🇧🇷 Brazil

Brazil's sovereign credit profile as of November 2025 reflects a complex interplay between economic resilience and persistent structural challenges that continue to constrain its path toward investment grade status. The country maintains sub-investment grade ratings from all three major agencies, with Moody's positioning Brazil closest to investment grade at Ba1 with a positive outlook, while S&P and Fitch maintain BB ratings with stable outlooks. This rating configuration reflects recognition of Brazil's fundamental strengths as a large, diversified economy with substantial natural resources, a resilient banking sector, and adequate external buffers, while acknowledging ongoing concerns about fiscal sustainability and governance weaknesses. The economy benefits from its position as a global agricultural powerhouse, leadership in digital financial innovation through the PIX payment system, and growing diversification into manufacturing and technology sectors that collectively support a $2.8 trillion economy.

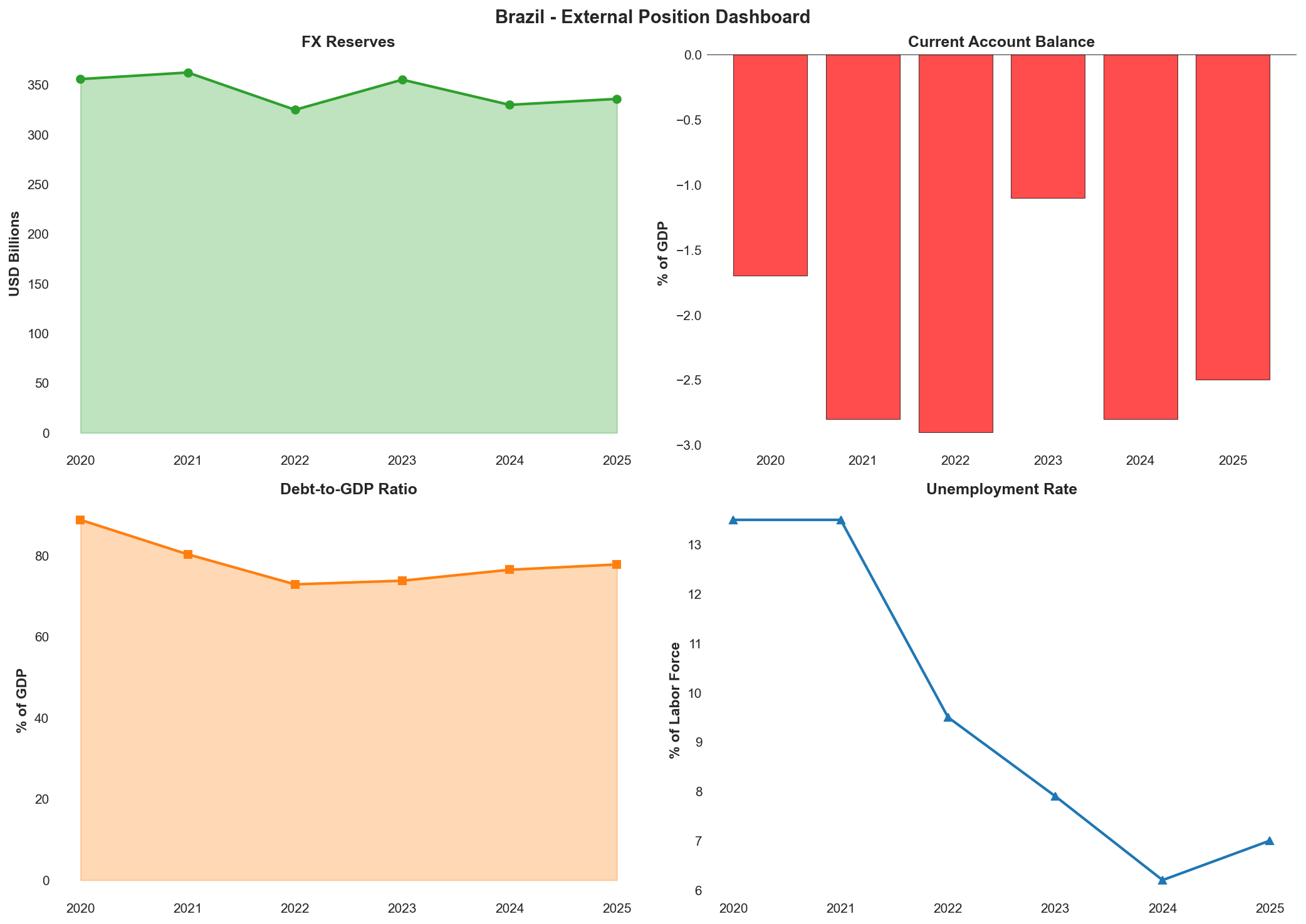

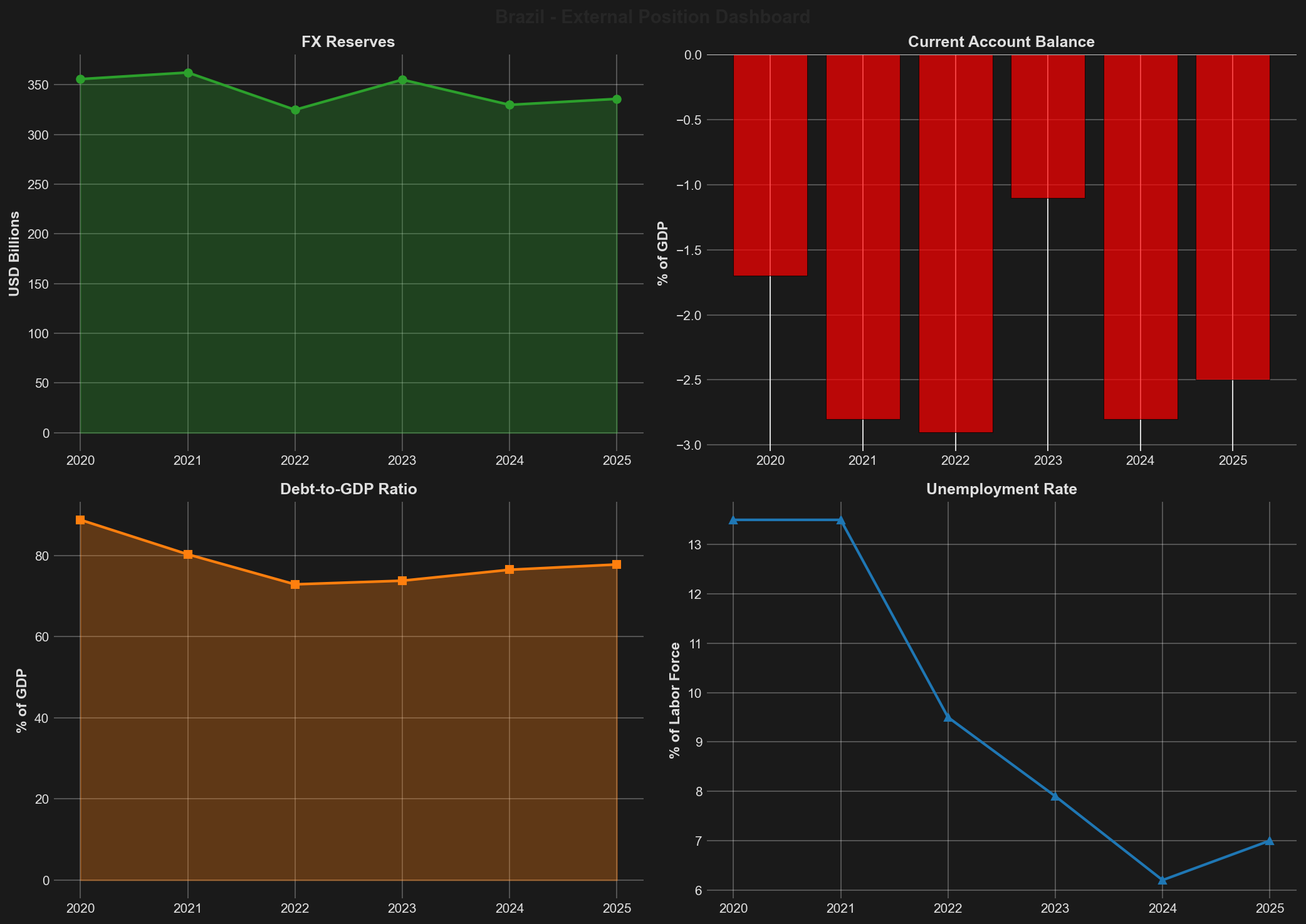

The current economic situation presents a challenging near-term environment as aggressive monetary tightening works to combat inflation that has persistently exceeded the central bank's tolerance band. Following strong 3.4% GDP growth in 2024, momentum has slowed significantly in 2025 with growth projected at 2.2% as the SELIC rate reached 14.75% by mid-year, the highest level in nearly two decades. Inflation accelerated to 5.53% by April 2025, well above the central bank's 3% target and outside the 4.5% tolerance ceiling, driven by fiscal expansion, currency depreciation of 27.9% in 2024, and resilient domestic demand. The current account deficit widened to 2.55% of GDP in 2024 from 1.1% in 2023, reflecting strong import growth, though this remains comfortably financed by foreign direct investment inflows of $64.2 billion. Foreign exchange reserves stand at $335.7 billion as of November 2025, providing substantial buffers equivalent to 14-15 months of import coverage, while the flexible exchange rate regime continues to serve as an important shock absorber for external pressures.

