning in critical minerals provides structural support for the external accounts despite near-term vulnerabilities. As the world's largest copper producer with 24% of global output and second-largest lithium producer with 30% of global reserves, Chile occupies an essential position in global supply chains for electrification and renewable energy infrastructure. The green hydrogen initiative, targeting production costs below $1.5/kg by 2030 through exceptional solar resources in the Atacama Desert and wind potential in Patagonia, could transform the export base whilst reducing commodity dependency. However, realising this potential requires sustained investment, technological development, and infrastructure construction over the medium term, with meaningful export revenues unlikely before 2028-2030.

External vulnerabilities remain manageable but require continued monitoring given Chile's openness to global trade and capital flows. The country's trade-to-GDP ratio exceeds 60%, creating sensitivity to global demand conditions and commodity price cycles. Potential risks include US copper tariffs threatened by the Trump administration, Chinese economic slowdown affecting demand for Chilean exports, global recession impacting commodity prices and investment flows, and financial market volatility affecting capital flows and exchange rates. However, Chile's flexible exchange rate, adequate reserves, strong institutional frameworks, and diversified funding sources provide substantial resilience against moderate external shocks, supporting the investment-grade credit profile despite the moderate net debtor position.

Credit Strengths & Vulnerabilities

Credit Strengths

Chile's sovereign credit profile benefits from the strongest institutional frameworks in Latin America, with robust democratic governance, independent judiciary, and effective checks and balances that distinguish it from regional peers. The country maintains the highest democracy scores in the region according to Freedom House, with peaceful transfers of power, competitive elections, and respect for civil liberties providing political stability despite recent social tensions. The Central Bank of Chile operates with full independence and strong technical capacity, successfully navigating the post-pandemic inflation surge through timely monetary tightening and maintaining credibility throughout the adjustment process. The fiscal framework includes a structural balance rule that adjusts for copper price cycles, providing a credible anchor for medium-term consolidation despite near-term slippage, whilst sovereign wealth funds accumulated during commodity booms offer countercyclical buffers.

Public debt levels remain moderate at 42-44% of GDP, well below the 55.1% median for A-category rating peers, with a favourable maturity profile averaging 11.4 years and diversified currency composition reducing refinancing and exchange rate risks. The government maintains regular access to international capital markets at competitive spreads, exemplified by the July 2024 social bond issuance of €1.6 billion priced at just 105 basis points over mid-swaps, demonstrating sustained investor confidence. Debt dynamics appear sustainable under baseline scenarios, with IMF projections indicating stabilisation around 44.4% of GDP by 2030 as fiscal consolidation progresses toward the government's target of balanced budgets by 2027.

Chile's strategic positioning as the world's largest copper producer with 24% of global output and second-largest lithium producer with 30% of global reserves provides structural advantages in an era of global electrification and renewable energy expansion. Copper demand is projected to grow substantially through 2030 and beyond, driven by electric vehicle adoption, renewable energy infrastructure, and grid modernisation, whilst lithium demand for battery production shows even more dramatic growth trajectories. Chile's low-cost copper production, with Codelco operating some of the world's largest mines, and high-quality lithium resources in the Atacama salt flats position the country favourably in global supply chains for critical minerals essential to the energy transition.

The extensive free trade network covering 65 economies representing 88% of global GDP provides crucial market access and diversification, reducing vulnerability to individual market disruptions. Recent agreements including the EU interim trade accord entering force in February 2025 and the modernised EFTA agreement signed in 2024 enhance export opportunities whilst securing strategic partnerships for lithium supply to European battery manufacturers. Chile's membership in the Pacific Alliance alongside Mexico, Colombia, and Peru, combined with comprehensive agreements with major Asian economies including China, Japan, and South Korea, positions it as a regional integration hub with preferential access to diverse markets.

The banking sector demonstrates robust health with adequate capitalisation, improving profitability metrics, and manageable asset quality indicators despite cyclical pressures. Major banks maintain strong capital positions exceeding regulatory requirements, with system-wide metrics showing resilience in Central Bank stress tests. Digital transformation continues apace, with high financial inclusion rates and growing fintech adoption enhancing efficiency and access. The regulatory framework has strengthened through recent reforms including the Open Finance System regulations and Consolidated Debt Registry Law, improving transparency and credit risk assessment capabilities.

Credit Vulnerabilities

Commodity dependency represents Chile's most significant structural vulnerability, with copper representing over 50% of exports, mining contributing 14-16% of GDP, and approximately 19% of government revenues derived from mining activities. This concentration creates substantial sensitivity to copper price cycles, with fiscal revenues and external accounts highly correlated to global commodity markets. The 2014-2016 copper price collapse, when prices fell from over $4.00 per pound to below $2.00, demonstrated the magnitude of potential shocks, requiring significant fiscal adjustment and drawing down sovereign wealth fund buffers. Whilst copper demand fundamentals appear supportive given electrification trends, downside risks from Chinese economic slowdown, global recession, technological substitution, or enhanced recycling could materially impact Chile's economic and fiscal performance.