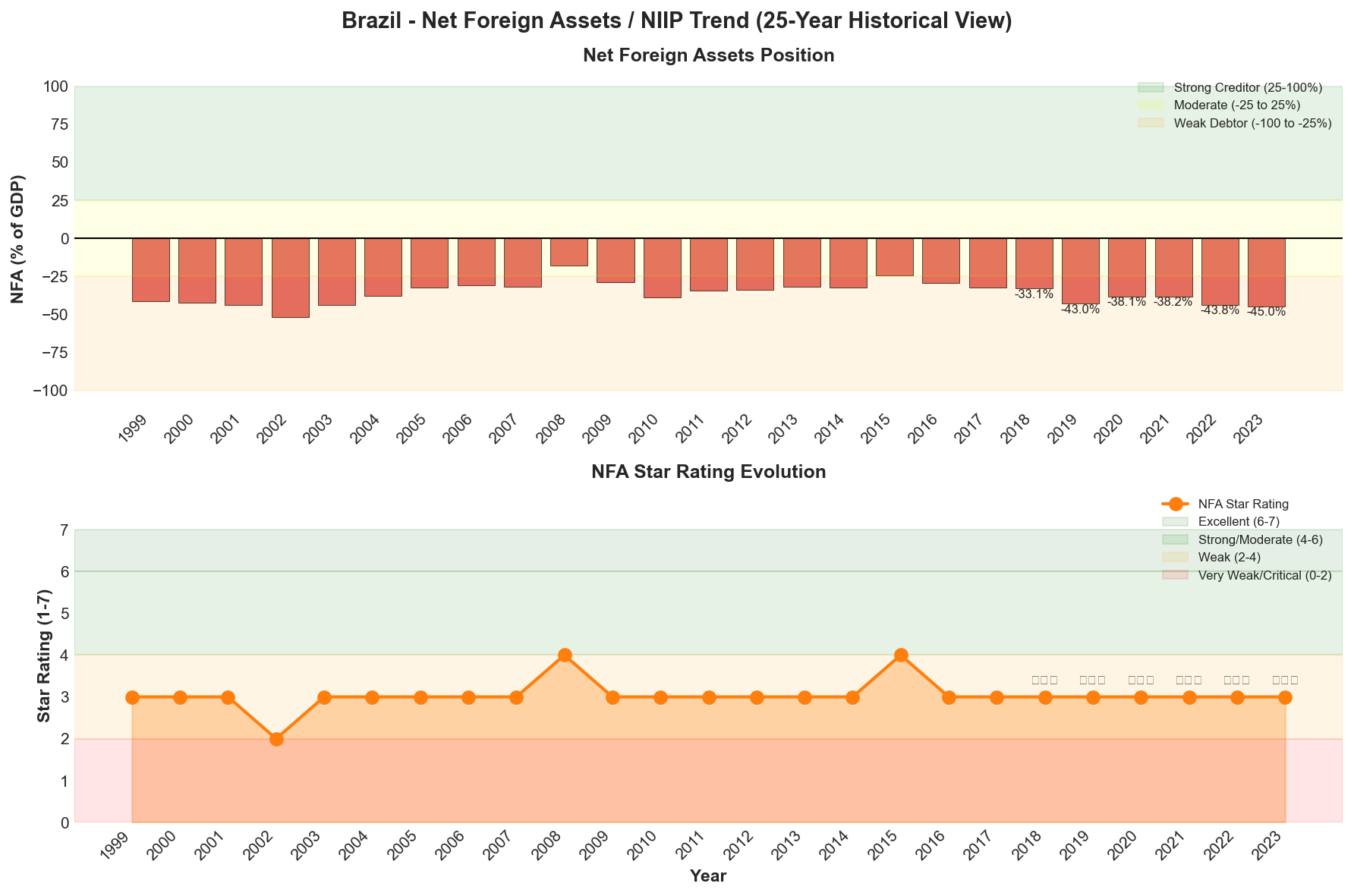

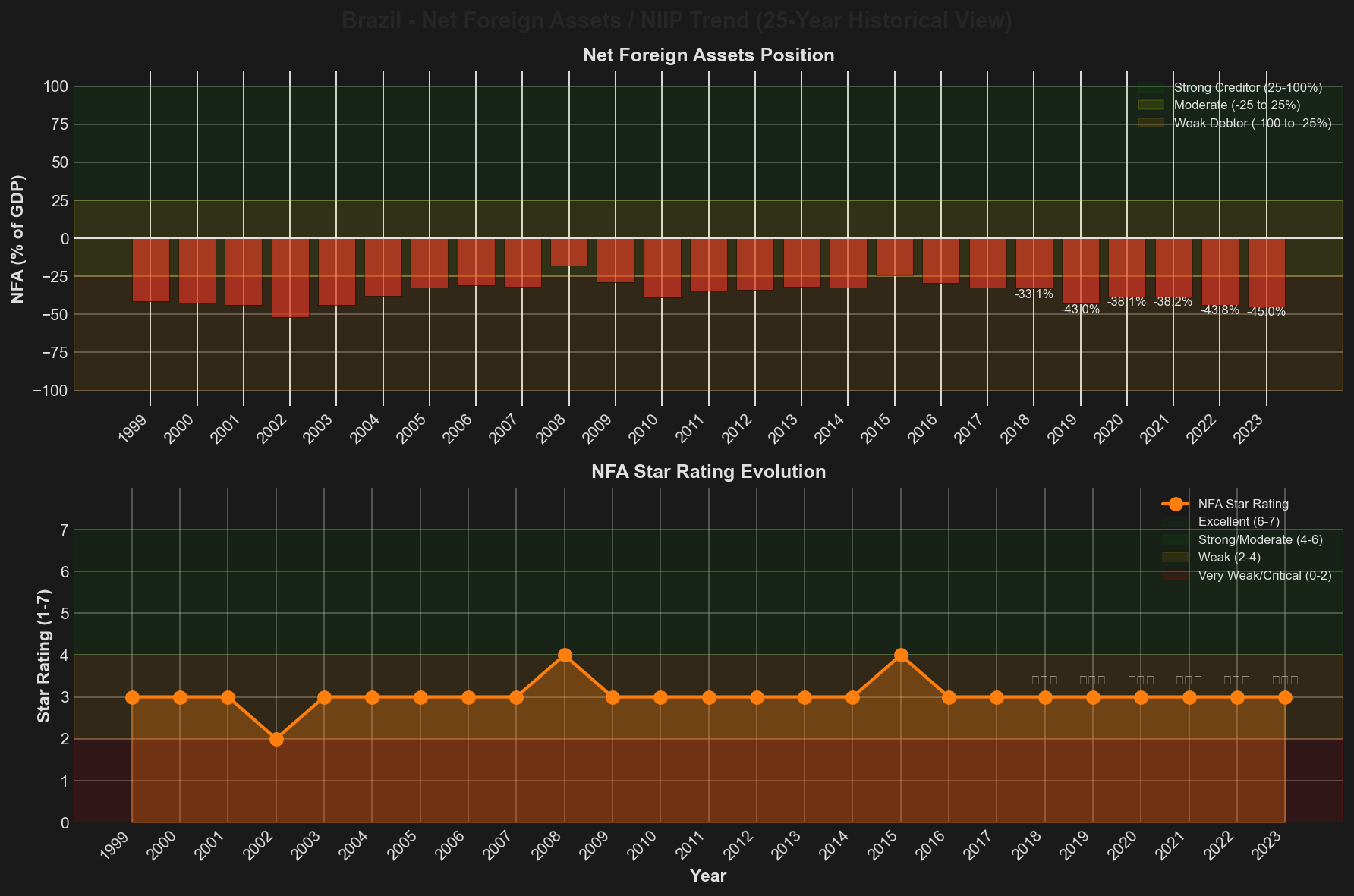

The main credit challenges center on persistent fiscal imbalances and rising public debt dynamics that threaten medium-term sustainability. Public debt reached 76.5% of GDP in 2024 and is projected to rise toward 79.6% by 2028 under current policies, with the IMF forecasting a further deterioration to 98.1% of GDP by 2030 absent significant policy adjustments. The primary fiscal deficit of 0.1% of GDP in 2024 falls well short of the surplus needed to stabilize debt, while structural budget rigidities limit fiscal flexibility with mandatory spending consuming the majority of revenues. Political fragmentation under President Lula's third term complicates reform implementation, with a powerful Centrão bloc controlling Congress and requiring constant coalition management that often comes at the cost of fiscal discipline. Governance indicators remain weak, with Brazil ranking 107th globally on corruption perceptions and scoring below world averages on political stability, creating policy uncertainty and implementation risks. The Net Foreign Assets position of -45.0% of GDP as of 2023, earning a 3-star rating on a 7-point scale, reflects a weak external debtor position that, while manageable given the predominantly local currency composition of public debt, nonetheless represents a structural vulnerability requiring careful management.

Brazil's path toward investment grade status hinges on demonstrating sustained fiscal consolidation, maintaining inflation within target ranges, and advancing structural reforms that enhance productivity and competitiveness. The historic tax reform approved in December 2023, which will consolidate five consumption taxes into three over 2026-2033, represents a transformative achievement that could boost productivity and simplify the business environment, though implementation challenges remain substantial. Moody's positive outlook signals potential upgrade momentum if fiscal metrics improve and debt stabilizes, while S&P and Fitch's stable outlooks reflect a more cautious assessment requiring demonstrated fiscal discipline before considering upgrades. The medium-term outlook depends critically on navigating the 2026 electoral cycle without disrupting reform momentum, successfully implementing tax reform, and achieving primary fiscal surpluses of at least 1% of GDP to reverse the debt trajectory. While near-term risks from inflation persistence, currency pressures, and global trade tensions remain elevated, Brazil's fundamental economic strengths, institutional resilience, and demonstrated capacity for pragmatic policymaking provide a foundation for gradual credit improvement over the coming years.

Key Economic Trends

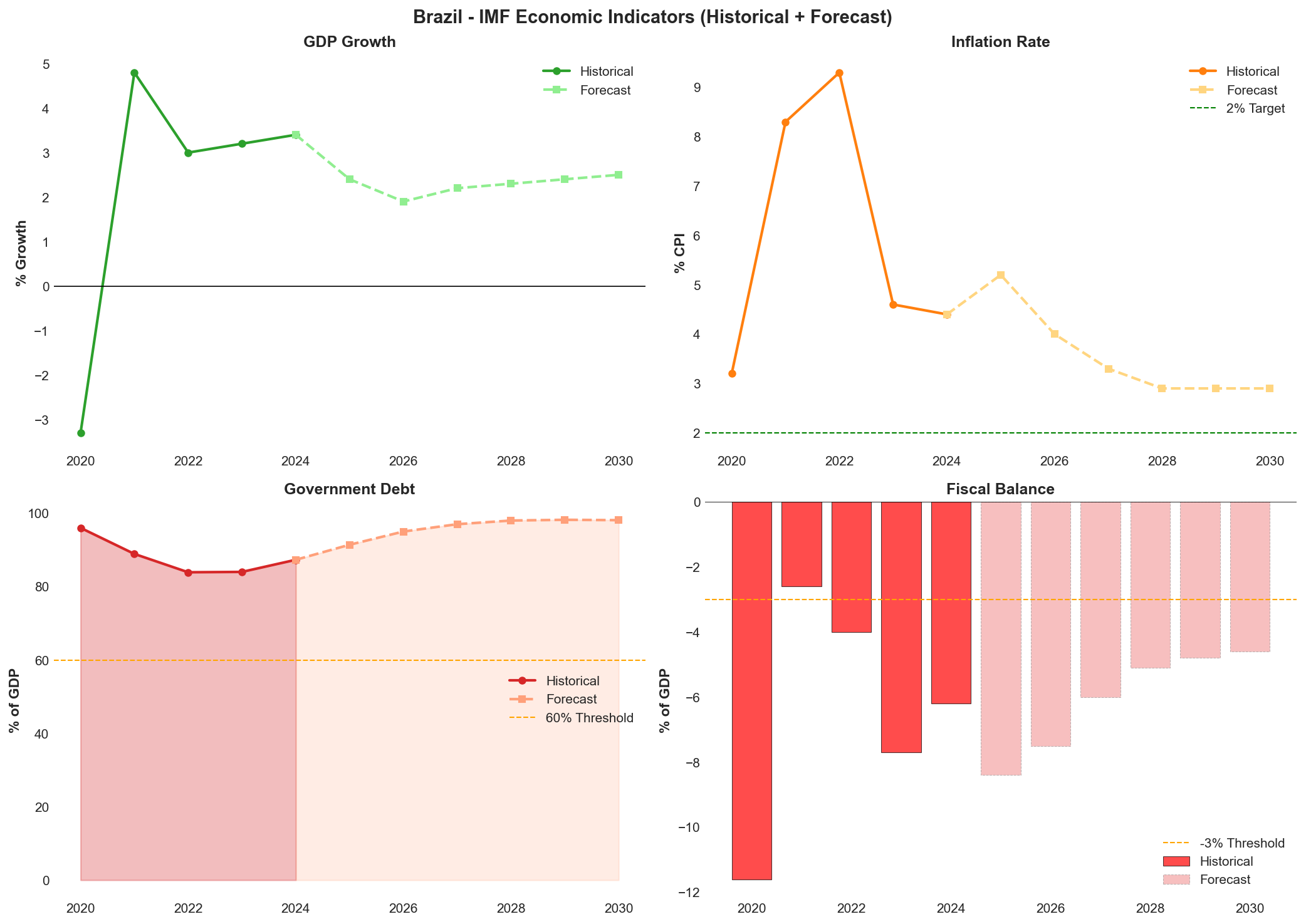

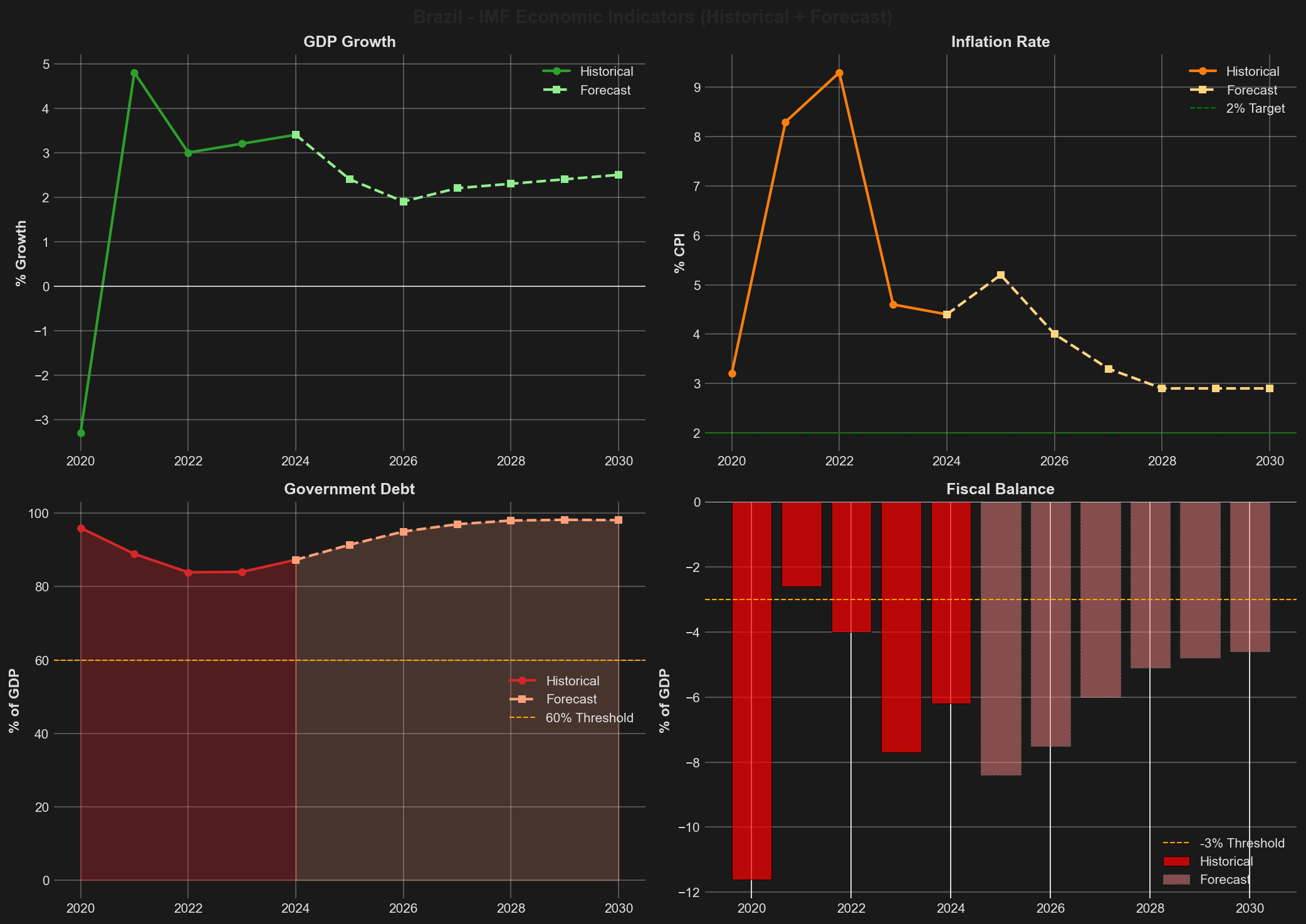

*Comprehensive view of key macroeconomic indicators from IMF data, showing historical trends (2020-2024) and medium-term forecasts through 2030 for GDP growth, inflation, government debt, and fiscal balance.*

Ratings Summary

As of November 2025, Brazil maintains sub-investment grade sovereign credit ratings from all three major international rating agencies. Moody's Investors Service rates Brazil at Ba1 with a Positive outlook, positioning the country just one notch below investment grade and closest among the major agencies to an upgrade. S&P Global Ratings assigns a BB rating with a Stable outlook, two notches below investment grade, while Fitch Ratings maintains an identical BB rating with a Stable outlook. Brazil's Net Foreign Assets assessment stands at 3 out of 7 stars (⭐⭐⭐), reflecting a weak external debtor position with Net International Investment Position of -45.0% of GDP as of 2023, categorized as "Weak" in the -50% to -25% range.

Credit Ratings

| Rating Agency | Current Rating | Outlook | Last Action Date |

|---|---|---|---|

| Moody's | Ba1 | Positive | October 1, 2024 |

| S&P Global | BB | Stable | December 19, 2023 |

| Fitch | BB | Stable | December 15, 2023 |

The rating actions by the three major agencies reflect divergent assessments of Brazil's reform trajectory and fiscal credibility. Moody's October 2024 upgrade to Ba1 represented the most significant positive action, recognizing material credit improvements from robust GDP growth, successful passage of historic tax reform, and demonstrated policy pragmatism under the Lula administration. The positive outlook signals that Moody's expects gradual fiscal improvement and debt stabilization over the medium term, with potential for an upgrade to investment grade (Baa3) if Brazil demonstrates sustained progress in reducing fiscal deficits and stabilizing debt dynamics below 75% of GDP. This positioning reflects Moody's view that Brazil has made sufficient institutional and policy advances to warrant proximity to investment grade status.

S&P Global Ratings' December 2023 upgrade from BB- to BB, while positive, left Brazil two notches below investment grade and assigned a stable outlook that suggests no imminent rating change. The upgrade cited the approval of landmark tax reform and Brazil's strengthened track record of pragmatic policies as key factors supporting creditworthiness. However, S&P maintains significant concerns about fiscal imbalances, projecting general government deficits averaging 6.2% of GDP over the medium term and expressing skepticism about the government's ability to deliver meaningful fiscal consolidation given political constraints. The stable outlook reflects S&P's view that while Brazil has made progress, substantial additional improvements in fiscal metrics are required before considering a further upgrade.

Fitch Ratings' December 2023 affirmation at BB with a stable outlook represents the most cautious assessment among the three agencies. While acknowledging policy pragmatism under President Lula and the significance of tax reform approval, Fitch emphasizes concerns about high government debt levels and expresses doubts about the administration's ability and willingness to implement the fiscal consolidation necessary to stabilize debt dynamics. Fitch's stable outlook suggests the agency sees balanced risks, with reform progress offset by fiscal challenges and political uncertainties. The agency's positioning indicates that Brazil must demonstrate concrete fiscal improvements and debt stabilization before Fitch would consider moving the rating closer to investment grade.