Geographic export concentration compounds commodity vulnerability, with China absorbing 36.1% of Chilean exports primarily in copper and other mining products. This dependence on a single destination market creates exposure to Chinese economic cycles, policy changes, or trade tensions that could disrupt demand or pricing. The potential for US copper tariffs threatened by the Trump administration adds another layer of uncertainty, though direct exposure is more limited given only 11.3% of copper exports flow to the United States. Nevertheless, global trade policy uncertainty and potential spillovers through commodity price channels represent material risks to the external accounts and fiscal revenues.

Political dynamics have proven challenging, with President Gabriel Boric's approval ratings languishing at 30-35% and ambitious reform agendas largely stalled beyond the pension reform breakthrough. Social tensions remain elevated despite the definitive end of constitutional reform efforts, with security concerns, persistent inequality, and inadequate social services dominating public discourse. The November 2025 presidential election introduces policy uncertainty, with polling indicating a rightward shift that could alter fiscal priorities and reform trajectories. Whilst Chile's strong institutional frameworks provide resilience against political volatility, sustained low approval ratings and social pressures create risks of populist policy responses or reform paralysis that could undermine fiscal consolidation efforts or structural transformation initiatives.

Labour market weaknesses persist despite economic recovery, with unemployment at 8.6% in 2024 above pre-pandemic levels and projected to decline only gradually to 7.9% by 2030. Informality rates exceeding 25% particularly affect women and younger workers, reducing productivity, limiting tax revenues, and creating social vulnerabilities. Female labour force participation at just 53% compared to 72% for males indicates substantial untapped productive potential, whilst skills mismatches and labour market rigidities constrain employment growth in higher-productivity sectors. These structural labour market challenges limit growth potential and create ongoing social pressures for increased spending on employment programmes and social protection.

Economic complexity remains limited despite Chile's upper-middle-income status, with the country ranking 44th out of 64 economies in the IMD World Competitiveness index. Manufacturing represents just 10-12% of GDP, concentrated in resource processing rather than higher-value-added production, whilst services sector productivity lags advanced economy benchmarks. Research and development spending at just 0.6% of GDP compares unfavourably to the OECD average, limiting innovation capacity and technological advancement. Infrastructure gaps in transportation, digital connectivity, and water management constrain competitiveness and require substantial investment to support diversification efforts. These structural constraints on productivity growth and economic sophistication limit potential GDP growth to around 2.2% annually, below rates needed to rapidly close income gaps with advanced economies.

Credit Opportunities

The green hydrogen initiative represents Chile's most transformative economic opportunity, with potential to fundamentally alter the export base whilst reducing commodity dependency. The country possesses exceptional renewable energy resources, with the Atacama Desert offering the world's highest solar irradiation and Patagonia providing abundant wind potential, enabling projected green hydrogen production costs below $1.5/kg by 2030, amongst the lowest globally. The investment pipeline totals approximately $330 billion across multiple projects, with six pilot projects totalling 396MW already selected and construction beginning on several facilities. Successful development could position Chile as a major supplier for global decarbonisation efforts, with export markets in Europe, Asia, and potentially North America seeking low-carbon hydrogen for industrial processes, transportation, and energy storage.

Lithium demand growth presents another structural opportunity, with global electric vehicle adoption and energy storage expansion driving exponential increases in battery demand. Chile controls approximately 30% of global lithium reserves, primarily in high-quality brine deposits in the Atacama salt flats that offer cost advantages over hard-rock mining. The government's revised lithium strategy announced in 2023, whilst maintaining state control through partnerships rather than full privatisation, provides a framework for expanded production through joint ventures with international battery manufacturers and chemical companies. Successful execution could substantially increase lithium export revenues whilst attracting downstream processing investment to capture additional value from battery-grade chemicals and cathode materials production.

Agricultural export diversification shows promising momentum, with shipments exceeding $7 billion in 2024 with 20% growth, particularly in premium products including cherries ($3.5 billion), table grapes ($1 billion), and wine. Chile's counter-seasonal production relative to Northern Hemisphere markets, combined with phytosanitary advantages and quality reputation, provides competitive positioning in high-value segments. The extensive free trade network offers preferential access to major consumer markets, whilst ongoing negotiations to expand agricultural provisions in existing agreements could further enhance opportunities. Climate advantages in certain regions and growing global demand for healthy, sustainable food products support continued expansion potential, though water scarcity constraints require addressing through infrastructure investment and efficiency improvements.

Digital transformation offers opportunities to enhance productivity, improve public service delivery, and develop new export sectors in software and business services. Chile's relatively advanced digital infrastructure, high internet penetration rates, and educated workforce provide foundations for expansion in fintech, e-commerce, and digital services. Recent regulatory reforms including the Open Finance System and digital banking licences create frameworks for innovation whilst maintaining financial stability. The government's digital transformation agenda for public services could improve efficiency and citizen satisfaction whilst reducing costs, though implementation has lagged ambitions and requires sustained commitment.