Economic Indicators

| Indicator | 2020 | 2021 | 2022 | 2023 | 2024 | 2025* |

|---|---|---|---|---|---|---|

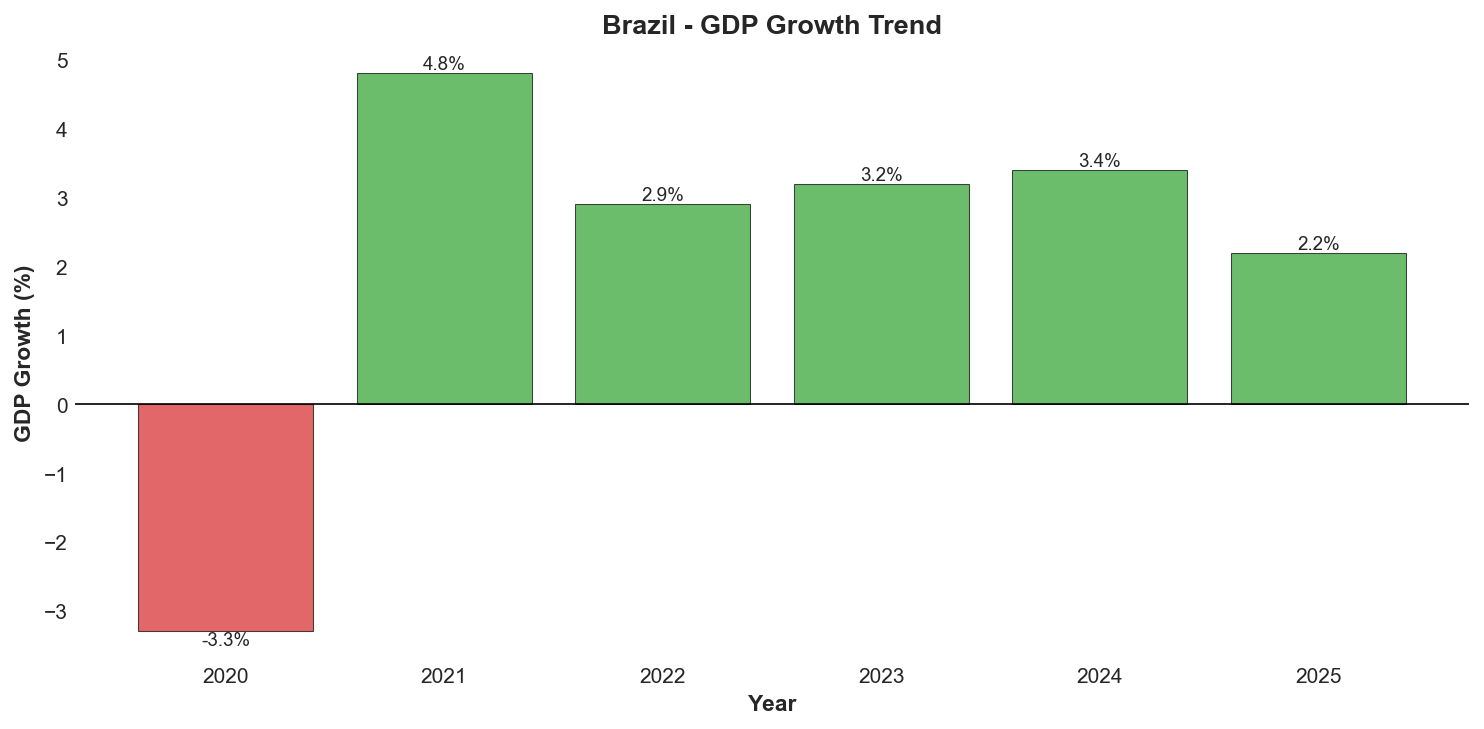

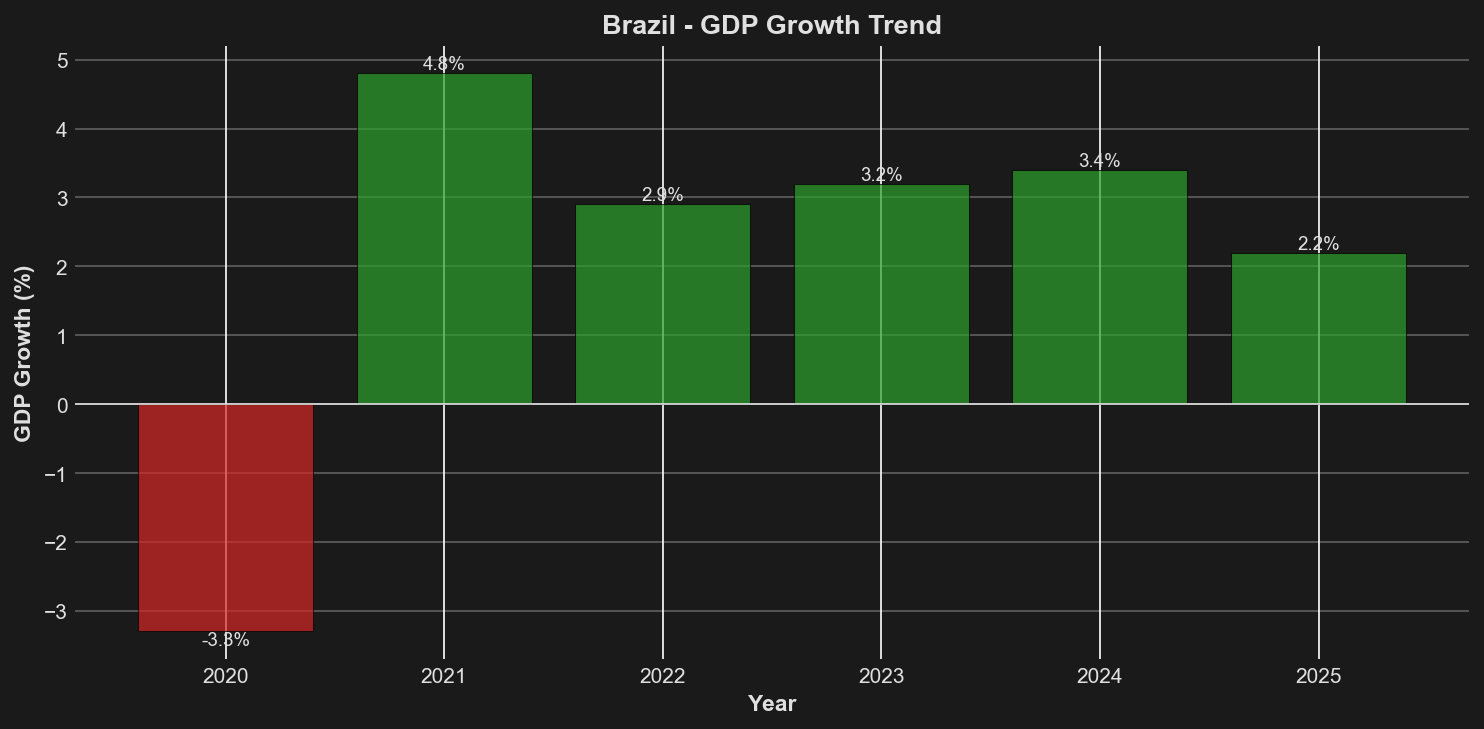

| GDP Growth (%) | -3.3 | 4.8 | 2.9 | 3.2 | 3.4 | 2.2 (proj) |

| Inflation Rate (%) | 4.5 | 10.1 | 12.1 | 4.6 | 4.8 | 5.5 |

| Debt-to-GDP Ratio (%) | 88.8 | 80.3 | 72.9 | 73.8 | 76.5 | 77.8 |

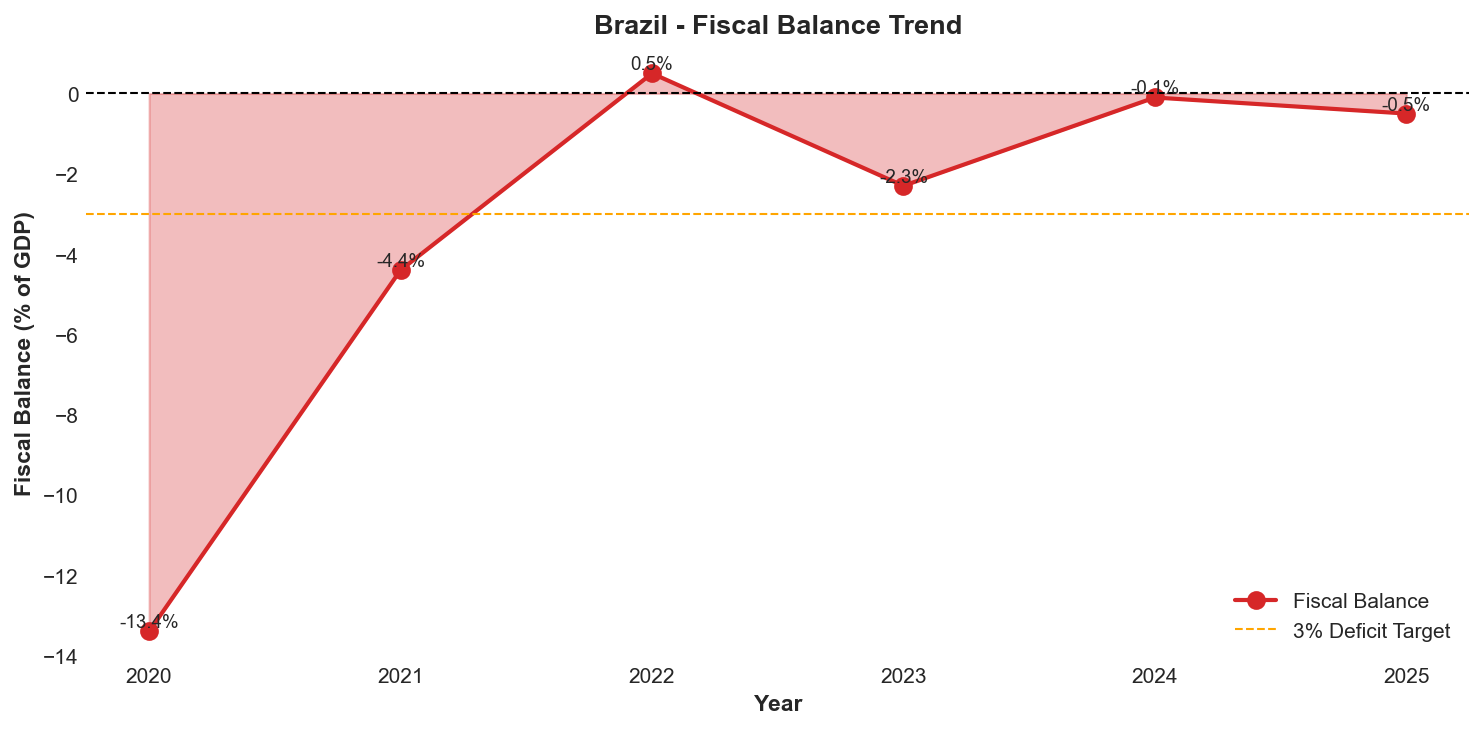

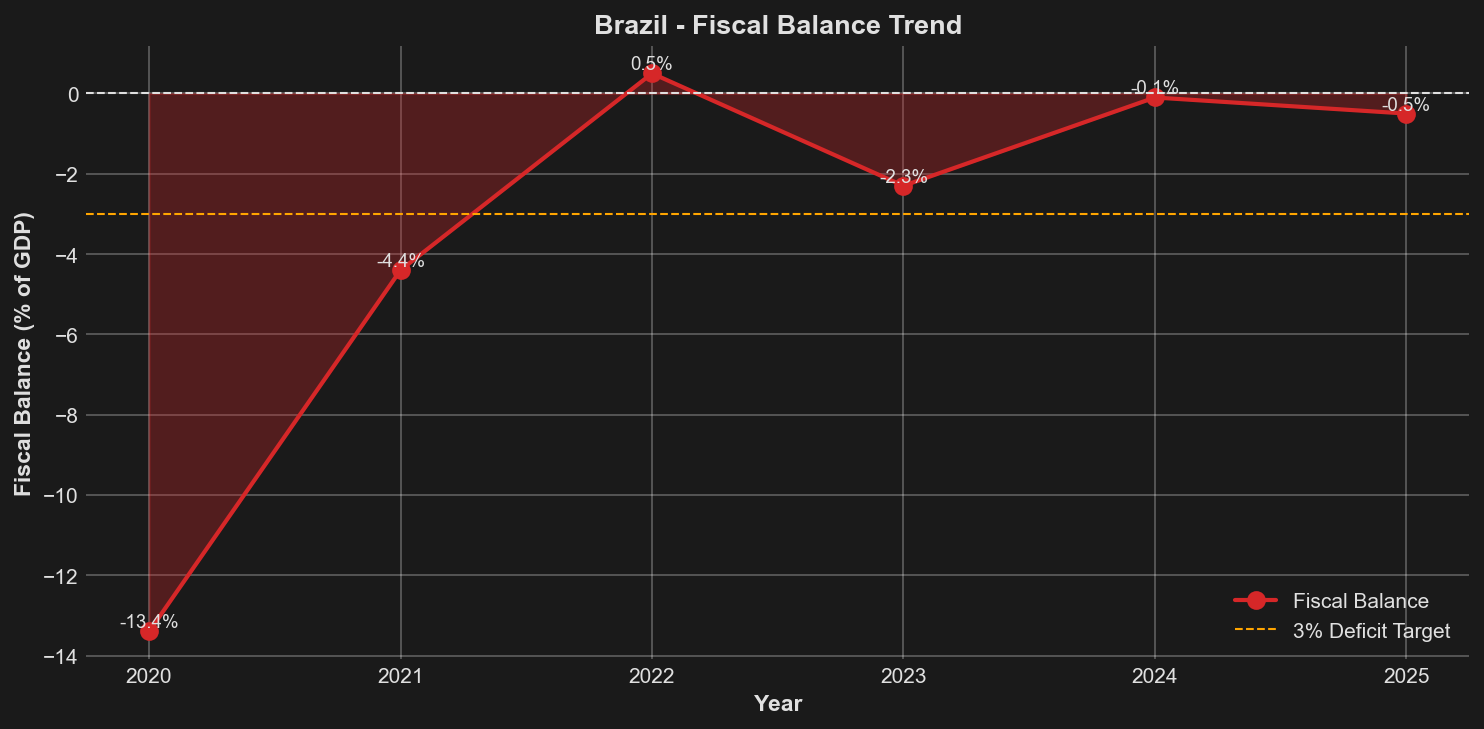

| Fiscal Balance (% of GDP) | -13.4 | -4.4 | 0.5 | -2.3 | -0.1 | -0.5 |

| Current Account Balance (% of GDP) | -1.7 | -2.8 | -2.9 | -1.1 | -2.8 | -2.5 |

| Foreign Exchange Reserves (USD bn) | 355.6 | 362.2 | 324.7 | 355.0 | 329.7 | 335.7 |

| Unemployment Rate (%) | 13.5 | 13.5 | 9.5 | 7.9 | 6.2 | 7.0 |

| Exchange Rate (BRL/USD) | 5.16 | 5.40 | 5.17 | 4.99 | 6.19 | 5.78 |

*2025 data through November or projections

*Comprehensive external position dashboard showing foreign exchange reserves, current account balance, and unemployment trends.*

*Historical GDP growth trends showing annual percentage changes, with color coding for positive (green) and negative (red) growth periods.*

Economic Performance Trends

Brazil's economic indicators reveal a post-pandemic recovery trajectory that peaked in 2024 with 3.4% GDP growth, the strongest performance since the 4.8% rebound in 2021. This robust expansion reflected resilient domestic demand, record-low unemployment reaching 6.2%, and strong real wage growth of 4.8% that supported household consumption. However, this strong performance came at the cost of persistent inflationary pressures, with consumer price inflation rising from 4.6% in 2023 to 4.8% in 2024 and accelerating further to 5.53% by April 2025, well above the central bank's 3% target and breaching the 4.5% tolerance ceiling. The inflation persistence stems from multiple sources including fiscal expansion, significant currency depreciation of 27.9% in 2024, resilient labor markets with unemployment at historic lows, and strong domestic demand that has proven more durable than anticipated.

*Fiscal balance as percentage of GDP, showing government surplus (positive) or deficit (negative) positions over time.*

The fiscal trajectory presents the most significant credit challenge, with the debt-to-GDP ratio reversing its post-pandemic decline and rising to 76.5% in 2024 from a low of 72.9% in 2022. This deterioration reflects the combination of persistent primary deficits, higher interest costs from elevated SELIC rates, and slower nominal GDP growth. The primary fiscal balance showed only marginal improvement to -0.1% of GDP in 2024 from -2.3% in 2023, falling well short of the surplus needed to stabilize debt dynamics. Looking forward, the IMF projects Brazil's fiscal challenges to intensify significantly, with the fiscal balance deteriorating to -4.6% of GDP by 2030 and government debt rising to 98.1% of GDP absent substantial policy adjustments, underscoring the urgency of fiscal consolidation efforts.

External Sector Dynamics

The external sector showed mixed developments, with the current account deficit widening significantly to 2.8% of GDP in 2024 from 1.1% in 2023, driven primarily by strong domestic demand boosting imports by 9% while export performance remained stable at $337 billion. The trade surplus declined 24.6% to $74.6 billion in 2024, reflecting both the import surge and weather-related impacts on agricultural exports. Despite this deterioration, the current account deficit remains comfortably financed by foreign direct investment inflows of $64.2 billion (2.9% of GDP), with Brazil ranking as the fifth-largest global FDI destination. Foreign exchange reserves of $335.7 billion as of November 2025 provide substantial buffers, covering 14-15 months of imports and exceeding short-term external debt, though the central bank deployed over $30 billion in interventions during the December 2024 currency crisis.

The labor market demonstrated remarkable strength through 2024, with unemployment falling to a record low of 6.2% and formal job creation remaining robust. However, this tight labor market contributed to inflationary pressures through wage growth and supported consumption demand that complicated the central bank's inflation-fighting efforts. As monetary tightening takes full effect in 2025, unemployment is projected to rise modestly to 7.0% as growth slows and domestic demand moderates. The exchange rate volatility, with the real depreciating sharply to 6.19 per dollar in 2024 before partially recovering to 5.78 by November 2025, reflects both domestic fiscal concerns and global dollar strength, requiring aggressive monetary policy and foreign exchange intervention responses to stabilize currency markets and anchor inflation expectations.