Regional integration through the Pacific Alliance and bilateral agreements provides opportunities to enhance trade, attract investment, and improve competitiveness through regulatory harmonisation and infrastructure connectivity. Chile's strategic positioning as a gateway between South America and Asia-Pacific markets, combined with its institutional quality and business environment advantages, supports potential as a regional services and logistics hub. Ongoing negotiations to deepen Pacific Alliance integration and expand membership could enhance these opportunities, whilst bilateral agreements with major economies provide frameworks for expanded economic cooperation beyond traditional trade in goods.

Credit Threats

Chinese economic slowdown represents the most significant near-term external threat, given China's absorption of 36% of Chilean exports primarily in copper and other mining products. A sharp deceleration in Chinese growth, property sector distress, or policy-driven demand reduction could materially impact copper prices and volumes, with direct effects on Chilean export revenues, fiscal receipts, and economic activity. The correlation between Chinese industrial production and Chilean export performance has strengthened over the past two decades as China's share of copper consumption has grown to approximately 50% of global demand, creating substantial vulnerability to Chinese economic cycles.

Global recession risks have elevated given monetary policy tightening in advanced economies, geopolitical tensions, and financial stability concerns. A synchronised global downturn would affect Chile through multiple channels including reduced commodity demand and prices, tighter financial conditions and capital flow reversals, and weaker investor sentiment toward emerging markets. Chile's openness to trade and capital flows, whilst providing diversification benefits in normal times, creates transmission channels for global shocks. The flexible exchange rate would provide some automatic stabilisation through depreciation supporting export competitiveness, though the magnitude of potential shocks could overwhelm this mechanism and require policy responses that might conflict with fiscal consolidation objectives.

US trade policy uncertainty, particularly potential copper tariffs threatened by the Trump administration, creates downside risks despite Chile's relatively limited direct exposure with just 11.3% of copper exports destined for the United States. Broader trade tensions or tariff escalation could affect global commodity prices through demand destruction or supply chain disruption, with spillover effects on Chilean export revenues. The precedent of steel and aluminium tariffs imposed in March 2025 at 25% rates demonstrates the potential for sudden policy shifts, though Chile's free trade agreement with the United States provides some protection and dispute resolution mechanisms.

Climate change impacts pose increasing threats to multiple economic sectors, with water scarcity affecting mining operations, agricultural production, and hydroelectric generation. Chile's arid northern regions, which host major copper mines and lithium operations, face intensifying drought conditions that could constrain production or increase costs through desalination requirements. Agricultural regions in the central valley have experienced multi-year drought conditions affecting yields and quality, whilst changing precipitation patterns threaten hydroelectric capacity that provides approximately 30% of electricity generation. Adaptation will require substantial investment in water infrastructure, efficiency improvements, and potentially production system changes, imposing costs and creating transition risks.

Political polarisation ahead of the November 2025 presidential election and beyond creates risks of policy instability or reform paralysis. The rightward shift evident in polling could produce tensions between a conservative president and a more progressive congress, potentially gridlocking legislative processes. Alternatively, a populist response to persistent social tensions could generate fiscally unsustainable spending commitments or policy changes that undermine investment climate and growth potential. Whilst Chile's strong institutional frameworks provide resilience against extreme policy swings, sustained political dysfunction could erode the governance advantages that support the investment-grade rating.

Regional instability from migration pressures, organised crime, and political volatility in neighbouring countries creates spillover risks. Chile has experienced substantial immigration flows, particularly from Venezuela and Haiti, creating integration challenges and contributing to security concerns. Cross-border organised crime, particularly drug trafficking through northern borders, has intensified violence and prompted military deployments. Political instability in Peru, with frequent government changes and social unrest, affects bilateral trade and creates uncertainty for shared infrastructure projects. Whilst Chile's institutional strength provides buffers against regional contagion, sustained regional deterioration could affect investor sentiment, trade flows, and security conditions.

Economic Analysis

Chile's economic structure reflects a relatively diversified composition for a commodity-dependent economy, with services comprising 54-57% of GDP, industry including mining at 32%, and agriculture at 3.5%. However, this apparent diversification masks the outsized importance of mining, which generates 58% of exports and provides approximately 19% of government revenues despite its modest direct GDP contribution. The disconnect between mining's GDP share and its fiscal and external importance reflects the sector's high profitability, capital intensity, and foreign ownership structure, with substantial value captured through taxation and royalties rather than domestic value-added. This creates a fundamental tension in Chile's development model, where economic diversification efforts must overcome the gravitational pull of highly profitable mining activities that dominate investment, exports, and fiscal revenues.

Growth Dynamics and Potential

The Chilean economy achieved GDP growth of 2.2-2.6% in 2024, recovering from near-stagnation of 0.2% in 2023 as monetary policy easing and improved external conditions supported domestic demand recovery. This performance, whilst representing normalisation after the dramatic pandemic-era swings, highlights Chile's constrained growth potential estimated at approximately 2.2% annually by the IMF through 2030. This modest potential reflects multiple structural constraints including low productivity growth, limited economic complexity, demographic headwinds from an ageing population, and infrastructure gaps that constrain competitiveness. Total factor productivity growth has averaged less than 1% annually over the past decade, well below rates achieved by successful Asian economies during their development phases, indicating difficulties in technological adoption, innovation, and efficiency improvements.

Labour productivity growth has similarly disappointed, constrained by high informality rates exceeding 25%, skills mismatches between educational outputs and labour market demands, and limited on-the-job training and human capital development. The education system, whilst achieving high enrolment rates, produces mixed quality outcomes with Chilean students scoring below OECD averages in mathematics and science assessments. Tertiary education has expanded substantially but faces quality concerns and misalignment with labour market needs, particularly in technical and vocational training essential for manufacturing and advanced services development. These human capital constraints limit the economy's capacity to move into higher-productivity activities and absorb technological advances.

Capital accumulation has slowed from the rapid rates achieved during the 2000s commodity boom, with gross fixed capital formation averaging approximately 22% of GDP in recent years compared to peaks above 27% in 2012-2013. Investment has concentrated in mining and energy sectors, with more limited flows to manufacturing, infrastructure, and knowledge-intensive services that could support diversification. Foreign direct investment, whilst substantial at $15.3 billion in 2024, has similarly concentrated in extractive sectors and renewable energy rather than manufacturing or tradeable services. Domestic savings rates around 20% of GDP provide adequate resources for investment, though pension system reforms and demographic ageing may constrain future savings capacity.

Monetary Policy and Inflation Dynamics

The Central Bank of Chile has successfully navigated the post-pandemic inflation surge, demonstrating the credibility and effectiveness of its inflation targeting framework. After raising the policy rate to 11.25% by October 2022 to combat inflation that peaked around 14%, the Bank has implemented a gradual easing cycle with rates declining to 4.75% by January 2025. This cautious approach reflects the Bank's commitment to ensuring inflation converges sustainably to the 3% target, with current inflation at 4.7% still above target partly due to the 60% cumulative electricity tariff increase implemented between June 2024 and February 2025. Core inflation measures have declined more rapidly, suggesting underlying price pressures have moderated substantially, supporting the case for continued gradual easing toward the neutral rate estimated at 3.5-4%.

The inflation targeting regime maintains strong credibility despite recent challenges, with inflation expectations anchored around the 3% target at medium-term horizons. The Central Bank's transparent communication, data-dependent approach, and willingness to maintain restrictive policy despite growth concerns have reinforced this credibility. The flexible exchange rate regime has served as an effective automatic stabiliser, with the peso depreciating 12.4% against the dollar in 2024 absorbing external shocks without requiring dramatic policy interventions. However, pass-through from exchange rate movements to consumer prices remains a monitoring factor, particularly for imported goods and services that comprise a substantial share of the consumption basket.

Looking ahead, monetary policy faces the challenge of supporting growth recovery whilst ensuring inflation convergence, with the balance tilted toward continued gradual easing given moderating price pressures and growth below potential. The Central Bank projects inflation reaching the 3% target by early 2026, with IMF forecasts indicating sustained price stability at 3.0% through 2030. This outlook assumes continued fiscal consolidation, moderate wage growth consistent with productivity gains, and stable commodity prices without major external shocks. Upside risks to inflation include potential peso depreciation from external financial volatility, stronger-than-expected domestic demand recovery, or commodity price surges, whilst downside risks centre on weaker global growth affecting domestic activity and import prices.

Fiscal Policy and Sustainability

Fiscal policy has achieved substantial consolidation from pandemic-era deficits, with the general government balance improving from a record 7.5% of GDP shortfall in 2021 to approximately 2.7% in 2024. However, the 2024 outcome exceeded the government's target of 2.3% due to revenue underperformance linked to weaker-than-expected copper prices and economic activity, highlighting the persistent challenge of commodity-dependent fiscal revenues. Copper price sensitivity remains substantial, with estimates suggesting each $0.10 per pound change in copper prices affects fiscal revenues by approximately 0.2-0.3% of GDP, creating significant volatility and forecasting challenges.

The government maintains its commitment to achieving broad fiscal balance by 2027, requiring additional consolidation measures worth approximately 1% of GDP over the next three years. This target, whilst ambitious given political constraints and social spending pressures, appears feasible under baseline scenarios with moderate copper prices and continued economic recovery. The fiscal framework benefits from the structural balance rule that adjusts for copper price cycles, providing a credible anchor for medium-term consolidation despite near-term slippage. However, the rule's complexity and reliance on unobservable variables including potential GDP and long-term copper prices creates implementation challenges and reduces transparency compared to simpler nominal targets.

Public debt dynamics appear sustainable under baseline scenarios, with the stock projected to stabilise around 44.4% of GDP by 2030 according to IMF forecasts. This trajectory reflects successful fiscal consolidation combined with moderate nominal GDP growth, keeping debt ratios well below levels that would raise sustainability concerns for an investment-grade sovereign. The debt stock benefits from a favourable maturity profile averaging 11.4 years, diversified currency composition with approximately 70% denominated in foreign currency but matched by natural hedges through copper export revenues, and diversified investor base including domestic pension funds and international institutional investors.