Net Foreign Assets & External Position

Twenty-five year historical evolution of net foreign assets as percentage of GDP (upper panel) and corresponding NFA star rating progression (lower panel), illustrating long-term external balance sheet dynamics and structural shifts in sovereign external position.

Brazil's external balance sheet reflects a persistent structural weakness in its Net International Investment Position, which stood at -45.0% of GDP as of 2023 according to the External Wealth of Nations database. This positions Brazil in the "Weak" category with a 3-star rating on a 7-point scale, indicating a notable external debtor position that requires careful management despite mitigating factors. The Net Foreign Assets position has deteriorated modestly over the past five years, declining from -43.0% of GDP in 2019 to -38.1% in 2020 during the pandemic, remaining relatively stable around -38% in 2021-2022, before weakening to -43.8% in 2022 and further to -45.0% in 2023. This trend reflects the cumulative impact of persistent current account deficits, currency depreciation effects on foreign currency-denominated liabilities, and valuation changes in Brazil's external asset and liability positions.

External Vulnerability Assessment

The negative Net Foreign Assets position indicates that Brazil's external liabilities substantially exceed its external assets, creating a structural vulnerability that manifests through several channels. Foreign residents hold significant claims on Brazilian assets, including portfolio investments in domestic equity and debt markets, foreign direct investment in Brazilian companies and real estate, and external debt obligations of both the public and private sectors. This net debtor position means Brazil must generate sufficient foreign exchange earnings through trade surpluses and capital inflows to service these external obligations, creating sensitivity to global financial conditions, commodity price fluctuations, and investor sentiment toward emerging markets. The deterioration from -43.0% to -45.0% of GDP between 2019 and 2023 suggests that external vulnerabilities have modestly increased despite Brazil's strong export performance and substantial foreign direct investment inflows.

However, several factors significantly mitigate the risks associated with Brazil's negative Net Foreign Assets position. Most importantly, Brazilian government debt is predominantly denominated in local currency, with external debt representing only 27.5% of GDP and declining from historical peaks above 40%. This composition dramatically reduces currency mismatch risks and vulnerability to exchange rate shocks that have historically triggered sovereign debt crises in emerging markets. The flexible exchange rate regime provides an important adjustment mechanism, allowing the real to depreciate in response to external pressures rather than defending an unsustainable peg that depletes reserves. Additionally, Brazil's substantial foreign exchange reserves of $335.7 billion as of November 2025 provide a robust buffer against external shocks, covering 14-15 months of imports and exceeding short-term external debt by a comfortable margin.

External Financing and Capital Flows

Brazil's external financing structure demonstrates both strengths and vulnerabilities in its integration with global capital markets. Foreign direct investment inflows of $64.2 billion in 2024 (2.9% of GDP) comfortably finance the current account deficit of 2.8% of GDP, reflecting sustained foreign investor interest in Brazil's large domestic market, natural resource endowments, and growth opportunities in renewable energy, technology, and traditional sectors. This FDI-financed current account deficit represents a relatively stable form of external financing compared to more volatile portfolio flows, as direct investment typically involves longer-term commitments and greater resilience during periods of market stress. Brazil's ranking as the fifth-largest global FDI destination underscores its continued attractiveness despite governance challenges and fiscal concerns.

Portfolio flows present a more mixed picture, turning negative at -$4.3 billion in 2024 as foreign investors reduced exposure to Brazilian assets amid fiscal concerns and currency volatility. The sharp real depreciation of 27.9% in 2024, driven by both domestic fiscal credibility issues and global dollar strength, reflected portfolio outflows and reduced foreign appetite for Brazilian bonds and equities. The central bank's deployment of over $30 billion in foreign exchange interventions during the December 2024 currency crisis demonstrated both the authorities' capacity and willingness to stabilize markets during periods of stress, though such interventions cannot substitute for addressing underlying fiscal and credibility concerns. The predominantly local currency composition of government debt means that foreign portfolio investors primarily hold exposure through local currency bonds rather than external debt, creating different risk dynamics than traditional emerging market external debt vulnerabilities.

Trade Structure and External Resilience

Brazil's trade structure provides important sources of external resilience despite the negative Net Foreign Assets position. The country achieved a trade surplus of $74.6 billion in 2024, though this represented a 24.6% decline from the previous year due to strong import growth. Export performance remained robust at $337 billion, with a historic shift as oil overtook soybeans as the top export for the first time since 1997, reflecting expanded pre-salt production and strong global energy prices. Oil exports reached $44.8 billion, while agricultural exports of soybeans, coffee, sugar, and orange juice maintained Brazil's dominant global market positions despite an 11% decline due to weather impacts. Manufacturing exports achieved record levels at $181.9 billion, demonstrating growing diversification beyond traditional commodity dependence.

The geographic and product diversification of Brazil's export base provides resilience against external shocks, though significant concentration risks remain. China accounts for 44% of oil exports and 74% of soybean shipments, creating substantial exposure to Chinese demand fluctuations and economic performance. The April 2025 imposition of 10% "reciprocal" tariffs by the Trump administration on all Brazilian exports to the United States, adding to existing 25% tariffs on steel and aluminum, creates additional headwinds for the external sector. However, Brazil's relatively balanced bilateral trade with the United States ($80+ billion annually) and ability to redirect exports to other markets limits the impact compared to more trade-dependent emerging markets. The potential ratification of the EU-Mercosur trade agreement would provide further diversification opportunities and enhanced market access to European consumers.

Looking forward, Brazil's external position faces both opportunities and challenges. The IMF projects the current account deficit to deteriorate significantly to -49.2% of GDP by 2030, though this figure appears inconsistent with historical patterns and likely reflects data interpretation issues rather than a realistic forecast of external imbalances. More plausibly, the current account deficit is expected to stabilize around 2.5-3.0% of GDP over the medium term, remaining comfortably financeable through FDI inflows and supported by growing oil production targeting 3.2 million barrels per day by 2028. The Net Foreign Assets position will likely remain in the "Weak" category absent sustained current account surpluses, requiring continued careful management of fiscal credibility, currency stability, and investor confidence to maintain stable external financing conditions. The combination of adequate reserves, flexible exchange rates, local currency debt composition, and diversified export base provides important buffers, though the structural net debtor position remains a credit constraint that limits Brazil's rating potential compared to emerging markets with stronger external balance sheets.

Credit Strengths & Vulnerabilities

Credit Strengths

Brazil's sovereign credit profile benefits from several fundamental strengths that provide resilience against economic shocks and support medium-term growth potential. The country's large, diversified economy with $2.8 trillion in GDP represents the ninth-largest economy globally and the largest in Latin America, providing substantial scale advantages and reducing dependence on any single sector or external market. This economic diversification spans agriculture, manufacturing, services, and increasingly technology sectors, with a comprehensive industrial base that produces everything from aircraft to automobiles to advanced biofuels. The sheer size of the domestic market creates opportunities for economies of scale and attracts sustained foreign direct investment across multiple sectors.

Brazil's abundant natural resources constitute a major competitive advantage in the global economy, particularly as the world transitions toward renewable energy and sustainable agriculture. The country maintains world-leading export positions in soybeans, coffee, sugar, orange juice, and increasingly oil from pre-salt reserves, with production targeting 3.2 million barrels per day by 2028. The Amazon rainforest and extensive biodiversity provide potential for bioeconomy development estimated to contribute BRL 40 billion in annual GDP increases by 2050. Renewable energy capacity, including hydroelectric, wind, and solar power, positions Brazil favorably for the global energy transition, while leadership in biofuels through ethanol production demonstrates long-standing commitment to sustainable energy sources.

The banking sector demonstrates strong fundamentals that support financial stability and economic resilience. System-wide capitalization remains robust with 98.5% of institutions meeting prudential requirements and major banks maintaining Common Equity Tier 1 ratios above 13%, well above regulatory minimums. Asset quality has improved with non-performing loans declining to 3.0% in December 2024 from recent peaks, reflecting aggressive provisioning and effective risk management by major institutions. Profitability remains healthy with leading banks achieving returns on equity between 12-22%, supported by high net interest margins and efficiency gains from digital transformation. The sector's resilience was confirmed through central bank stress tests showing adequate loss absorption capacity across severe economic scenarios.

Brazil's digital financial infrastructure represents a global leadership position that enhances economic efficiency and financial inclusion. The PIX instant payment system revolutionized retail transactions with 155 million users processing 27 trillion reais in 2024, dramatically reducing transaction costs and expanding access to digital payments. The upcoming launch of DREX, the central bank digital currency, will further modernize wholesale transactions using blockchain technology. This digital infrastructure, combined with a vibrant fintech sector including 13 unicorns and 340,000+ tech companies in São Paulo, positions Brazil at the forefront of financial innovation and creates opportunities for productivity gains across the economy.

The flexible exchange rate regime provides an important automatic stabilizer for external shocks, allowing the real to adjust to changing economic conditions rather than defending an unsustainable peg that depletes reserves. Foreign exchange reserves of $335.7 billion as of November 2025 provide substantial buffers covering 14-15 months of imports and exceeding short-term external debt, with demonstrated willingness by the central bank to deploy reserves during periods of market stress. The predominantly local currency composition of government debt, with external debt representing only 27.5% of GDP, dramatically reduces currency mismatch risks and vulnerability to exchange rate shocks that have historically triggered emerging market crises.

Credit Vulnerabilities

Persistent fiscal challenges represent the most significant credit constraint on Brazil's sovereign rating, with public debt rising to 76.5% of GDP in 2024 and projected to reach 79.6% by 2028 under current policies, with the IMF forecasting further deterioration to 98.1% by 2030 absent substantial policy adjustments. The primary fiscal deficit of 0.1% of GDP in 2024 falls well short of the surplus needed to stabilize debt dynamics, while the overall fiscal deficit including interest payments remains substantial. Structural budget rigidities severely limit fiscal flexibility, with mandatory spending including pensions, social programs, and constitutionally mandated transfers consuming the majority of revenues and leaving little room for discretionary adjustments or countercyclical policy responses during economic downturns.

High real interest rates at 14.75% as of November 2025 constrain investment and growth while significantly increasing debt service costs that consume an increasing share of government revenues. The elevated SELIC rate, necessary to combat inflation that has persistently exceeded the central bank's tolerance band, creates a challenging policy trade-off between price stability and fiscal sustainability. Real interest rates among the highest globally reduce private sector investment in productive capacity, limit infrastructure development, and constrain medium-term growth potential. The combination of high rates and rising debt creates a concerning debt service burden that will require sustained primary surpluses to stabilize, yet political constraints make achieving such surpluses extremely difficult.

Political fragmentation and governance weaknesses create substantial policy uncertainty and implementation risks for critical reforms. President Lula's administration faces a fragmented Congress with 23 parties represented, requiring constant coalition management with the powerful Centrão bloc that controls 73% of municipalities and demands concessions often at the cost of fiscal discipline. The president's approval rating declined from 47% in January 2025 to 41% by April, reflecting growing dissatisfaction with economic management and persistent inflation. Weak governance indicators including a corruption score of 34/100 (ranked 107/180 globally) and political stability below world averages undermine investor confidence and increase the risk premium demanded for Brazilian assets. Internal tensions within the administration between fiscal hawks and spending advocates further complicate coherent policymaking.

Low productivity growth outside the agriculture sector constrains Brazil's medium-term growth potential and competitiveness in global markets. While agricultural productivity has increased substantially through technological adoption and modern farming practices, manufacturing and services sectors face persistent productivity challenges from infrastructure bottlenecks, complex regulatory environments, and skills mismatches in the labor force. The economy's potential growth rate of 2.3-2.5% reflects these structural constraints, limiting the pace at which Brazil can grow without generating inflationary pressures. Infrastructure deficiencies in transportation, logistics, and digital connectivity increase business costs and reduce competitiveness, while the complex tax system prior to reform implementation created substantial compliance burdens and distortions in resource allocation.