Fiscal risks warrant monitoring despite the generally favourable baseline outlook. Contingent liabilities from state-owned enterprises, particularly Codelco which faces substantial capital expenditure requirements to maintain production from ageing mines, could require fiscal support. The pension reform approved in January 2025, whilst addressing long-standing structural issues, imposes fiscal costs of 1.7% of GDP annually as the state assumes greater responsibility for minimum pension guarantees and supplements low-balance accounts. Healthcare spending pressures from an ageing population, with the proportion of Chileans over 65 projected to double from 12% currently to 24% by 2050, will require substantial resources or difficult reforms to maintain fiscal sustainability. These pressures underscore the importance of maintaining fiscal discipline during favourable commodity price periods to build buffers for future challenges.

External Sector and Competitiveness

Chile's external sector demonstrates both strengths and vulnerabilities, with record merchandise exports of $103.3 billion in 2024 generating a trade surplus of $23.6 billion that expanded 19.3% year-over-year. Copper exports totalled $20.1 billion, benefiting from stable prices around $4.18-4.20 per pound and volume growth from new mining projects including Teck Resources' Quebrada Blanca Phase 2 and expansions at existing operations. However, export concentration creates vulnerability, with mining products comprising 58% of total exports and copper alone representing approximately 50%. This concentration has persisted despite decades of diversification efforts, reflecting the sector's exceptional profitability and Chile's comparative advantage in low-cost copper production.

Diversification efforts show modest progress in specific sectors, with agricultural exports exceeding $7 billion in 2024 with 20% growth, particularly in premium products including cherries ($3.5 billion), table grapes ($1 billion), and wine. Chile's counter-seasonal production relative to Northern Hemisphere markets, combined with phytosanitary advantages and quality reputation, provides competitive positioning in high-value segments. The forestry sector contributes approximately $6 billion in exports, primarily in pulp and timber products, whilst salmon aquaculture generates around $5 billion despite environmental challenges and disease outbreaks that have periodically disrupted production. Manufacturing exports remain limited at approximately $10 billion, concentrated in resource processing including refined copper, methanol, and cellulose rather than higher-value-added products.

Competitiveness challenges constrain diversification efforts despite Chile's relatively favourable business environment. The country ranks 44th out of 64 economies in the IMD World Competitiveness index, leading Latin America but trailing Asian peers at similar income levels. Infrastructure gaps in transportation, with port congestion and limited rail connectivity increasing logistics costs, constrain export competitiveness particularly for time-sensitive agricultural products. Digital infrastructure has improved substantially with high broadband penetration in urban areas, though rural connectivity remains limited. Energy costs have declined dramatically with renewable energy expansion, providing competitive advantages for energy-intensive industries including green hydrogen and data centres.

Labour costs have risen substantially over the past two decades as Chile's income levels have converged toward advanced economy standards, eroding cost competitiveness in labour-intensive manufacturing whilst supporting domestic consumption. The minimum wage has increased from approximately $400 monthly in 2010 to over $500 currently, approaching levels in Southern European countries despite lower productivity levels. This wage growth, whilst supporting living standards and reducing poverty, has contributed to manufacturing sector contraction and limited Chile's ability to compete in labour-intensive exports. The challenge going forward involves moving into higher-productivity activities that can sustain advanced economy wages rather than competing on cost in standardised manufacturing.

The extensive free trade network covering 65 economies provides crucial market access and diversification, reducing vulnerability to individual market disruptions. Recent agreements including the EU interim trade accord entering force in February 2025 and the modernised EFTA agreement signed in 2024 enhance export opportunities whilst securing strategic partnerships for lithium supply to European battery manufacturers. Chile's membership in the Pacific Alliance alongside Mexico, Colombia, and Peru, combined with comprehensive agreements with major Asian economies including China, Japan, and South Korea, positions it as a regional integration hub with preferential access to diverse markets. However, the proliferation of agreements creates complexity for businesses navigating different rules of origin and regulatory requirements, whilst the benefits have concentrated in large exporters with capacity to manage compliance costs.

Political & Institutional Assessment

President Gabriel Boric's administration has experienced one of the steepest approval declines in recent Chilean history, falling from initial hopes of transformative change following his December 2021 election to approval ratings of 30-35% by 2024-2025. The 36-year-old former student protest leader entered office with an ambitious progressive agenda including constitutional reform, pension system overhaul, healthcare expansion, tax increases, and enhanced social protections. However, the administration has struggled with inexperience in governance, limited congressional majority requiring constant negotiation with opposition parties, and the challenges of implementing structural reforms in a context of slowing economic growth, rising inflation, and security concerns that have shifted public priorities rightward.

The major legislative victory of comprehensive pension reform approved in January 2025 required significant compromises that illustrate both the administration's capacity for pragmatic negotiation and the constraints it faces. The reform increases mandatory contributions from 10% to 16% over nine years, with the additional 6 percentage points split between individual accounts and a new social security fund that will provide minimum pension guarantees and supplements for low-balance accounts. This hybrid approach maintains the private AFP system that has operated since the Pinochet era whilst adding state components, rather than the complete overhaul to a public pay-as-you-go system originally promised. The reform addresses long-standing structural issues including inadequate replacement rates averaging just 34% of final salaries and gender disparities from career interruptions, though it imposes fiscal costs of 1.7% of GDP annually that will constrain space for other priorities.