Credit Opportunities

The historic tax reform approved in December 2023 represents a transformative opportunity to boost productivity and simplify Brazil's notoriously complex business environment. The reform will consolidate five consumption taxes into three over the 2026-2033 implementation period, potentially reducing compliance costs, eliminating cascading tax effects, and improving resource allocation across the economy. While the expected unified VAT rate of 27-30% will be among the world's highest, the simplification benefits and elimination of distortions could generate significant productivity gains. Successful implementation would enhance Brazil's business climate, attract additional foreign investment, and support higher sustainable growth rates over the medium term.

Green economy leadership provides substantial opportunities for economic development and export growth as global demand shifts toward sustainable products and renewable energy. Brazil's hosting of COP30 in 2026 will showcase its environmental credentials and bioeconomy potential, while the Amazon rainforest's preservation creates opportunities for carbon credit markets and sustainable development initiatives. The renewable energy sector offers significant investment opportunities in offshore wind development, solar power expansion, and continued leadership in biofuels, with growing global demand for sustainable aviation fuel and other advanced biofuels. Agricultural practices that combine productivity with sustainability could command premium prices in increasingly environmentally conscious global markets.

Technology sector expansion at 9% annual growth rates demonstrates Brazil's potential to diversify beyond traditional commodity dependence and develop higher value-added industries. São Paulo's emergence as a major technology hub with 340,000+ companies, 13 unicorns, and vibrant startup ecosystem creates opportunities for innovation-driven growth and productivity improvements across the economy. The success of digital payment infrastructure through PIX and upcoming DREX implementation showcases Brazilian technological capabilities and creates platforms for further financial innovation. Growing technology exports and services trade could help diversify the export base and reduce vulnerability to commodity price fluctuations.

Trade diversification benefits from shifting global trade patterns and potential new trade agreements provide opportunities to reduce dependence on concentrated export markets. The potential ratification of the EU-Mercosur agreement would provide enhanced access to European markets for Brazilian agricultural and manufactured goods, while US-China tensions create opportunities for Brazil to expand market share in both markets. Growing South-South trade relationships and expanding ties with African and Middle Eastern markets offer additional diversification opportunities. Oil production growth targeting 3.2 million barrels per day by 2028 from pre-salt fields will generate substantial export revenues and fiscal resources if global energy prices remain supportive.

Credit Threats

Inflation persistence above the central bank's tolerance band represents the most immediate threat to macroeconomic stability and credit quality. The 5.53% inflation rate as of April 2025, well above the 4.5% ceiling, reflects multiple sources of pressure including fiscal expansion, currency depreciation, tight labor markets, and resilient domestic demand. If inflation expectations become de-anchored, the central bank may need to maintain restrictive monetary policy for an extended period or tighten further, potentially triggering a more severe economic slowdown than currently projected. The combination of high inflation and high interest rates creates a challenging environment for fiscal consolidation, as debt service costs rise while growth slows, making it more difficult to achieve the primary surpluses needed to stabilize debt dynamics.

Global trade tensions including new US tariffs and potential escalation of protectionist policies threaten Brazil's export-dependent growth model. The April 2025 imposition of 10% reciprocal tariffs on all Brazilian exports to the United States, combined with existing 25% tariffs on steel and aluminum, creates headwinds for manufacturing exports and could trigger retaliatory measures that escalate into broader trade conflicts. While Brazil's diversified export markets provide some resilience, a global shift toward protectionism would reduce trade volumes and potentially lower commodity prices, impacting both export revenues and fiscal performance. The concentration of exports to China, accounting for 44% of oil exports and 74% of soybean shipments, creates vulnerability to Chinese economic slowdown or policy shifts that reduce demand for Brazilian commodities.

Climate and environmental risks pose growing threats to economic performance and international reputation. Amazon deforestation pressures create tensions between agricultural expansion and environmental preservation, with potential for international sanctions or trade restrictions if deforestation accelerates. Extreme weather events including droughts and floods have become more frequent and severe, impacting agricultural production, hydroelectric power generation, and infrastructure. The 11% decline in agricultural exports in 2024 due to weather impacts demonstrates the economic vulnerability to climate variability. International pressure for environmental protection could constrain development options or require costly investments in sustainable practices, while failure to meet environmental commitments could trigger reputational damage and reduced access to green financing.

Political uncertainty ahead of the 2026 general elections threatens to disrupt reform momentum and fiscal consolidation efforts. The electoral cycle typically generates pressures for increased spending and populist policies that undermine fiscal discipline, while the potential for political polarization could result in policy discontinuity if the opposition gains power. Growing internal tensions within the Lula administration between fiscal hawks and spending advocates suggest that maintaining policy coherence will become increasingly difficult as elections approach. The risk that fiscal consolidation proves politically unsustainable and is abandoned in favor of short-term popularity measures represents a significant threat to the credit trajectory, potentially triggering rating downgrades if debt dynamics deteriorate substantially.

Economic Analysis

Brazil's economic structure as of November 2025 reflects both the strengths of a large, diversified emerging market and the persistent challenges of middle-income development traps that constrain productivity growth and living standards. The economy demonstrated remarkable resilience in 2024, achieving 3.4% GDP growth driven by robust domestic demand, record-low unemployment of 6.2%, and strong real wage growth of 4.8% that supported household consumption. This performance occurred despite the central bank initiating an aggressive tightening cycle, raising the SELIC rate from 10.75% to 12.25% by year-end 2024, and further to 14.75% by November 2025, reflecting the authorities' commitment to re-anchoring inflation expectations after consumer prices persistently exceeded the tolerance band.

Monetary Policy and Inflation Dynamics

The monetary policy response reflects persistent inflationary pressures stemming from multiple sources that have proven more durable than initially anticipated. Fiscal expansion, currency depreciation of 27.9% in 2024, resilient domestic demand from tight labor markets, and supply-side pressures from weather-related agricultural disruptions combined to push inflation to 5.53% by April 2025, well above the central bank's 3% target and outside the 4.5% tolerance ceiling. The central bank, operating with full autonomy since the 2021 legal reform that provides institutional independence, has committed to maintaining "significantly contractionary monetary policy for a prolonged period" to re-anchor inflation expectations and ensure convergence to target. This stance, while necessary for price stability and credibility, is expected to slow growth to 2.2% in 2025 and potentially below 2% in 2026 as the full impact of monetary tightening materializes through reduced consumption and investment.

The inflation challenge reflects both cyclical and structural factors that complicate the policy response. Cyclically, the combination of strong labor markets with unemployment at historic lows, robust wage growth, and resilient consumer confidence created demand pressures that exceeded the economy's productive capacity. The sharp currency depreciation in 2024, driven by fiscal credibility concerns and global dollar strength, passed through to consumer prices particularly for tradable goods and imported inputs. Structurally, Brazil's inflation dynamics reflect indexation mechanisms that create persistence, concentrated market structures in some sectors that limit competition, and supply-side constraints from infrastructure bottlenecks that prevent rapid capacity expansion in response to demand increases. The central bank's challenge involves maintaining sufficiently restrictive policy to ensure inflation convergence without triggering an unnecessarily severe economic contraction.

Fiscal Policy and Debt Dynamics

Fiscal policy remains the key credit constraint, with public debt rising to 76.5% of GDP in 2024 despite strong growth, and projected to reach 79.6% by 2028 under current policies, with the IMF forecasting a further deterioration to 98.1% of GDP by 2030 absent significant policy adjustments. The government faces structural budget rigidities that severely limit fiscal flexibility, with mandatory spending including pensions, social programs, and constitutionally mandated transfers to states and municipalities consuming the majority of revenues. Finance Minister Fernando Haddad's efforts to implement fiscal consolidation through spending caps and revenue measures face political resistance both within the administration, where cabinet allies advocate for increased social spending, and from Congress, where the Centrão bloc demands concessions that often involve additional expenditures.

The primary fiscal deficit of 0.1% of GDP in 2024 represented improvement from the 2.3% deficit in 2023, but falls well short of the surplus needed to stabilize debt dynamics given high real interest rates. The overall fiscal deficit including interest payments remains substantial at approximately 7-8% of GDP, reflecting the debt service burden from elevated SELIC rates. The government's fiscal framework, established in 2023, targets gradual consolidation with primary balance improvement of 0.5% of GDP annually, but market skepticism about the framework's credibility contributed to currency pressures and required more aggressive monetary tightening. The challenge involves demonstrating fiscal discipline sufficient to stabilize debt while maintaining social programs that are politically essential and economically important for reducing inequality.

Structural Reforms and Productivity

Structural reforms provide medium-term support for economic performance, most notably the historic tax reform approved in December 2023 that represents the most significant tax system overhaul since the 1988 constitution. This reform will consolidate five consumption taxes (IPI, PIS, COFINS, ICMS, and ISS) into three (IBS, CBS, and IS) over the 2026-2033 implementation period, potentially boosting productivity by 12-20% according to various estimates through reduced compliance costs, elimination of cascading tax effects, and improved resource allocation. However, implementation challenges remain substantial, including defining sector-specific rates, managing the transition period, and addressing concerns that the unified VAT rate of 27-30% will be among the world's highest. The reform's success depends on effective implementation that realizes simplification benefits while managing political pressures for exemptions and special treatments that could undermine the reform's objectives.

The economy also benefits from ongoing digital transformation that enhances efficiency and financial inclusion. The PIX instant payment system revolutionized retail transactions with 155 million users processing 27 trillion reais in 2024, dramatically reducing transaction costs and expanding access to digital payments for previously unbanked populations. The upcoming launch of DREX, the central bank digital currency, will further modernize wholesale transactions using blockchain technology and potentially enable new forms of programmable money and smart contracts. The fintech sector's rapid growth, with 13 unicorns and vibrant startup ecosystem, drives innovation in financial services, payments, lending, and insurance that increases competition and improves service quality.

Economic Diversification and Sectoral Performance

Brazil's economic model continues evolving from commodity dependence toward greater diversification, though natural resources remain central to export performance and fiscal revenues. Manufacturing exports reached a record $181.9 billion in 2024, demonstrating growing competitiveness in sectors including aircraft (Embraer), automobiles, machinery, and chemicals. The technology sector grows at 9% annually, with São Paulo emerging as a major regional hub with 340,000+ companies and expanding presence in software development, fintech, e-commerce, and digital services. However, productivity outside agriculture remains low compared to advanced economies, reflecting infrastructure bottlenecks, regulatory complexity, skills mismatches, and limited research and development investment that constrain innovation and technological adoption.

Agricultural sector performance demonstrates both Brazil's competitive advantages and vulnerability to weather variability. While agricultural exports declined 11% in 2024 due to drought impacts, Brazil maintains dominant global market positions in soybeans (accounting for approximately 50% of global exports), coffee (30% of global production), sugar (45% of global exports), and orange juice (70% of global exports). The sector benefits from abundant arable land, favorable climate, advanced agricultural technology adoption, and efficient large-scale farming operations. Oil production from pre-salt reserves continues expanding, with output targeting 3.2 million barrels per day by 2028, positioning Brazil as an increasingly important global energy supplier. The historic shift in 2024 with oil overtaking soybeans as the top export reflects both expanded production capacity and strong global energy prices.

The services sector, accounting for approximately 70% of GDP, faces productivity challenges from regulatory barriers, infrastructure constraints, and skills gaps that limit growth potential. Retail trade, financial services, telecommunications, and business services represent major components, with growing digitalization creating opportunities for efficiency gains. Tourism remains underdeveloped relative to Brazil's natural and cultural attractions, representing potential for expansion if infrastructure and security concerns are addressed. The economy's medium-term potential growth of 2.3-2.5% reflects these structural constraints, requiring sustained reforms to enhance productivity, improve infrastructure, and develop human capital to unlock higher sustainable growth rates that would support rising living standards and fiscal sustainability.

Political & Institutional Assessment

Brazil's political landscape under President Luiz Inácio Lula da Silva's third term reveals significant governance challenges that impact sovereign creditworthiness and create policy uncertainty. Lula's approval rating declined from 47% in January 2025 to 41% by November, reflecting growing dissatisfaction with economic management, persistent inflation that erodes purchasing power, and perceptions of insufficient progress on key priorities including poverty reduction and public services improvement. The 79-year-old president faces a more complex political environment than during his previous terms (2003-2010), with a fragmented Congress, powerful Centrão bloc controlling legislative outcomes, and internal tensions within his own administration between fiscal hawks and spending advocates that complicate coherent policymaking.