Other structural reforms have largely stalled or been scaled back substantially from original ambitions. Healthcare reform proposals to create a unified public-private system have been reduced to more modest financing adjustments and targeted expansions of public coverage. Tax reform efforts to raise revenues by 4% of GDP through wealth taxes, higher corporate rates, and mining royalty increases have been blocked by congressional opposition, with the government achieving only limited revenue measures. Education reforms to eliminate for-profit universities and expand free tertiary education have progressed slowly given fiscal constraints and stakeholder resistance. Labour market reforms to strengthen collective bargaining and reduce precarious employment have faced business opposition and concerns about competitiveness impacts.

The definitive end of Chile's constitutional reform process after two failed referendums has paradoxically provided political stability by removing fundamental uncertainty about the country's institutional framework. The progressive constitutional draft rejected 62% to 38% in September 2022 included provisions for a plurinational state recognising indigenous autonomy, expanded social rights including housing and healthcare, environmental protections, and gender parity requirements that voters deemed too radical. The conservative alternative defeated 56% to 44% in December 2023 moved in the opposite direction with strengthened property rights, restrictions on abortion, and reduced state role that voters rejected as insufficiently addressing social demands. President Boric declared the constitutional process closed for his term, shifting focus to incremental reforms within the existing 1980 constitution framework substantially amended over the decades.

Chile's institutional strength remains a key credit positive despite recent governance challenges. The country maintains the strongest democracy scores in Latin America according to Freedom House, with independent judiciary, robust checks and balances, competitive elections, and respect for civil liberties. The separation of powers functions effectively, with the Constitutional Court, Supreme Court, and Comptroller General providing oversight and constraint on executive and legislative actions. The electoral system, reformed in 2015 to replace the binomial system that had favoured centre-right parties, now provides more proportional representation though it has produced fragmented congresses requiring coalition-building and compromise.

However, concerning deterioration in governance indicators warrants monitoring. Transparency International's Corruption Perception Index showed Chile's score declining from 66 in 2023 to 63 in 2024, the lowest since tracking began, reflecting high-profile scandals including irregular distribution of public funds during the pandemic and sexual harassment allegations against President Boric that, whilst not resulting in formal charges, damaged public trust. The scandals have prompted institutional responses including investigations, resignations, and procedural reforms, demonstrating accountability mechanisms function, though the frequency and visibility of cases have eroded confidence in political leadership.

Security has emerged as the dominant political issue ahead of the November 2025 presidential election, with homicide rates increasing from 4.5 per 100,000 in 2018 to 6.7 in 2022, though showing a 9.4% improvement in 2024 following intensified enforcement efforts. The killing of three police officers in early 2024 prompted national mourning and accelerated security legislation including enhanced penalties for organised crime, expanded surveillance authorities, and increased police resources. The ongoing state of emergency in four southern provinces since May 2022 reflects persistent tensions in Mapuche territories, where ancestral land disputes with forestry companies remain unresolved despite a presidential commission established in June 2023 to propose dialogue mechanisms and potential land restitution frameworks.

Immigration pressures have intensified political tensions, with Chile's foreign-born population increasing from approximately 3% in 2010 to over 8% by 2024, primarily from Venezuela, Haiti, Peru, and Colombia. The rapid influx has strained public services, generated labour market competition particularly in informal sectors, and contributed to security concerns given involvement of some migrants in criminal activities. The government deployed military forces to northern borders in February 2024, successfully reducing irregular crossings by over 40% through enhanced controls, though humanitarian concerns about treatment of migrants and asylum seekers have generated criticism from civil society organisations. Immigration policy has become increasingly restrictive with expedited deportation procedures and tighter entry requirements, reflecting rightward shift in public opinion.

Looking toward the November 2025 presidential election, polling indicates a rightward shift with conservative candidates José Antonio Kast (15-17%) and Evelyn Matthei (17-20%) leading, whilst the centre-left's Jeannette Jara, who won her primary with 60% in June 2025, trails in general election polling at approximately 12-15%. Kast, who narrowly lost to Boric in 2021, campaigns on security, economic growth, and traditional values, though his association with Pinochet-era figures creates vulnerabilities. Matthei, a former labour minister and Santiago mayoral candidate, presents a more moderate conservative profile emphasising competent management and pragmatic solutions. Jara, a former social development minister, struggles to distance herself from the Boric administration's low approval whilst maintaining progressive credentials.

The campaign has centred on security, immigration, and economic stagnation rather than structural reforms, suggesting a more pragmatic political cycle ahead focused on immediate concerns rather than transformative change. The simultaneous congressional elections for all 155 Chamber seats and 23 Senate seats will be crucial for determining the next administration's legislative capacity, with Boric's Apruebo Dignidad coalition expected to lose ground given current approval ratings and rightward momentum in public opinion. The centre-left Christian Democrats and Socialists may gain at the expense of more radical left parties, whilst the right could consolidate gains if it maintains unity between Kast's Republican Party and Matthei's more traditional centre-right coalition.

Regardless of electoral outcomes, Chile's strong institutional frameworks provide confidence in continued democratic governance and policy continuity within established parameters. The independent Central Bank will maintain monetary policy credibility, the fiscal framework provides anchors for consolidation, and the judiciary ensures rule of law. However, the next administration will face difficult trade-offs between fiscal consolidation requirements, social spending pressures, and growth-enhancing reforms in a context of moderate commodity prices and constrained fiscal space. The capacity to build political consensus for difficult reforms whilst addressing security concerns and managing social tensions will determine whether Chile can accelerate growth potential and advance economic transformation or remains constrained by political gridlock and incremental adjustments.

Banking Sector & Financial Stability

Chile's banking sector demonstrates robust health with adequate capitalisation, improving profitability metrics, and manageable asset quality indicators despite cyclical pressures from the post-pandemic adjustment. The system has been progressively implementing Basel III standards since 2020, with the Central Bank setting the countercyclical capital buffer at 0.5% of risk-weighted assets in 2024, below the neutral target of 1% given moderate credit growth and contained systemic risks. Major banks maintain strong capital positions well above regulatory minimums, with Santander Chile, the largest bank by market share at 16.9%, reporting a BIS ratio of 17.1% and Common Equity Tier 1 of 10.5% as of December 2024. System-wide capital adequacy ratios exceed 14%, providing substantial buffers against potential losses from economic downturns or asset quality deterioration.

The banking system shows healthy concentration with the top five banks controlling over 70% of assets, including state-owned BancoEstado which serves as a development bank whilst competing commercially. Santander Chile leads with 16.9% market share, followed by Banco de Chile at 15.8%, BancoEstado at 14.2%, Itaú at 11.3%, and Scotiabank at 10.8%. This concentration provides economies of scale and supports profitability whilst maintaining sufficient competition to ensure reasonable pricing and service quality. Foreign ownership is substantial, with Spanish, Brazilian, Canadian, and US institutions controlling major banks, providing access to international expertise, technology, and capital whilst creating potential transmission channels for external shocks.

Asset quality indicators show gradual deterioration but remain manageable, with non-performing loans at 2.13% as of December 2023 and the impaired portfolio ratio rising to 5.63% when including restructured loans and those showing early delinquency signals. Delinquency has particularly affected smaller firms in real estate, construction, and trade sectors that struggled during the post-pandemic adjustment as domestic demand cooled and interest rates rose. Banks that extended Fogape pandemic loans, which provided government guarantees for SME lending during COVID-19, have shown higher arrears as these guarantees expired and economic conditions normalised. However, loan-loss provisions increased to 2.57% of total loans, providing adequate coverage for expected losses under baseline scenarios, with Central Bank stress tests confirming resilience to moderate adverse shocks.

Credit growth has been weak through 2024, with total loans declining 0.85% year-over-year in 2023 before recovering modestly to 1.85% growth by late 2024. Commercial lending has driven the recovery, expanding approximately 3-4% as businesses rebuilt working capital and financed inventory after the demand contraction in 2023. Consumer credit has remained subdued with growth near zero, reflecting both supply constraints as banks tightened underwriting standards following pandemic-era delinquency increases and demand weakness as households prioritised debt reduction over new borrowing. Mortgage lending has shown modest growth around 2-3%, supported by government subsidies for first-time buyers and declining interest rates, though housing market activity remains below pre-pandemic levels given affordability constraints and economic uncertainty.

Profitability metrics have improved significantly as interest rates normalised and net interest margins expanded from compressed levels during the pandemic. System-wide net interest margins increased from 2.2% in 2023 to 4.2% by the fourth quarter of 2024, reflecting the lagged adjustment of deposit rates relative to lending rates as monetary policy tightened. Santander Chile reported return on average equity of 20.2% for full-year 2024, with quarterly ROAE reaching 26% in the fourth quarter, demonstrating strong earnings power. Efficiency ratios have improved with cost-to-income declining to approximately 42-45% for major banks, supported by digital transformation initiatives that have reduced branch networks and automated routine transactions.

Digital transformation continues apace, with major banks reporting that over 80% of transactions now occur through digital channels including mobile applications and internet banking. Santander Chile reported 2.2 million digital customers representing approximately 60% of its client base, with mobile app usage growing 25% year-over-year. Digital adoption has accelerated during the pandemic and continued subsequently, driven by improved user interfaces, expanded functionality including investment products and insurance, and demographic shifts as younger customers prefer digital interactions. This transformation has enabled substantial cost reductions through branch consolidation and staff reallocation, with the number of bank branches declining approximately 20% over the past five years whilst ATM networks have remained stable.

Fintech development has accelerated with regulatory support, creating both competitive pressures and partnership opportunities for traditional banks. The Financial Market Commission issued NCG 502 in February 2024 regulating fintech service providers, establishing licensing requirements, consumer protection standards, and prudential oversight for payment platforms, peer-to-peer lenders, and digital wallets. The Open Finance System regulations published in July 2024 will require banks to share customer data through standardised APIs starting July 2026, enabling fintech companies to develop innovative products using banking data with customer consent. Tenpo Bank awaits final regulatory approval to become Chile's first fully digital bank by end-2025, having received preliminary authorisation and completed capital raising.