Congressional Dynamics and Coalition Management

The February 2025 congressional leadership elections delivered a significant blow to the administration's agenda and demonstrated the limits of executive influence over legislative priorities. New House Speaker Hugo Motta and Senate President Davi Alcolumbre both promised independence from the executive branch, signaling reduced willingness to automatically support government initiatives and increased demands for concessions in exchange for legislative cooperation. The Centrão's dominance, controlling 73% of municipalities after 2024 local elections, requires constant negotiation and coalition management that often comes at the cost of fiscal discipline, as legislative support is frequently secured through increased spending, patronage appointments, and pork-barrel projects that undermine fiscal consolidation efforts.

The fragmentation of Brazil's political system, with 23 parties represented in Congress and no single party holding more than 15% of seats, creates inherent instability in policymaking and requires building ad hoc coalitions for each major initiative. This fragmentation reflects both the proportional representation electoral system and the relatively low barriers to party formation, resulting in a proliferation of small parties that prioritize narrow interests over national policy coherence. The coalition management challenge involves balancing diverse interests across ideological spectrum from far-left to center-right parties, each with different priorities and constituencies, making it extremely difficult to maintain consistent policy direction particularly on controversial issues like fiscal reform that impose concentrated costs on specific groups.

Institutional Quality and Governance

Institutional quality remains a key credit weakness that distinguishes Brazil from higher-rated emerging markets and creates implementation risks for critical reforms. Brazil ranks 80th of 142 countries in the World Justice Project's Rule of Law Index, with particularly poor scores in criminal justice (113th) and judicial impartiality that undermine contract enforcement and property rights protection. The Corruption Perceptions Index score of 34/100 places Brazil well below the global average and significantly below investment-grade emerging markets like Chile (67/100) or Uruguay (74/100), though the country showed modest improvement in 2024's "absence of corruption" metrics reflecting ongoing anti-corruption efforts.

The judiciary demonstrates both strengths and weaknesses in its role as institutional check on executive and legislative power. The Supreme Federal Court (STF) has played an increasingly active role in political and policy matters, sometimes intervening in ways that create legal uncertainty and blur the separation of powers. While judicial independence provides important protection against arbitrary government action, concerns about judicial overreach and inconsistent rulings create unpredictability for businesses and investors. The judiciary's efficiency remains problematic, with lengthy case resolution times and substantial backlogs that delay dispute resolution and increase business costs. Efforts to modernize court procedures through digitalization have improved efficiency in some areas, but fundamental challenges of case volume and procedural complexity persist.

Policy Credibility and Market Confidence

Finance Minister Fernando Haddad faces growing internal opposition within Lula's administration, with cabinet allies including ministers of social development, education, and health advocating for increased spending despite inflation concerns and fiscal constraints. This tension between fiscal hawks seeking consolidation and spending advocates prioritizing social programs undermines market confidence in the government's commitment to fiscal discipline. The December 2024 currency crisis, which saw the real depreciate sharply and required over $30 billion in central bank interventions, reflected market skepticism about fiscal credibility and concerns that political pressures would prevent necessary consolidation measures.

The government's fiscal framework, established in 2023 with targets for gradual primary balance improvement, lacks full credibility with markets due to concerns about enforcement mechanisms and political will to implement spending restraint. The framework allows for flexibility in meeting targets through revenue increases rather than expenditure control, creating concerns that the government will rely on tax increases that could undermine growth rather than addressing structural spending rigidities. Market participants express skepticism about the government's ability to resist political pressures for increased spending as the 2026 electoral cycle approaches, when incentives for fiscal discipline typically weaken in favor of short-term popularity measures.

Electoral Cycle and Policy Continuity

Looking ahead, the 2026 general elections already cast shadows over policy continuity and reform momentum. The potential for political polarization similar to the intense 2022 campaign, which saw Lula defeat incumbent Jair Bolsonaro by a narrow margin, could disrupt economic policymaking and create uncertainty about the direction of future policy. If fiscal consolidation proves politically costly through reduced social spending or unpopular tax increases, the government may abandon or weaken consolidation efforts to improve electoral prospects. Conversely, if the opposition gains power, significant policy discontinuity could result given the ideological differences between Lula's Workers' Party and center-right opposition on issues including state role in the economy, social spending priorities, and regulatory approaches.

However, Brazil's democratic institutions have shown resilience through multiple political transitions and crises, providing some confidence in institutional continuity despite political volatility. The successful passage of tax reform in December 2023, requiring constitutional amendment and broad political support, demonstrates that transformative legislation remains possible despite political constraints when sufficient consensus emerges around reform necessity. The central bank's autonomy, established by law in 2021 with fixed terms for board members that extend beyond presidential terms, provides an important institutional anchor for monetary policy credibility regardless of political pressures. The judiciary, despite concerns about overreach, provides checks on executive power that limit the potential for arbitrary policy changes. These institutional strengths suggest that while political challenges are substantial, Brazil's democratic framework provides foundations for navigating political transitions without fundamental disruptions to economic policy or institutional functioning.

Banking Sector & Financial Stability

Brazil's banking sector demonstrates strong fundamentals that support financial stability and provide resilience against economic shocks as of November 2025. The system maintains robust capitalization well above regulatory minimums, with 98.5% of institutions meeting prudential requirements according to the central bank's latest stress tests conducted in mid-2025. Major banks show particularly strong capital positions, with Itaú Unibanco maintaining a Common Equity Tier 1 ratio of 13.7% and targeting levels 50 basis points above regulatory minimums to provide additional buffers against unexpected losses. Bradesco and Santander Brasil similarly maintain CET1 ratios above 13%, while state-owned banks including Banco do Brasil and Caixa Econômica Federal meet all capital requirements despite their larger exposure to government-directed lending programs.

Asset Quality and Credit Cycle

Asset quality has stabilized after the 2022-2023 credit stress cycle that saw non-performing loans rise as pandemic-era support measures expired and monetary tightening impacted borrower repayment capacity. System-wide non-performing loans declined to 3.0% in December 2024 from recent peaks above 3.5%, though this remains above the pre-pandemic low of 2.1% achieved in 2019-2020. The improvement reflects aggressive provisioning by major banks, with the three largest private institutions charging off R$92 billion in 2023 to clean up balance sheets and recognize losses on deteriorated credits. While Bradesco continues working through legacy issues with NPLs at 5.2%, reflecting challenges in its credit card and personal loan portfolios, market leader Itaú maintains superior asset quality at 2.8%, demonstrating effective risk management and more conservative underwriting standards.

The credit cycle dynamics reflect both macroeconomic conditions and structural changes in lending practices following the pandemic experience. Consumer credit, particularly unsecured personal loans and credit cards, experienced the most significant deterioration as households that borrowed heavily during the pandemic faced repayment challenges when emergency support ended and inflation eroded real incomes. Corporate credit quality remained more stable, with large companies maintaining access to capital markets and smaller firms benefiting from relationship banking and restructuring support. Real estate credit, representing a smaller share of total lending than in many advanced economies, showed resilience with low default rates reflecting conservative loan-to-value ratios and strong collateral values in major urban markets.

Profitability and Business Model

Profitability remains healthy despite the credit cycle challenges, with major banks demonstrating strong earnings power and return on equity. Itaú achieved a 22.1% return on equity in Q4 2024, while Santander Brasil recovered to 17% and Bradesco improved to 12.4% as credit costs normalized and operational efficiency gains materialized. The sector benefits from high net interest margins in the elevated rate environment, with the SELIC at 14.75% as of November 2025 supporting lending spreads despite competitive pressures. However, this advantage will moderate as monetary easing eventually begins, requiring banks to focus on fee income growth, operational efficiency, and credit quality to maintain profitability.

Efficiency gains, particularly at Itaú with its 36% cost-to-income ratio, demonstrate the benefits of digital transformation and scale advantages in the Brazilian market. Major banks have invested heavily in technology infrastructure, mobile banking platforms, and data analytics capabilities that reduce operational costs while improving customer experience. The success of digital-only banks like Nubank, which reached 100 million customers and achieved profitability, has forced traditional banks to accelerate digital transformation and improve service quality to retain customers. This competition has benefited consumers through reduced fees, improved service, and greater financial inclusion, while pushing banks to become more efficient and customer-focused.

Digital Innovation and Financial Inclusion

Brazil leads global financial innovation through its digital payments infrastructure, fundamentally transforming the banking sector's competitive dynamics and operational models. The PIX instant payment system, launched in November 2020, processed 27 trillion reais in transactions with 155 million users in 2024, revolutionizing retail payments and dramatically reducing transaction costs. PIX's success reflects its convenience (instant 24/7 transfers), zero cost to consumers, and universal accessibility across all financial institutions. The system has particularly benefited small businesses and individuals previously dependent on cash or expensive payment methods, enhancing financial inclusion and economic efficiency.

The upcoming launch of DREX, the central bank digital currency, in 2025 will further modernize wholesale transactions using blockchain technology and potentially enable new forms of programmable money and smart contracts. DREX aims to improve efficiency in interbank settlements, enable atomic transactions that reduce counterparty risk, and provide infrastructure for tokenized assets including securities and real estate. While initially focused on wholesale use cases, DREX could eventually expand to retail applications that further transform payment systems and financial services delivery.

Traditional banks have successfully competed with fintechs by expanding digital offerings, acquiring technology companies, and partnering with fintech innovators to enhance capabilities. Itaú, Bradesco, and Santander Brasil all operate digital-only subsidiaries targeting younger customers and competing directly with neobanks on user experience and pricing. However, new entrants like Nu Holdings continue driving innovation, with Nu's 100 million customers making it Latin America's largest digital bank and demonstrating the potential for technology-driven business models to achieve scale rapidly. The competitive pressure from fintechs has forced traditional banks to reduce fees, improve digital interfaces, and become more customer-centric, benefiting the overall financial system through increased efficiency and innovation.

Regulatory Framework and Systemic Oversight

The regulatory framework provides strong systemic oversight under the autonomous central bank, which gained legal independence in 2021 with fixed terms for board members and clear mandates for price stability and financial stability. Regular stress testing confirms the system's resilience to severe economic scenarios, with the central bank's 2025 stress tests simulating scenarios including GDP contraction of 3.5%, unemployment rising to 14%, and significant currency depreciation. Results showed adequate loss absorption capacity across all simulations, with the banking system maintaining capital ratios above regulatory minimums even under severe stress scenarios, though some smaller institutions would require capital injections in the most extreme scenarios.

The central bank actively monitors systemic risks through macroprudential surveillance that tracks credit growth, asset price developments, interconnections between institutions, and potential sources of systemic vulnerability. Macroprudential measures including countercyclical capital buffers, sectoral capital requirements, and loan-to-value limits on real estate lending provide tools to address emerging risks before they threaten financial stability. Enhanced cyber resilience and operational risk management reflect evolving supervisory priorities as digitalization increases cyber threats and operational dependencies on technology infrastructure. The central bank has implemented stringent cybersecurity requirements, mandatory incident reporting, and regular testing of business continuity plans to ensure operational resilience.

While pockets of vulnerability remain in unsecured consumer lending, where high interest rates and aggressive competition have sometimes led to inadequate risk assessment, and SME credit, where information asymmetries complicate credit evaluation, the overall banking system provides solid support for economic growth while maintaining financial stability. The combination of strong capital positions, improving asset quality, healthy profitability, digital innovation leadership, and robust regulatory oversight positions Brazil's banking sector as a credit strength that mitigates sovereign risks and supports economic resilience. The sector's ability to navigate the 2022-2023 credit cycle without systemic stress, while continuing to support economic activity and drive financial innovation, demonstrates the fundamental soundness of Brazil's financial system.