The Consolidated Debt Registry Law passed in July 2024 will enhance credit risk assessment when implemented in April 2026, requiring all lenders including fintechs, retailers, and non-bank financial institutions to report lending to a centralised registry managed by the Central Bank. This will provide lenders with comprehensive views of borrower indebtedness across all credit sources, addressing information asymmetries that have contributed to over-indebtedness particularly in consumer credit. The registry will also support macroprudential oversight by providing authorities with real-time data on credit growth, concentration, and emerging risks across the financial system.

Liquidity conditions remain adequate with banks maintaining liquid asset buffers well above regulatory requirements. The liquidity coverage ratio, which measures high-quality liquid assets relative to projected net cash outflows over 30 days, averages approximately 150-180% for major banks, well above the 100% minimum. Funding structures have improved with greater reliance on stable retail deposits rather than wholesale funding, reducing vulnerability to market disruptions. Deposit growth has been healthy at approximately 4-5% annually, supported by returning confidence and positive real interest rates, with the deposit base diversified across retail, corporate, and institutional clients.

External funding remains important for larger banks, with international bond issuances and credit lines from foreign parent companies providing diversification and supporting foreign currency lending. Santander Chile successfully issued $500 million in senior unsecured bonds in September 2024 at 140 basis points over US Treasuries, demonstrating continued market access at reasonable spreads. However, external funding creates vulnerability to global financial conditions, with potential tightening or risk-off sentiment affecting availability and pricing. The Central Bank monitors external funding ratios and maintains swap facilities to provide foreign currency liquidity if needed during stress periods.

Central Bank assessments confirm the banking system's resilience to stress scenarios, with regular stress tests examining impacts of severe recessions, commodity price collapses, and external shocks. The most recent stress test published in 2024 examined scenarios including GDP contraction of 3-4%, unemployment rising to 12%, and copper prices falling to $3.00 per pound. Results indicated that whilst profitability would decline substantially and some banks might experience capital ratio reductions below optimal levels, no systemic institutions would breach minimum requirements, and the system would maintain capacity to support credit supply. These results provide confidence in financial stability, though the Central Bank emphasises the importance of maintaining strong capital buffers during favourable periods to absorb potential future shocks.

Key risks to financial stability warrant continued monitoring despite the generally favourable current assessment. Elevated long-term interest rates, with 10-year government bond yields around 5.5-6.0%, create mark-to-market losses on fixed-income portfolios and increase funding costs, though most banks have limited interest rate risk given predominance of floating-rate lending. External uncertainty from geopolitical tensions, US policy changes including potential tariffs, and global financial volatility could affect capital flows, exchange rates, and risk sentiment with spillovers to Chilean markets. Domestic risks include potential fiscal slippage affecting sovereign creditworthiness and bank funding costs, political uncertainty around the November 2025 election, and social tensions that could disrupt economic activity.

The regulatory framework has strengthened substantially over the past decade, with the Financial Market Commission established in 2014 consolidating supervision of banks, securities markets, and insurance under a single authority. The CMF has implemented risk-based supervision focusing resources on systemically important institutions and emerging risks, whilst maintaining comprehensive oversight of smaller entities. Coordination with the Central Bank on macroprudential policy has improved through formal committees and information sharing, enabling more effective identification and mitigation of systemic risks. However, the rapid growth of fintech and non-bank lending creates regulatory challenges, with authorities working to balance innovation support with appropriate consumer protection and systemic risk management.

Outlook & Scenarios

Short-Term Outlook (12 months)

Chile's near-term economic trajectory through November 2026 appears constructive with GDP growth expected to stabilise around 2.0-2.3% in 2025, supported by gradual monetary easing as inflation converges toward the 3% target by early 2026. The Central Bank's cautious approach to rate cuts, with the policy rate at 4.75% as of January 2025 and likely heading toward the neutral range of 3.5-4% by year-end, should support credit recovery and domestic demand without reigniting inflationary pressures. Consumer spending is projected to grow modestly around 2.5-3.0% as real wage growth turns positive with inflation declining and labour market conditions gradually improving, though elevated household debt levels from pandemic-era borrowing will constrain consumption expansion. Investment growth should accelerate to 3-4% driven by mining sector capital expenditure for production maintenance and expansion, renewable energy projects, and initial green hydrogen pilot facilities, though broader private investment will remain cautious given political uncertainty ahead of the November 2025 election.

Inflation is projected to decline from 4.7% in early 2025 to approximately 3.5-4.0% by end-2025, with convergence to the 3% target expected by early 2026 as the effects of electricity tariff increases dissipate and core inflation moderates further. The Central Bank will likely implement additional 50-75 basis points of rate cuts through 2025, bringing the policy rate to approximately 4.0% by year-end, close to the neutral level that neither stimulates nor restrains economic activity. This gradual easing approach reflects the Bank's commitment to ensuring inflation convergence whilst supporting growth recovery, with the pace of cuts dependent on incoming data regarding inflation dynamics, exchange rate movements, and external financial conditions.