Outlook & Scenarios

Short-Term Outlook (12 months)

Brazil faces a challenging near-term outlook through November 2026 characterized by slowing growth, persistent inflation pressures, and continued monetary policy tightening that will weigh on domestic demand and economic activity. GDP growth is projected to decelerate sharply to 2.2% in 2025 from 3.4% in 2024, as the full impact of monetary tightening materializes with the SELIC rate at 14.75% and potentially headed higher if inflation fails to moderate as expected. Private consumption, which drove much of 2024's strong performance, will face significant headwinds from high borrowing costs, moderating real wage growth as labor markets loosen, and reduced consumer confidence amid economic uncertainty. Investment is expected to contract as elevated interest rates make capital projects uneconomical and business confidence weakens amid political uncertainty and global trade tensions.

Inflation remains the paramount near-term concern, with the 5.53% rate in April 2025 well above the central bank's 4.5% tolerance ceiling and showing limited signs of moderating despite aggressive monetary tightening. The combination of fiscal expansion, potential for further currency pressures if fiscal credibility concerns intensify, and strong labor markets with unemployment projected at only 7.0% suggests inflation will remain elevated through much of 2025. The central bank has committed to maintaining "significantly contractionary monetary policy for a prolonged period," indicating that rate cuts are unlikely before late 2025 or early 2026, and only if inflation shows clear convergence toward target. This necessitates accepting below-potential growth to re-anchor inflation expectations and restore price stability, creating a difficult trade-off between short-term economic pain and medium-term credibility.

The fiscal outlook shows modest improvement, with the primary deficit expected at 0.5% of GDP in 2025 compared to 0.1% in 2024, though this still falls short of the surplus needed to stabilize debt dynamics. The government faces intense political pressures to increase social spending ahead of the 2026 elections, while revenue growth may disappoint if economic activity slows more than expected. Finance Minister Haddad's ability to maintain fiscal discipline will be tested by internal opposition within the administration and congressional demands for increased spending, with market confidence depending critically on demonstrating commitment to consolidation despite political costs. The debt-to-GDP ratio is projected to rise to 77.8% by end-2025, continuing the upward trajectory that represents the key credit constraint.

External sector dynamics present mixed prospects, with the current account deficit expected to narrow modestly to 2.5% of GDP in 2025 from 2.8% in 2024 as import growth slows with domestic demand. Export performance will depend on global commodity prices, Chinese demand for Brazilian commodities, and the impact of US tariffs on manufacturing exports. Foreign direct investment of approximately $60-65 billion should comfortably finance the current account deficit, though portfolio flows may remain volatile depending on fiscal credibility and global risk sentiment. The central bank's foreign exchange reserves of $335.7 billion provide substantial buffers, though maintaining these levels may require continued interventions if currency pressures intensify. The real's trajectory will depend critically on fiscal policy credibility, with risks skewed toward depreciation if consolidation efforts falter.

Medium-Term Outlook (1-3 years)

The medium-term trajectory through 2028 depends critically on successful fiscal consolidation, structural reform implementation, and navigating the 2026 electoral cycle without major policy disruptions. Growth is expected to stabilize around Brazil's potential rate of 2.3-2.5% by 2026-2027, supported by gradual monetary easing as inflation converges toward target, though this assumes successful inflation control and fiscal consolidation that allows the central bank to reduce rates without reigniting price pressures. The implementation of tax reform beginning in 2026 should provide productivity gains and improve business competitiveness, though benefits will materialize gradually through 2033 as the transition to the new system proceeds and businesses adjust to simplified tax structures.

Key medium-term opportunities include leveraging Brazil's natural resource advantages in the global energy transition, with oil production targeting 3.2 million barrels per day by 2028 generating substantial export revenues and fiscal resources. The renewable energy sector offers significant investment opportunities in offshore wind development, solar power expansion, and continued leadership in biofuels, with growing global demand for sustainable aviation fuel and other advanced biofuels supporting export diversification. The technology sector's 9% annual growth and fintech leadership position Brazil well for digital economy expansion, while the bioeconomy potential of the Amazon region could contribute BRL 40 billion in annual GDP increases by 2050 if sustainable development models are successfully implemented.

However, risks remain elevated from multiple sources that could derail the positive medium-term scenario. The 2026 electoral cycle poses the most immediate political risk, with potential for policy discontinuity if the opposition gains power or for fiscal discipline to be abandoned in pursuit of electoral popularity. Climate-related challenges, including Amazon preservation pressures and extreme weather events that impact agricultural production and hydroelectric power generation, pose growing economic risks that could become more severe over time. China slowdown concerns create vulnerability given heavy export dependence, with 44% of oil exports and 74% of soybean shipments destined for Chinese markets. Global trade tensions, including potential escalation of US tariffs or broader protectionist trends, could reduce export growth and complicate economic management.

Success in achieving investment grade status by 2027-2028, which would represent a major credit milestone and unlock substantial portfolio inflows, will require demonstrable progress in reducing the debt-to-GDP ratio below 75% and maintaining primary surpluses of at least 1% of GDP. This necessitates difficult political choices to restrain spending growth, resist pressures for increased social programs, and potentially implement revenue measures that are politically costly. The IMF's projection of debt rising to 98.1% of GDP by 2030 under current policies underscores the urgency of fiscal consolidation, as such a trajectory would likely trigger rating downgrades rather than upgrades and create serious debt sustainability concerns. The medium-term outlook therefore hinges on political will to implement necessary but unpopular fiscal measures, successful structural reform implementation that boosts growth potential, and favorable external conditions including stable commodity prices and continued foreign investment inflows.

Rating Scenarios

The rating outlook presents three distinct scenarios with varying probabilities based on fiscal policy execution, inflation control, and external conditions. The base case scenario, assigned approximately 60% probability, assumes modest fiscal consolidation with primary deficits gradually declining toward balance by 2027-2028, inflation converging to target by late 2026 allowing gradual monetary easing, and continued structural reform implementation including tax reform. Under this scenario, Moody's would likely upgrade Brazil to Baa3 (investment grade) by late 2026 or early 2027, while S&P and Fitch would upgrade to BB+ by 2027, leaving Brazil with split ratings but achieving investment grade from at least one major agency. Debt would stabilize around 78-80% of GDP, growth would recover to potential rates of 2.3-2.5%, and external buffers would remain adequate with reserves above $300 billion.

The positive scenario, assigned approximately 20% probability, assumes successful fiscal consolidation with primary surpluses of 1-1.5% of GDP achieved by 2027, inflation returning to target by end-2025 allowing earlier monetary easing, and accelerated structural reform implementation that boosts productivity and growth potential. Under this scenario, all three major agencies would upgrade Brazil to investment grade by 2027-2028, with Moody's potentially reaching Baa2 and S&P/Fitch reaching BBB- by 2028. Debt would decline toward 75% of GDP, growth would accelerate to 3% as reforms boost productivity, and substantial portfolio inflows following investment grade achievement would strengthen external buffers and support currency appreciation. This scenario requires strong political will to implement fiscal consolidation despite electoral pressures, successful tax reform implementation that delivers productivity gains, and favorable external conditions including strong commodity prices and robust foreign investment.

The negative scenario, assigned approximately 20% probability, assumes fiscal consolidation failure with primary deficits persisting above 0.5% of GDP, inflation remaining above target requiring prolonged monetary tightening, and reform momentum stalling amid political gridlock. Under this scenario, Moody's would revise its outlook to stable or negative by mid-2026 and potentially downgrade to Ba2 by 2027, while S&P and Fitch would downgrade to BB- by 2027-2028. Debt would rise above 85% of GDP by 2028, approaching the IMF's concerning projection of 98.1% by 2030, growth would remain below potential at 1.5-2.0% as high interest rates persist, and external pressures would intensify with reserves declining below $300 billion amid capital outflows. This scenario could be triggered by political disruption from the 2026 elections, abandonment of fiscal discipline in pursuit of electoral popularity, external shocks including sharp commodity price declines or China slowdown, or loss of central bank credibility if inflation expectations become de-anchored.

The key rating drivers across all scenarios center on fiscal policy credibility and debt trajectory, which represent the binding constraint on Brazil's credit quality. Demonstrating sustained primary surpluses that stabilize and eventually reduce the debt-to-GDP ratio is essential for rating upgrades, while failure to consolidate would trigger downgrades regardless of other positive factors. Inflation control and monetary policy credibility represent the second critical factor, as persistent inflation above target would require prolonged high interest rates that undermine fiscal sustainability and growth prospects. Structural reform implementation, particularly tax reform, provides medium-term support but cannot substitute for near-term fiscal discipline. External conditions including commodity prices, Chinese demand, and global risk sentiment influence the outlook but are less critical than domestic policy choices given Brazil's adequate external buffers and flexible exchange rate regime.

Conclusion

Brazil's sovereign credit profile as of November 2025 reflects a critical juncture between the potential for gradual improvement toward investment grade status and the risk of deterioration if fiscal consolidation efforts falter. The country's fundamental strengths remain substantial, including a large, diversified economy with $2.8 trillion in GDP, abundant natural resources that position Brazil favorably for the global energy transition, a resilient banking sector with strong capital positions and digital innovation leadership, and adequate external buffers with $335.7 billion in foreign exchange reserves. The successful passage of historic tax reform in December 2023 demonstrates the capacity for transformative policy achievements despite political fragmentation, while the central bank's institutional autonomy provides an important anchor for monetary policy credibility.

However, persistent fiscal challenges represent the binding constraint on creditworthiness, with public debt rising to 76.5% of GDP in 2024 and projected to reach 79.6% by 2028 under current policies, with the IMF forecasting further deterioration to 98.1% by 2030 absent substantial policy adjustments. The primary fiscal deficit of 0.1% of GDP in 2024 falls well short of the surplus needed to stabilize debt dynamics, while structural budget rigidities limit fiscal flexibility and political fragmentation complicates reform implementation. High real interest rates at 14.75%, necessary to combat inflation that has persistently exceeded the central bank's tolerance band, create a challenging policy trade-off between price stability and fiscal sustainability while constraining investment and growth.

The near-term outlook through November 2026 presents significant challenges, with growth slowing to 2.2% in 2025 as monetary tightening impacts domestic demand, inflation remaining elevated above target, and political pressures intensifying ahead of the 2026 general elections. The medium-term trajectory depends critically on demonstrating fiscal discipline despite electoral pressures, successfully implementing tax reform to boost productivity, and maintaining inflation control that allows gradual monetary easing. Moody's positive outlook signals potential for upgrade to investment grade by late 2026 or early 2027 if fiscal consolidation progresses, while S&P and Fitch's stable outlooks reflect more cautious assessments requiring demonstrated fiscal discipline before considering upgrades.

Brazil's path to broad investment grade status and improved sovereign creditworthiness requires sustained political commitment to fiscal consolidation, successful structural reform implementation, and continued institutional strengthening that enhances governance and reduces policy uncertainty. The country possesses the economic fundamentals and institutional capacity to achieve these objectives, but faces substantial political and implementation challenges that create meaningful execution risks. The next 12-24 months will prove critical in determining whether Brazil can navigate these challenges successfully and resume the gradual credit improvement trajectory, or whether fiscal and political pressures will derail consolidation efforts and trigger rating deterioration. The outcome will depend primarily on domestic policy choices rather than external conditions, placing the responsibility for Brazil's credit trajectory squarely with policymakers and political leaders who must balance short-term political pressures against medium-term economic sustainability.

Data Sources

This analysis relies on data from the following authoritative sources: Brazilian Central Bank (BCB) for monetary policy, banking sector statistics, and external sector data; Instituto Brasileiro de Geografia e Estatística (IBGE) for GDP, inflation, and employment data; Ministry of Finance for fiscal data, debt statistics, and economic projections; S&P Global Ratings, Moody's Investors Service, and Fitch Ratings for sovereign rating reports and credit assessments; International Monetary Fund for World Economic Outlook data, Article IV consultations, and fiscal projections; External Wealth of Nations (EWN) Database for Net International Investment Position data; World Bank for governance indicators and development data; Bank for International Settlements for banking and financial stability statistics; UNCTAD for foreign direct investment data; Trading Economics and CEIC Data for real-time economic indicators; major Brazilian banks' investor relations materials for banking sector performance data; and Reuters, Bloomberg, and Financial Times for current political and economic developments. All data is as of November 2025 unless otherwise specified.